The worldwide NFT market has seen a dramatic decline, dropping round 45% of its complete worth in simply 30 days, at the same time as general buying and selling exercise ticked up in October.

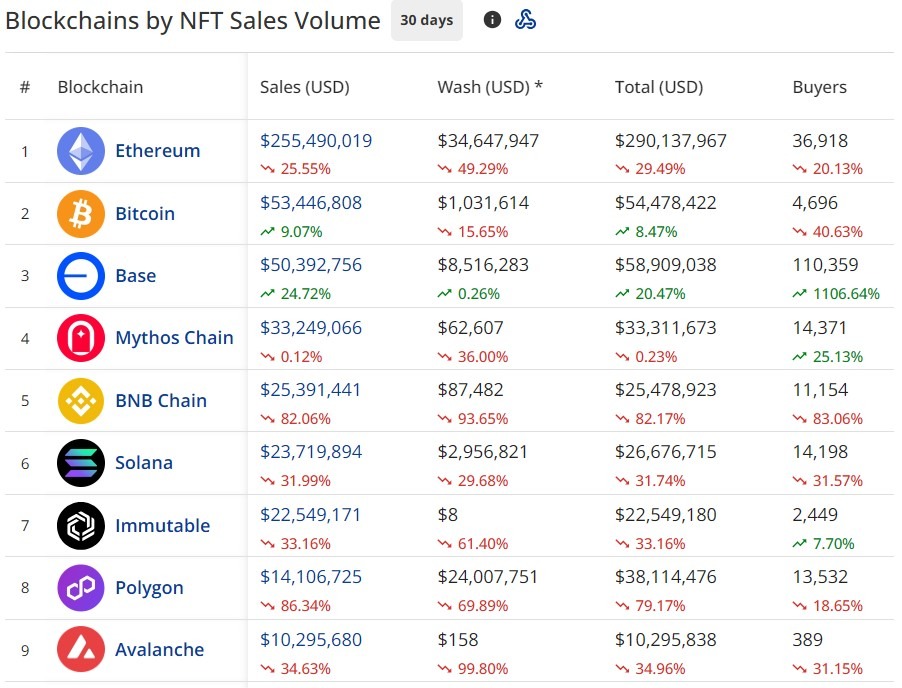

In accordance the data, complete NFT market capitalization plunged from $6.6 billion on Oct. 5 to $3.5 billion by Nov. 5. Regardless of this, CryptoSlam information reveals NFT gross sales rose 13% month-over-month, reaching $631 million in October. Notably, Bitcoin and Base NFTs stood out, gaining 9% and 24%, respectively, whereas different blockchains suffered steep declines.

BNB Chain and Polygon led the downturn, every dropping greater than 80% of their worth. Ethereum, the dominant NFT community, fell 25.5%, whereas Solana, Immutable, and Avalanche recorded losses between 31% and 35%.

The correction hit even blue-chip collections. CryptoPunks ground costs dropped from $214,000 to $117,000, and Moonbirds halved from $14,700 to $6,500. In the meantime, Bored Ape Yacht Membership (BAYC) and Pudgy Penguins noticed quantity development of 30% and 83%, however each suffered heavy worth declines – BAYC from $36,700 to $19,500, and Pudgy Penguins from $43,000 to $18,340.

The divergence between increased buying and selling exercise and falling valuations underscores how NFT liquidity stays speculative and tightly tied to general crypto sentiment.

At the same time as NFT costs stoop, key business gamers are shifting focus. OpenSea introduced plans to develop right into a common onchain buying and selling hub, whereas Animoca Manufacturers confirmed its intent to record on Nasdaq, signaling ongoing mainstream curiosity in Web3 regardless of the NFT cooldown.