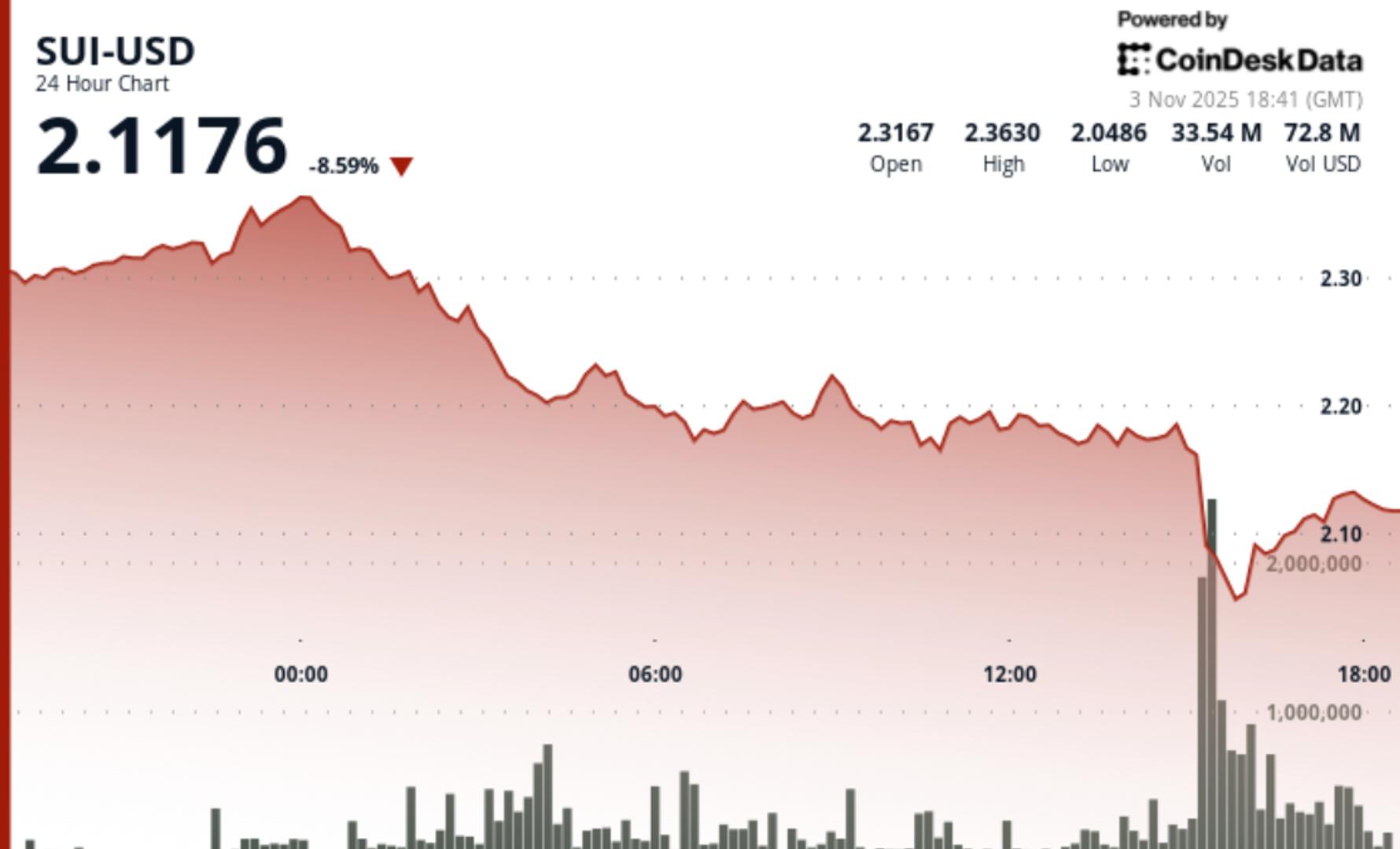

SUI, the native token of the Sui community, plunged 9% to $2.10 over the previous 24 hours, sharply underperforming the broader crypto market throughout a sector-wide selloff.

The token’s 4.89% lag behind the crypto market suggests the transfer wasn’t nearly market weak spot however that it was SUI-specific.

The selloff carried the hallmarks of institutional liquidation. Costs dropped from $2.32 to check important assist, with buying and selling quantity surging 53% above the 7-day common. The spike in exercise factors to large-block repositioning, not a retail-driven panic.

On the core of the transfer was a decisive breakdown at $2.16. SUI dropped by means of that stage on quantity of 99.13 million tokens — 628% above its 24-hour common — confirming sturdy bearish stress. That breakdown was adopted by a pointy rebound from $2.04, forming a V-shaped bounce as establishments appeared to scoop up the token at decrease ranges.

Nonetheless, the restoration misplaced steam close to $2.13, a psychological resistance zone. Quantity declined into the shut, suggesting consumers lacked conviction to push SUI meaningfully increased within the quick time period.

Elsewhere, the CoinDesk 5 Index (CD5) noticed a 3.35% drop to $1,860.70, together with a flash crash to $1,826.66 earlier than bouncing again. The transfer additionally confirmed indicators of institutional promoting, overwhelming technical assist in a high-volatility session.

Disclaimer: Components of this text have been generated with the help from AI instruments and reviewed by our editorial workforce to make sure accuracy and adherence to our requirements. For extra data, see CoinDesk’s full AI Coverage.