Nasdaq CEO Adena Friedman sees blockchain reshaping the normal monetary system in three key methods: by overhauling post-trade infrastructure, unlocking trapped capital via higher collateral mobility and enabling sooner, extra seamless funds.

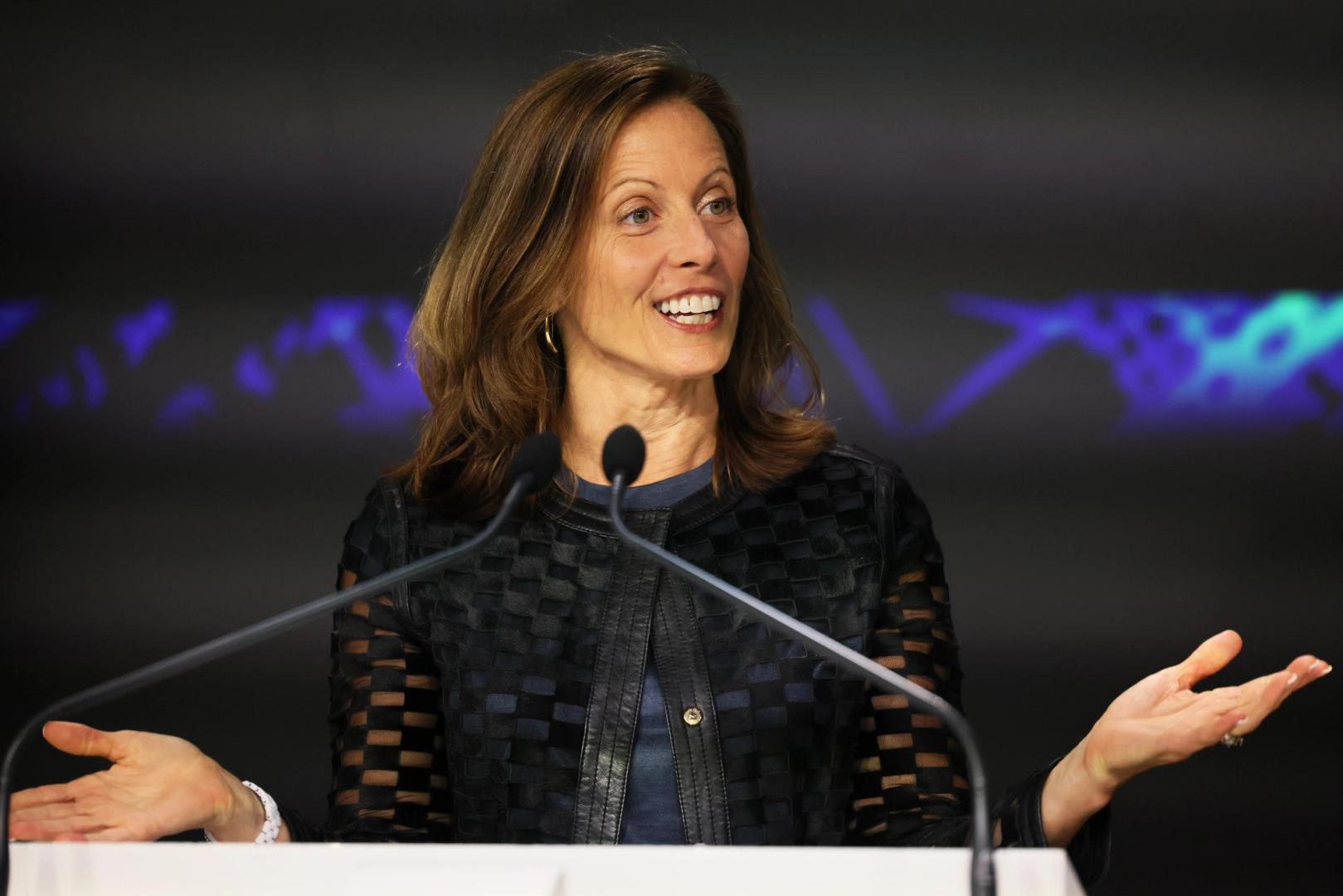

“There’s simply a lot capital trapped, whether or not it’s in clearinghouses or clearing brokers,” Friedman mentioned throughout a dialogue with Ripple President Monica Lengthy on the Swell convention in New York on Tuesday. “If we do it proper, we will really make that a possibility to ship extra capital to the system.”

Put up-trade processes — the programs that finalize and settle securities transactions — stay deeply fragmented and infrequently depend on decades-old infrastructure. Friedman famous that whereas some complexity is intentional, usually for causes like danger administration or allocation monitoring, a lot of the friction is pointless. She believes blockchain may assist unify and streamline these workflows, chopping down on inefficiencies that tie up capital and decelerate monetary exercise.

The second main alternative lies in enhancing how monetary establishments transfer and handle collateral — the property pledged in buying and selling and lending transactions to mitigate danger. In keeping with Friedman, digital property may make it simpler to switch collateral rapidly throughout platforms and borders. “What we actually love in regards to the thought of digital property is with the ability to transfer that collateral,” she mentioned. “We will create a collateral mobility effort and … free a whole lot of capital.”

Funds are the third space ripe for change. Whereas Nasdaq would not function within the funds sector, Friedman emphasised that smoother, extra environment friendly fee programs are key to permitting traders to take part in international markets with out friction.

She described in the present day’s fee infrastructure as a bottleneck, slowing down the movement of capital. If these programs may very well be improved or rebuilt utilizing blockchain, she mentioned, it may unlock important quantities of capital at the moment tied up in outdated processes. That, in flip, would assist traders transfer funds extra simply throughout platforms, borders and asset lessons — making the monetary system extra open and environment friendly.

Nasdaq has already begun laying groundwork. The change operator lately filed with the U.S. Securities and Trade Fee to help buying and selling of tokenized securities. Below the proposed framework, an investor may flag a commerce for tokenized settlement, and the post-trade system — together with clearinghouse DTCC — would route it accordingly, permitting for supply right into a digital pockets. This strategy, Friedman mentioned, maintains the core construction of present securities whereas providing traders larger flexibility.

She was fast to level out that the aim is not to exchange or fragment U.S. fairness markets, which she described as “extraordinarily resilient” and “extremely liquid,” however to reinforce them by layering in know-how that reduces friction and improves investor selection.

Tokenized markets could start in post-trade features, she mentioned, however may finally reshape how securities are issued and traded. “Let’s preserve all these nice issues [about the U.S. markets], after which let’s put the know-how in the place we will really scale back friction.”