Be part of Our Telegram channel to remain updated on breaking information protection

Michael Saylor’s Technique has purchased $45 million Bitcoin and plans a euro-denominated most well-liked inventory providing (STRE) to fund extra BTC buys.

The corporate disclosed in a Securities and Trade Fee (SEC) submitting that it bought 397 Bitcoin final week at a mean worth of $114,771, bringing its whole holdings to 641,205 BTC purchased for $47.49 billion and presently price about $66.7 billion.

In a separate press launch, Technique mentioned it plans to promote 3.5 million euro-denominated perpetual most well-liked shares, or STREs, to fund future Bitcoin purchases and different company wants. The providing stays topic to market circumstances, it mentioned

Every STRE share carries a €100 face worth and a ten% annual dividend, payable quarterly from late 2025 if declared. Missed funds will accrue curiosity and rise by one proportion level yearly till paid.

Technique is providing $STRE (“Stream”), our first ever Euro-Denominated Perpetual Most popular Inventory, to European and international institutional buyers. $MSTR pic.twitter.com/tCectc2uA2

— Michael Saylor (@saylor) November 3, 2025

If there’s a case the place Technique misses a dividend fee, the quantity that was meant to be paid will earn additional curiosity that compounds every quarter, the corporate mentioned. In such a state of affairs, the dividend charge will rise by 1% per yr till Technique catches up.

Technique additionally mentioned that whether it is unable to pay any dividends to STRE share holders, it has to situation a “discover of deferral.” The corporate will then attempt to increase funds to pay buyers their dividends inside 60 days. To cowl these missed funds, Technique mentioned it might look to promote different lessons of its inventory.

Technique can even select to purchase again or redeem all STRE shares in money below two circumstances. The primary situation is that fewer than 25% of the initially issued shares stay excellent, whereas the second is that if sure tax-related occasions happen.

Technique Builds On Current Most popular Inventory Choices

The STRE providing is the newest addition to Technique’s vary of most well-liked inventory choices, which embrace STRF, STRK, STRD, and STRC.

STRF presents buyers cumulative dividends at a set charge of 10% every year on a acknowledged quantity no matter whether or not dividends are declared, whereas STRK presents a set dividend charge of 8% every year and features a conversion characteristic.

In the meantime, STRD has a ten% annual dividend charge. Lastly, STRC offers buyers dividends that modify month-to-month and which are paid in money when declared by the corporate.

Technique has already began utilizing a number of the proceeds from these inventory choices to buy Bitcoin.

Technique began buying Bitcoin again in 2020, and is the pioneer behind the digital asset treasury (DAT) mannequin. Quite a few firms have adopted Technique’s lead, and a few have utilized the mannequin to cryptos together with Ethereum (ETH), Toncoin (TON), and Solana (SOL).

Technique has acquired 397 BTC for ~$45.6 million at ~$114,771 per bitcoin and has achieved BTC Yield of 26.1% YTD 2025. As of 11/2/2025, we hodl 641,205 $BTC acquired for ~$47.49 billion at ~$74,057 per bitcoin. $MSTR $STRC $STRK $STRF $STRD https://t.co/yJfoyeNzCm

— Technique (@Technique) November 3, 2025

Its shopping for exercise has slowed not too long ago. In October, it purchased 778 BTC, one of many smallest month-to-month acquisitions lately. In September, it purchased 3,526 BTC.

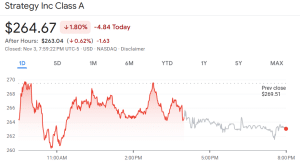

Technique’s Share Value Plunges

Technique’s inventory has dropped greater than 10% this week, and over 28% previously month.

MSTR worth (Supply: Google Finance)

Associated Articles:

Finest Pockets – Diversify Your Crypto Portfolio

- Straightforward to Use, Characteristic-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Energetic Customers

Be part of Our Telegram channel to remain updated on breaking information protection