It’s not usually you see a crypto venture pull off a buyback that truly works. Hyperliquid, the perpetuals DEX, simply did — spending round $780 million to purchase again 34.41 million HYPE tokens, and in some way turning that right into a 65% achieve. In the meantime, six different initiatives that attempted the identical play? They misplaced large. The distinction wasn’t luck — it got here right down to actual demand, utility, and timing.

Solely One Winner in a Billion-Greenback Experiment

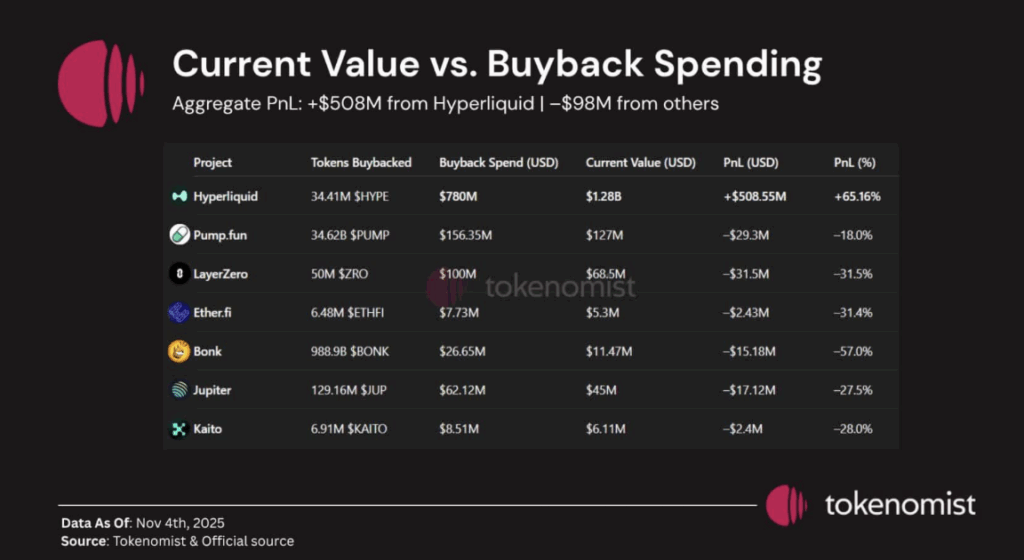

Based on Tokenomist knowledge, seven crypto initiatives collectively spent $1.1 billion on token buybacks. Out of all of them, solely Hyperliquid managed to finish up in revenue. The DEX’s buyback technique paid off with $1.28 billion in token worth post-purchase — a internet revenue of roughly $508.55 million, or a margin north of 65%.

The remainder of the sphere? Brutal. Bonk led the losses, falling 57% regardless of sinking $26.65 million into its buyback. LayerZero and Ether.fi every dropped greater than 31%, whereas Jupiter fell 27.5% even after spending over $62 million. Add Kaito and Pump.enjoyable into the combination, and the overall mixed loss throughout all six losers hit almost $100 million.

Buybacks, because it seems, don’t create worth — they only enlarge no matter was already there.

Why Hyperliquid’s Technique Labored

Hyperliquid isn’t a hype coin pretending to be one thing extra. It’s a revenue-generating DEX with actual utilization — merchants pay charges, and HYPE tokens supply tangible perks like discounted buying and selling prices and platform advantages. That creates natural demand, not simply hypothesis.

So when Hyperliquid launched its huge $780M buyback, it wasn’t attempting to artificially inflate worth — it was reinforcing actual demand that already existed. The transfer additionally launched a provide shock, since HYPE’s circulating provide remains to be comparatively restricted. Add in the truth that the buybacks occurred whereas the platform was nonetheless rising, not on the prime, and it’s simple to see why it labored.

On the time of writing, HYPE trades round $38.43, down barely on the day however nonetheless holding up robust after bouncing from $35 lows in late October. On-chain indicators present regular accumulation, suggesting consumers are nonetheless assured.

Why Everybody Else Misplaced

The failures paint a transparent image. Initiatives like Bonk or LayerZero tried to purchase demand that didn’t exist. Bonk, for instance, doesn’t have any significant income stream or real-world token utility — its $26M buyback was simply smoke and mirrors. The end result? A 56% worth collapse, with almost 30 trillion tokens dumped by holders.

Jupiter bumped into the identical downside — at the same time as Solana’s main DEX, its token didn’t carry the sort of practical worth that evokes long-term holding. LayerZero’s $100M buyback didn’t assist both; with little readability round what the token really does, traders had no purpose to stay round.

Briefly, you may’t pretend fundamentals. Initiatives that attempted to fabricate demand by way of flashy buybacks ended up accelerating their decline. Hyperliquid succeeded as a result of it amplified real traction — the others failed as a result of they’d nothing strong to amplify.

Disclaimer: BlockNews gives impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding selections. Some articles might use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial group of skilled crypto writers and analysts earlier than publication.