- Trade reserves dropped from 180M to 146M LINK — a transparent signal of long-term accumulation.

- Patrons are defending the $15.61 assist, with $18–$23 performing as key breakout zones.

- On-chain and futures information present bullish divergence — hinting a rebound would possibly already be forming.

One thing large is brewing round Chainlink (LINK). Trade reserves have been dropping quick — and that’s not normally a bearish signal. It’s truly the other. Since January, the entire LINK provide sitting on exchanges has fallen from over 180 million to round 146 million, a large discount of roughly 34 million tokens.

That’s a transparent sign of accumulation — traders are pulling their holdings off exchanges and locking them up for staking or long-term storage. Over 15 million LINK have left centralized exchanges in simply the previous month, shrinking the liquid provide to about 15% of whole tokens. Fewer tokens on exchanges normally imply fewer tokens out there to promote, and traditionally, that sort of setup builds the muse for giant upside strikes as soon as demand returns.

So yeah, whereas costs have cooled, the underlying construction appears to be like quietly bullish.

Patrons Nonetheless Holding the Line Round $15.61

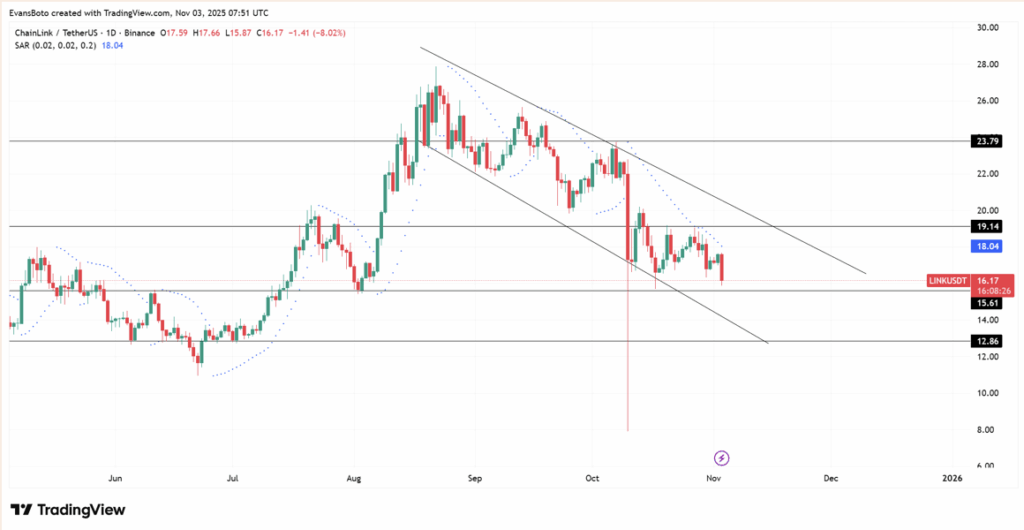

In the mean time, LINK’s buying and selling close to $16.17, down about 8% prior to now 24 hours — a wholesome dip inside what nonetheless appears to be like like a managed, technical pullback. The value motion has been monitoring a descending channel, which could sound bearish, however it’s usually simply consolidation earlier than one other push greater.

The vital assist zone proper now’s $15.61, the place consumers have stepped in a number of instances already. If that degree provides means, the following security internet is down at $12.86, however to date, bulls are defending it properly. On the flip facet, the Parabolic SAR sits close to $18.04, and clearing that degree might flip the short-term development again to bullish. Above that, resistance zones at $19.14 and $23.79 would be the actual check for a breakout.

In brief — if accumulation continues and LINK manages a clear each day shut above $18, we could possibly be trying firstly of a reversal section.

On-Chain Knowledge Backs the Accumulation Story

The on-chain image provides much more weight to this setup. On November 3, Chainlink noticed a $5.41 million internet outflow, persevering with a development that’s been operating since mid-year. Trade-held provide dropped from 18% to fifteen% of whole tokens, suggesting holders have gotten more and more assured — transferring their LINK into staking contracts and chilly wallets moderately than preserving it liquid for buying and selling.

