- A whale opened a $7.9M leveraged lengthy on ZEC through HyperLiquid, signaling robust confidence.

- Zcash is up 7%, buying and selling close to $464, with trendline assist nonetheless holding.

- Rising Open Curiosity and Taker Purchase dominance counsel a bullish breakout towards $500–$520 is on the horizon.

A recent whale transfer simply lit up the market. A newly created pockets dropped $7.9 million in USDC onto HyperLiquid, opening a 5x leveraged lengthy place on Zcash (ZEC). The order is ready to increase by a TWAP technique — which means it’s increase steadily, not suddenly. That type of precision suggests this isn’t only a gamble; it’s confidence in a development that’s already forming.

Whales don’t normally transfer this heavy except they’re anticipating momentum. This lengthy entry strains up with a wider rise in ZEC Open Curiosity and a noticeable uptick in buy-side derivatives exercise, each traditional indicators of speculative demand increase. When whales and merchants align like this, the market tends to get up quick — and volatility normally follows.

Patrons Preserve Management as ZEC Rides Its Trendline

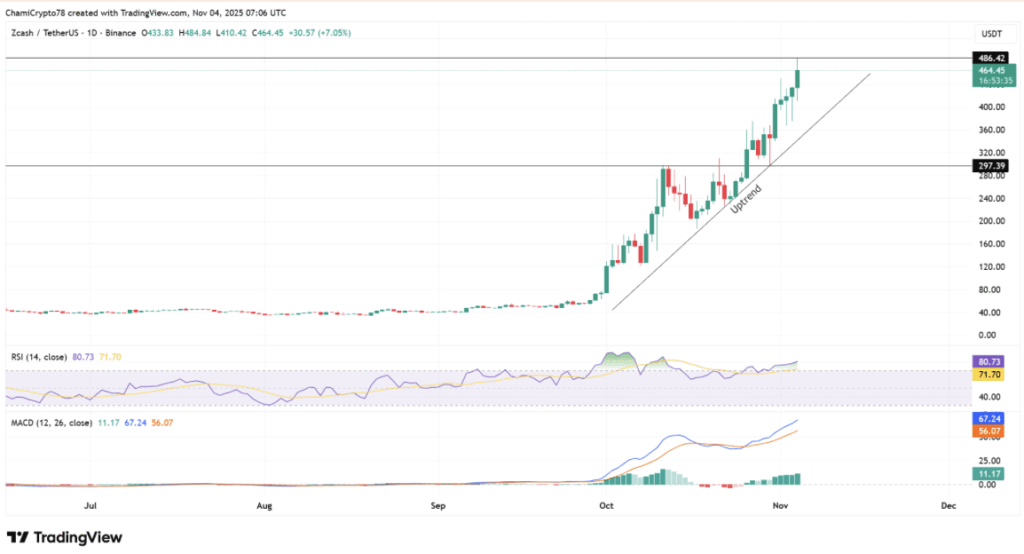

ZEC’s value has been holding regular inside a stable uptrend, up greater than 7% and buying and selling close to $464 on the time of writing. The every day chart reveals a string of upper lows, with a clear ascending trendline performing like a spine for the rally. Each dip towards it has attracted recent consumers — an indication that accumulation’s nonetheless robust.

That stated, there’s a bit of warmth out there. The RSI is sitting round 80.7, signaling that issues is likely to be getting stretched within the quick time period. The MACD histogram stays firmly optimistic although, suggesting that momentum hasn’t run out but. Nonetheless, the zone between $480 and $500 appears difficult; it’s the place sellers beforehand rejected value motion again in early October. If bulls can clear that ceiling, ZEC might push towards $520, whereas staying above $440 retains the development intact.

Derivatives Level to Rising Hypothesis

Zcash’s Open Curiosity surged 27.6% to roughly $734.7 million, displaying a pointy enhance in speculative positioning. This isn’t the type of OI spike that comes from quick overlaying — it’s lively shopping for, merchants piling in anticipating extra upside. Traditionally, that mixture (rising OI + rising value) hints at bullish conviction, not desperation.

Nonetheless, the larger the leverage, the larger the chance. If volatility picks up instantly, these leveraged longs might face heavy liquidations. For now, although, each spot and futures knowledge are displaying synchronized energy — which means there’s actual capital flowing into ZEC throughout markets, not simply leverage-driven hype.

Sturdy Purchase-Facet Alerts Regardless of Overheated RSI

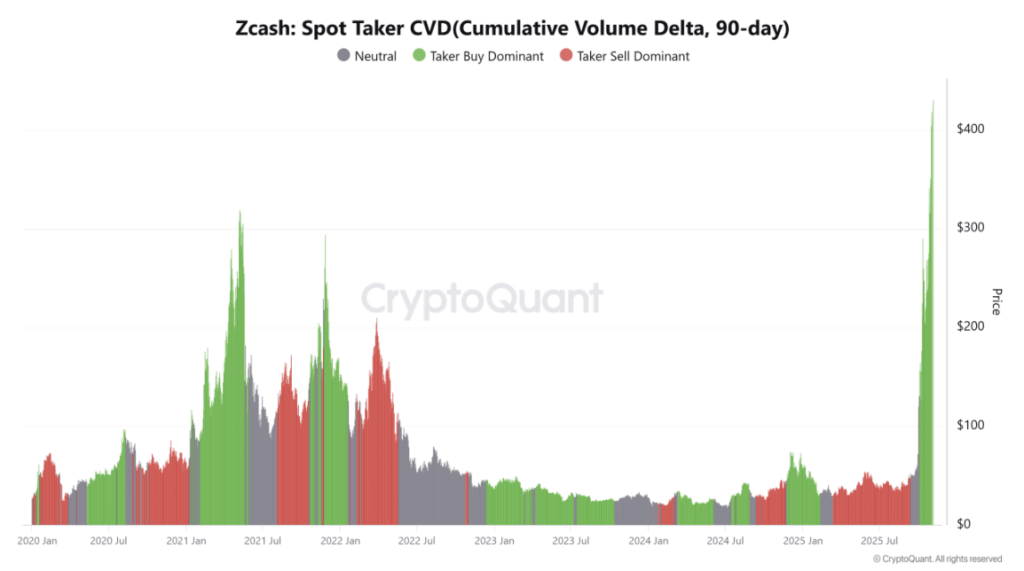

Spot knowledge provides one other layer to the story. Taker CVD metrics present that consumers are aggressively lifting presents, not simply ready for dips. That’s a robust signal — it means actual conviction on the purchase facet, each from retail and establishments. Despite the fact that RSI appears overheated, the persistent Taker Purchase dominance implies robust liquidity absorption, permitting ZEC to carry increased assist zones even throughout pullbacks.

If that continues, the coin’s construction might keep bullish longer than most anticipate. It’s uncommon to see this a lot demand maintain regular whereas momentum indicators flash purple — however ZEC appears to be doing precisely that.

Can Zcash Break $500?

All indicators level to ZEC having a official shot at breaching $500 quickly. The mixture of whale accumulation, increasing Open Curiosity, and aggressive buy-side stream is strictly what fuels short-term rallies.

Except sentiment instantly flips or a broader market selloff hits, Zcash appears positioned for a breakout part, doubtlessly carrying the subsequent leg towards $520 and past. The trendline’s stable, consumers are nonetheless stepping in, and for now, the whales appear to be main the cost.

Disclaimer: BlockNews offers impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles could use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial staff of skilled crypto writers and analysts earlier than publication.