The cryptocurrency market opened Tuesday deep within the crimson, with broad-based declines wiping near $140 billion from whole market capitalization in a single day.

In accordance with information from CoinMarketCap, the worldwide crypto market cap fell 3.99% to $3.45 trillion, as merchants shifted to defensive positions amid rising uncertainty and renewed macroeconomic jitters.

Bitcoin and Ethereum Lead the Slide

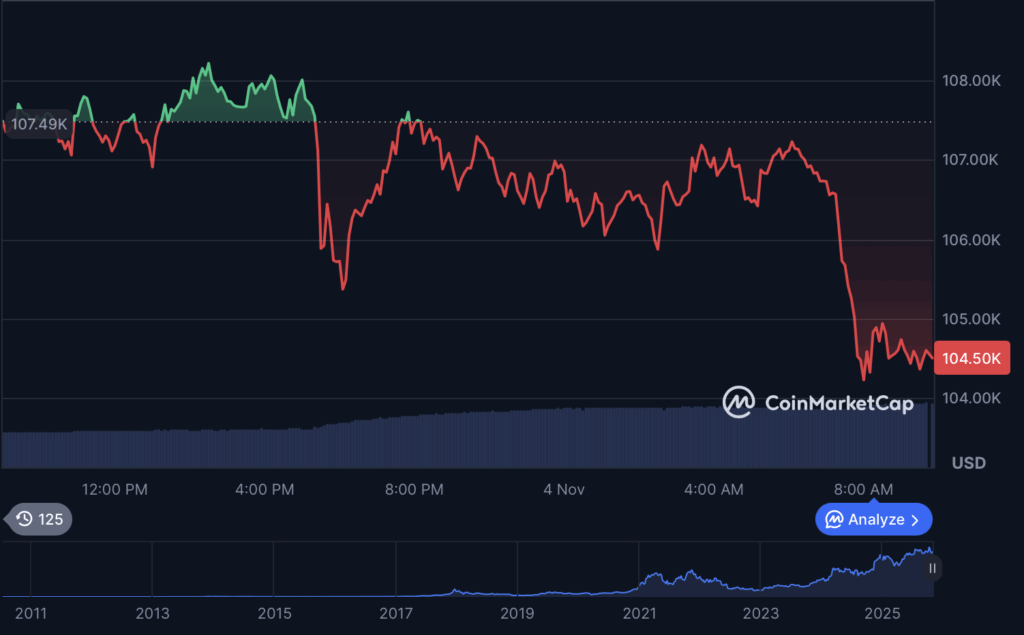

Bitcoin (BTC) dropped to $104,359, shedding practically 3% in 24 hours and lengthening its seven-day decline to eight.68%. The main cryptocurrency has struggled to carry above key psychological ranges, weighed down by a mixture of profit-taking and fading institutional inflows.

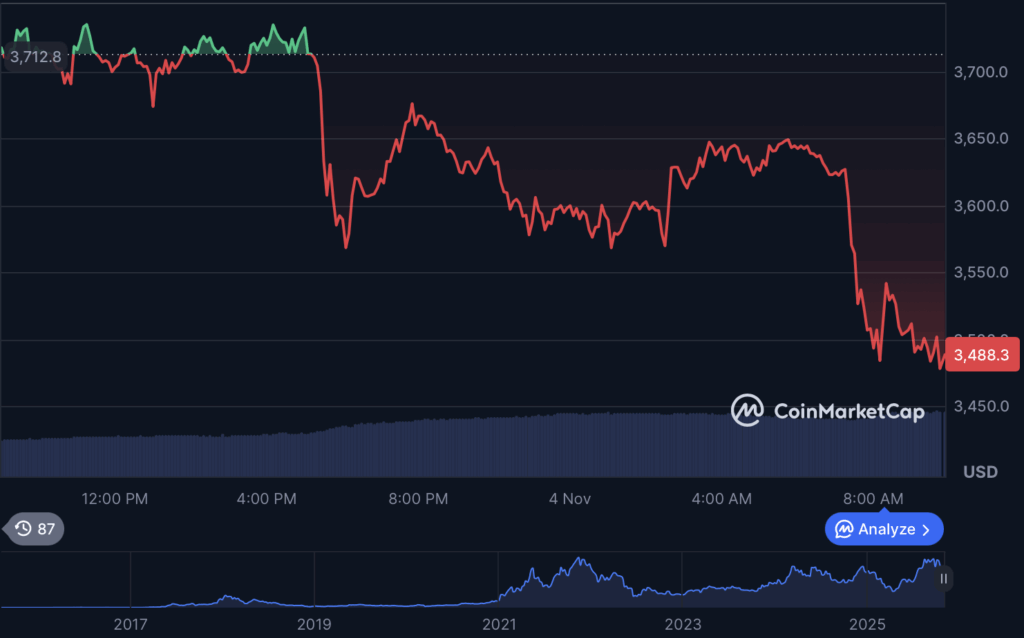

Ethereum (ETH) noticed a good sharper pullback, sliding 6.29% on the day to $3,478 and marking a 15.6% weekly drop. Analysts recommend the weak spot displays waning investor confidence after weeks of heavy volatility and restricted upside momentum.

Altcoins Below Heavy Strain

The correction was even steeper throughout main altcoins. Solana (SOL) led the downturn with an 11.33% day by day drop to $156.21, bringing its weekly losses close to 23%. BNB fell 8.55% to $942.06, whereas XRP and Cardano (ADA) slipped 7.21% and seven.78%, respectively.

Dogecoin (DOGE) and TRON (TRX) weren’t spared both, posting declines of over 7% and 5% in the identical interval.

Sentiment Turns Fearful

The Crypto Worry & Greed Index plummeted to 27, signaling a market dominated by worry — its lowest stage in weeks. On the similar time, the Altcoin Season Index registered a weak 26/100, confirming that Bitcoin stays comparatively stronger than most different belongings regardless of the downturn.

Market analysts say the retreat follows a mixture of technical corrections and macro headwinds. With merchants bracing for recent U.S. financial information later this week, urge for food for riskier belongings comparable to cryptocurrencies has cooled noticeably.

Oversold However Unstable

The common crypto RSI studying has dropped to 33.26, putting the market in “oversold” territory. This means a possible short-term rebound, although analysts warn that volatility may persist till clearer catalysts emerge.

Buying and selling volumes remained excessive, with Bitcoin seeing over $78 billion in 24-hour exercise and Ethereum topping $54 billion, indicating lively repositioning slightly than panic exits.

Outlook

Whereas the present retracement has fueled nervousness amongst merchants, some buyers view it as a wholesome cooldown after an overheated rally. Nonetheless, with sentiment hovering close to excessive worry and liquidity tightening, the market’s near-term path appears unsure.

As one analyst summarized on X: “Crypto is in risk-off mode — worry is excessive, liquidity is low, and everybody’s watching macro information. The subsequent transfer depends upon what the Fed does subsequent.”