Be a part of Our Telegram channel to remain updated on breaking information protection

The Financial institution of England stated the UK received’t be left behind within the international stablecoin race, pledging that Britain will transfer “simply as rapidly because the US” after Washington’s passage of the landmark GENIUS Act.

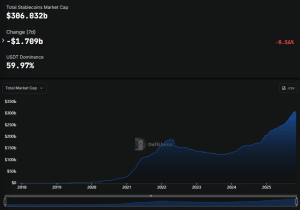

Talking on the SALT convention in London on Nov. 5, Deputy Governor Sarah Breeden stated the UK is decided to match the tempo set by the US because the stablecoin sector’s market capitalization surges previous $306 billion.

Stablecoin market cap (Supply: DefiLlama)

Her feedback come amid rising concern that the UK dangers lagging behind the US and different jurisdictions in shaping crypto coverage. The US has taken the lead with the GENIUS Act, which defines who could concern stablecoins, how they should be backed, and the regulatory requirements they have to meet.

✅ GENIUS ACT SIGNED INTO LAW

“The GENIUS Act creates a transparent and easy regulatory framework to determine & unleash the immense promise of dollar-backed stablecoins. This might be maybe the GREATEST revolution in monetary know-how for the reason that beginning of the web itself.” pic.twitter.com/CH5pnznAuf

— The White Home (@WhiteHouse) July 18, 2025

Financial institution Of England To Publish Session Paper Subsequent Week

The central financial institution will unveil its proposed stablecoin guidelines on Monday by way of a session paper outlining the way it plans to supervise so-called “systemic” tokens.

The upcoming session paper builds on momentum from a September assembly between UK Chancellor Rachel Reeves and US Treasury Secretary Scott Bessent after the US and UK governments introduced a joint process power aimed toward boosting collaboration on crypto and capital markets.

Breeden stated that the Financial institution of England’s proposals will solely apply to “systemic” stablecoins, or tokens which might be deemed able to changing into extensively used for funds. The remainder of the tokens available in the market can be regulated by the Monetary Conduct Authority below a much less stringent regime, the report added.

Financial institution Of England Confronted Criticism For Stablecoin Restrictions

Breeden’s feedback come after the Financial institution of England confronted sturdy pushback from lobbying teams for its plans to impose restrictions on stablecoin holdings to between £10,000 ($13,050) and £20,000.

The Financial institution of England is proposing a cap on particular person stablecoin holdings, limiting possession to only £10,000–£20,000 per particular person within the identify of “systemic threat.”

That is absurd, and we have to push again in opposition to this type of regulation. Stablecoins issued onchain don’t pose…

— Stani.eth (@StaniKulechov) September 15, 2025

The foyer teams argued that the deliberate restrictions could be troublesome and costly to implement. In the meantime, UK crypto advocacy teams have additionally urged the UK authorities to undertake a extra open stance in the direction of the digital asset trade.

GENIUS Act Sparked International Stablecoin Race

The US GENIUS Act, signed into legislation in July, kicked off a world stablecoin race with governments worldwide now methods to manage the marketplace for these tokens.

Along with the UK now making an attempt to maintain tempo with the US, the Canadian authorities has additionally unveiled its personal stablecoin laws plans.

In its 2025 federal finances, the Canadian authorities stated that its laws would require stablecoin issuers to carry and handle sufficient reserves, implement threat administration frameworks, safeguard customers’ private data, and set up redemption insurance policies.

“The laws may even embody nationwide safety safeguards to assist the integrity of the framework in order that fiat-backed stablecoins are secure and safe for shoppers and companies to make use of,” the federal government stated.

Moreover, Canada’s central financial institution plans to maintain $10 million from its Consolidated Income Fund remittances over the 2 years beginning in 2026-2027 to manage the laws. Thereafter, the estimated $5 million admin prices can be lined by charges on the stablecoin issuers which might be regulated below the laws.

Associated Articles:

Greatest Pockets – Diversify Your Crypto Portfolio

- Simple to Use, Function-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Lively Customers

Be a part of Our Telegram channel to remain updated on breaking information protection