Be a part of Our Telegram channel to remain updated on breaking information protection

Technique, the biggest company Bitcoin holder globally, will probably not need to dump a few of its reserves in the course of the subsequent market downturn, in keeping with analyst Willy Woo.

“MSTR liquidation within the subsequent bear market? I doubt it,” the analyst mentioned in an X put up earlier at present.

Technique Secure From Liquidation In The Subsequent Bear Market

Technique began accumulating Bitcoin again in 2020, and has persistently bought BTC through the years. Knowledge from Bitcoin Treasuries exhibits Technique now holds 641,205 BTC on its steadiness sheet.

Prime company BTC holders (Supply: Bitcoin Treasuries)

The corporate’s reserve is way larger than that of the next-biggest BTC treasury agency, MARA Holdings, which has 53,250 cash on its steadiness sheet.

To buy its Bitcoin, Technique has turned to debt financing to boost capital. Presently, many of the firm’s debt is convertible senior notes. The corporate is about to settle its conversions as they fall due by paying both money, frequent inventory, or a mixture of each.

Almost about the Sept. 15 2027 holder put proper date, Technique can have round $1.1 billion in debt due.

As a way to not need to promote Bitcoin to repay that debt, Technique’s inventory have to be buying and selling above $183.19, in keeping with Woo. This share worth corresponds with a Bitcoin worth of roughly $91,502, assuming a a number of net-asset-value (mNAV) of 1, the analyst mentioned.

One other analyst with the X consumer title “The Bitcoin Therapist,” mentioned within the feedback for Woo’s put up that there’ll have to be “one hell of a sustained bear market to see any liquidation for Technique.”

“Bitcoin must carry out horribly,” the analyst added.

Technique’s Inventory Value Continues Decline As Bitcoin Tumbles

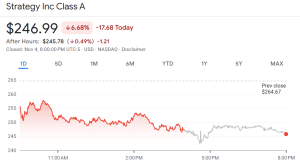

Woo’s put up comes as Technique’s shares prolong their medium-term downtrend. Prior to now 24 hours, the corporate’s inventory (MSTR) plummeted over 6%, knowledge from Google Finance exhibits.

MSTR worth (Supply: Google Finance)

The promoting exercise continued in the course of the after-hour buying and selling session, pushing MSTR a fraction of a share decrease throughout this era.

Zooming out to the longer-term time frames exhibits that MSTR has plummeted greater than 13% previously week. Technique’s inventory has additionally plunged over 31% previously month and greater than 36% previously six months.

The latest drop in share worth has seen Technique’s mNAV fall over 5% as effectively. In consequence, the metric stands at 1.31.

The efficiency seen by Technique’s share worth over latest months can be noticed with different digital asset treasury (DAT) corporations’ respective inventory costs. Corporations akin to Japan-based Metaplanet and main Ethereum treasury agency BitMine have seen comparable performances.

Including to these corporations’ woes is the latest downturn within the crypto market. On Oct. 10, the market underwent a flash crash which resulted in a report $19 billion getting liquidated from trades. This was after US President Donald Trump threatened to impose 100% tariffs on imported Chinese language items.

The crypto market has since tried to get better from that steep correction, however was hit with one other selloff within the final 24 hours. Throughout this era, main crypto BTC dropped beneath $100K to as little as $98,962.06. It has since recovered barely to commerce at $101,803.51 as of 12:55 a.m. EST, in accordance to CoinMarketCap. Regardless of the restoration, BTC remains to be down 4% previously 24 hours.

Technique Retains Including To Bitcoin Stockpile

Even amid the share worth decline, falling mNAV, and the market hunch, Technique continues so as to add to its Bitcoin reserves.

The corporate introduced its most up-to-date buy at the beginning of the week, and mentioned that it purchased 397 BTC for roughly $45.6 million at a mean buy worth of round $114,771 per Bitcoin.

Technique has acquired 397 BTC for ~$45.6 million at ~$114,771 per bitcoin and has achieved BTC Yield of 26.1% YTD 2025. As of 11/2/2025, we hodl 641,205 $BTC acquired for ~$47.49 billion at ~$74,057 per bitcoin. $MSTR $STRC $STRK $STRF $STRD https://t.co/gEuzDaloRb

— Michael Saylor (@saylor) November 3, 2025

In accordance with the corporate’s founder Michael Saylor, Technique has achieved a BTC yield of 26.1% year-to-date (YTD). The corporate’s complete holdings have been additionally acquired for roughly $47.49 billion at a mean purchase worth of $74,057, Saylor added.

The corporate has additionally launched a brand new providing referred to as “Stream” (STRE), which is a Euro-denominated Perpetual Most popular Inventory providing. The providing is geared toward European and international institutional buyers, and the corporate mentioned it’ll use the proceeds from this providing for company functions, which incorporates buying extra Bitcoin.

Associated Articles:

Finest Pockets – Diversify Your Crypto Portfolio

- Straightforward to Use, Characteristic-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Lively Customers

Be a part of Our Telegram channel to remain updated on breaking information protection