Be part of Our Telegram channel to remain updated on breaking information protection

The European Fee is contemplating a Securities and Change Fee (SEC)-style regulator by giving the European Securities and Markets Authority (ESMA) direct oversight of inventory and crypto exchanges.

Based on a Monetary Occasions report that cited folks aware of the matter, an upcoming draft proposal that’s anticipated by December would increase ESMA’s powers to oversee inventory and crypto change platforms, crypto asset service suppliers, and different trading-focused infrastructure. It will increase ESMA’s jurisdiction to grant it authority to resolve disputes between asset managers.

ESMA Chair Verena Ross mentioned the upcoming proposal seeks to deal with “continued fragmentations in markets” and create a unified capital market throughout Europe. She confirmed final month that the fee plans to switch oversight of the monetary sector from nationwide regulators to the ESMA.

🔵 2026 is about to be a yr of simplification, strengthened supervision & knowledge innovation for #ESMA.

Annual #WorkProgramme focuses on streamlining guidelines, supporting the #SIU technique, and delivering on core regulatory and supervisory mandates.

👉 https://t.co/FOv4HX19pH pic.twitter.com/i6cE8RP9UC

— ESMA – EU Securities Markets Regulator 🇪🇺 (@ESMAComms) October 3, 2025

A Potential Resolution To A MiCA Loophole

The European Union has been attempting to maneuver in direction of making a unified regulatory framework for digital belongings, and has already launched the Markets in Crypto-Property (MiCA) regulation again in December 2024.

MiCA was created to cowl crypto belongings that aren’t already lined by present EU monetary providers legal guidelines, together with ones for securities, deposits and insurance coverage. The framework basically creates guidelines for crypto belongings and repair suppliers within the business resembling exchanges and custodians.

It additionally introduces a passporting regime throughout EU member states for approved service suppliers. With this “passport,” firms which might be approved in a single member state can use the license to function throughout the 27-nation bloc.

Nonetheless, that has led to considerations that crypto service suppliers may search licenses beneath extra lenient regulatory jurisdictions. Amid the considerations, France’s securities regulator has threatened in September this yr to ban crypto license “passporting” beneath the MiCA regulation.

SEC Oversees Crypto In The US, However Trump Plans To Give CFTC Broader Supervision

Whereas the European Fee strikes towards an SEC-like physique, the Trump administration has expressed plans to offer the US Commodity Futures Buying and selling Fee (CFTC) broader oversight of the crypto business.

At present, the SEC regulates securities beneath legal guidelines just like the Securities Act of 1933 and the Securities Change Act of 1934. Many tasks and tokens within the crypto house fall beneath the SEC’s oversight in the event that they meet a take a look at for an “funding contract.”

In the meantime, the CFTC regulates commodities and derivatives beneath the Commodity Change Act.

Underneath the earlier Biden administration, the SEC argued that each one cryptos had been securities, a stance that’s shifted since Trump appointed pro-crypto Paul Atkins to chair the regulator.

The talk round whether or not some cryptos are securities or commodities is, nevertheless, nonetheless ongoing . US regulators are subsequently engaged on laws that can assist classify every token or undertaking.

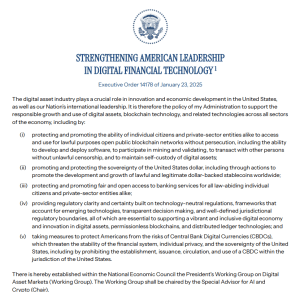

Trump additionally established a White Home working group for digital belongings, which has since handed down suggestions on methods to regulate the crypto market to the SEC and CFTC. Each businesses have began performing on the suggestions.

Government order establishing the White Home digital asset working group (Supply: White Home)

Associated Articles:

Greatest Pockets – Diversify Your Crypto Portfolio

- Simple to Use, Characteristic-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Energetic Customers

Be part of Our Telegram channel to remain updated on breaking information protection