The worldwide crypto market confirmed indicators of stabilization at present, with whole capitalization rising barely to $3.44 trillion, in accordance with information from CoinMarketCap.

Regardless of lingering volatility, a number of main belongings are displaying early indicators of restoration after every week of sustained declines.

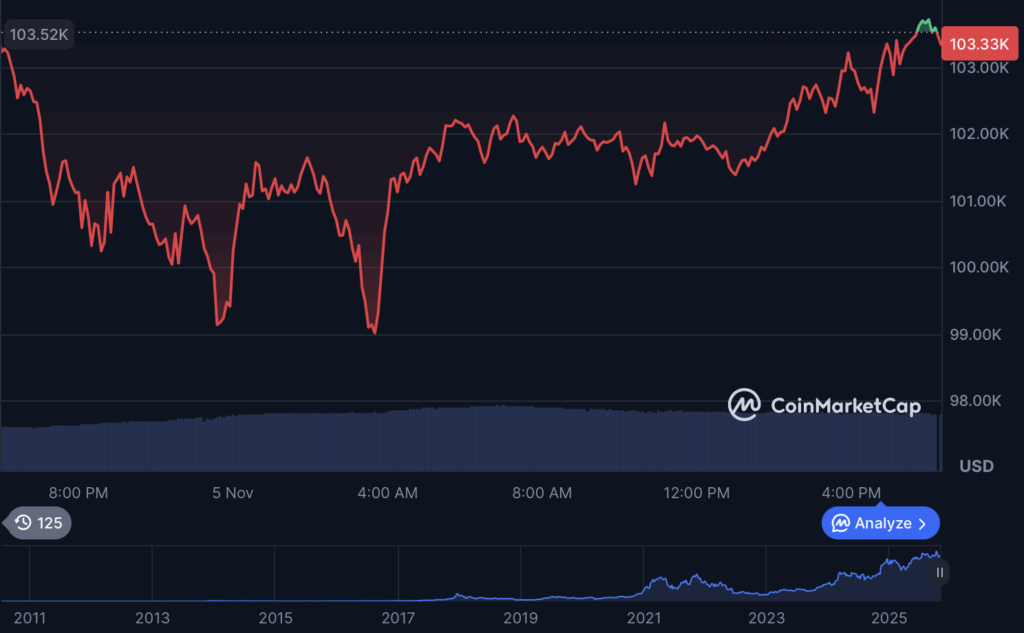

Bitcoin (BTC) climbed 0.5% prior to now 24 hours to commerce round $103,359, whereas Ethereum (ETH) rose 3.17% to $3,383, marking a modest rebound from latest lows close to the $3,200 degree. Each belongings stay down on the week, with Bitcoin dropping 6.98% and Ethereum 14.21%, however merchants say at present’s uptick might sign the beginning of a short-term aid rally.

Amongst altcoins, BNB gained 1.66% to $962, whereas XRP edged up 0.91% to $2.26. Solana (SOL) additionally noticed minor enchancment, recovering 1.49% to commerce at $159.18 after sharp losses earlier this week. Cardano (ADA) and Dogecoin (DOGE) posted smaller good points, rising 0.23% and 1.39%, respectively.

Stablecoins remained flat, with Tether (USDT) and USDC each hovering round their $1 peg. In the meantime, the Crypto Concern & Greed Index stayed deep within the “Concern” zone at 20, suggesting that sentiment stays fragile regardless of the day’s gentle uptick.

Analysts attribute at present’s rebound to a quick cooldown within the U.S. greenback’s power and profit-taking from quick sellers after the latest market dip. Nonetheless, with Bitcoin dominance holding close to 60% and macroeconomic uncertainty lingering forward of the Federal Reserve’s December fee resolution, merchants are cautious about calling a sustained restoration simply but.

“This seems to be extra like stabilization than reversal,” stated one analyst.

If Bitcoin can keep above the $100,000 line for just a few periods, we would see confidence return forward of the weekend.

For now, the market seems to be catching its breath – a quiet pause that would precede both a continued slide or the long-awaited aid rally bulls have been hoping for.