Any such persistent outflow normally factors to decreased promoting stress. It additionally creates what analysts name a “liquidity imbalance”, the place the circulating provide tightens sooner than demand can alter. Traditionally, these situations have preceded LINK’s largest rebounds — a sample we’ve seen play out in a number of previous cycles when giant holders used market dips to construct positions quietly.

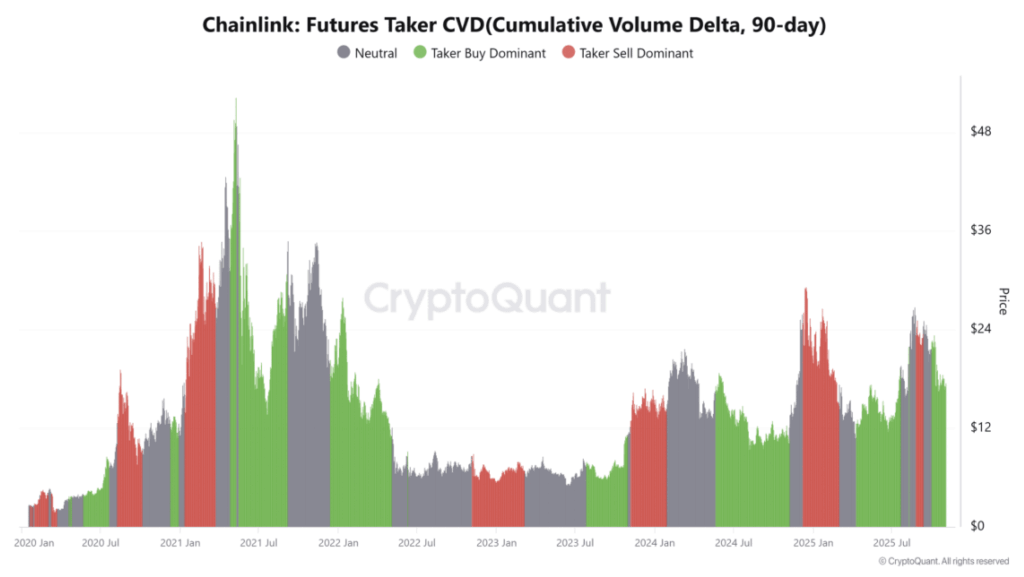

Derivatives Knowledge Exhibits Merchants Turning Bullish

The story will get much more attention-grabbing whenever you have a look at the derivatives facet. The 90-day Futures Taker CVD reveals a transparent case of taker purchase dominance, that means merchants are more and more opening lengthy positions. That’s a robust indicator of rising optimism and aligns completely with the spot accumulation taking place on-chain.

When each spot and futures merchants begin leaning the identical path — particularly throughout a correction — it usually means they’re positioning early for the following transfer up. Positive, there’s all the time room for short-term volatility, however proper now, sentiment appears to be quietly shifting towards an upside section.

If consumers maintain defending assist and quantity ticks up, LINK could possibly be gearing up for one more sturdy leg greater.

Closing Take — LINK’s Provide Squeeze Is Actual

Chainlink’s fundamentals are beginning to present actual power beneath the floor. The continuing provide drain from exchanges, constant whale accumulation, and growing taker purchase exercise all counsel that LINK’s present weak spot is extra like a coiled spring than a collapse.

If the $15.61 degree continues to carry and the worth pushes above $18.04, it might verify the beginning of a development reversal focusing on $19.14 first, then $23.79.

It’d take time for sentiment to catch up, however the setup’s already forming — fewer tokens out there, stronger arms holding, and merchants quietly loading up earlier than the following transfer.

Disclaimer: BlockNews offers unbiased reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding selections. Some articles could use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial group of skilled crypto writers and analysts earlier than publication.