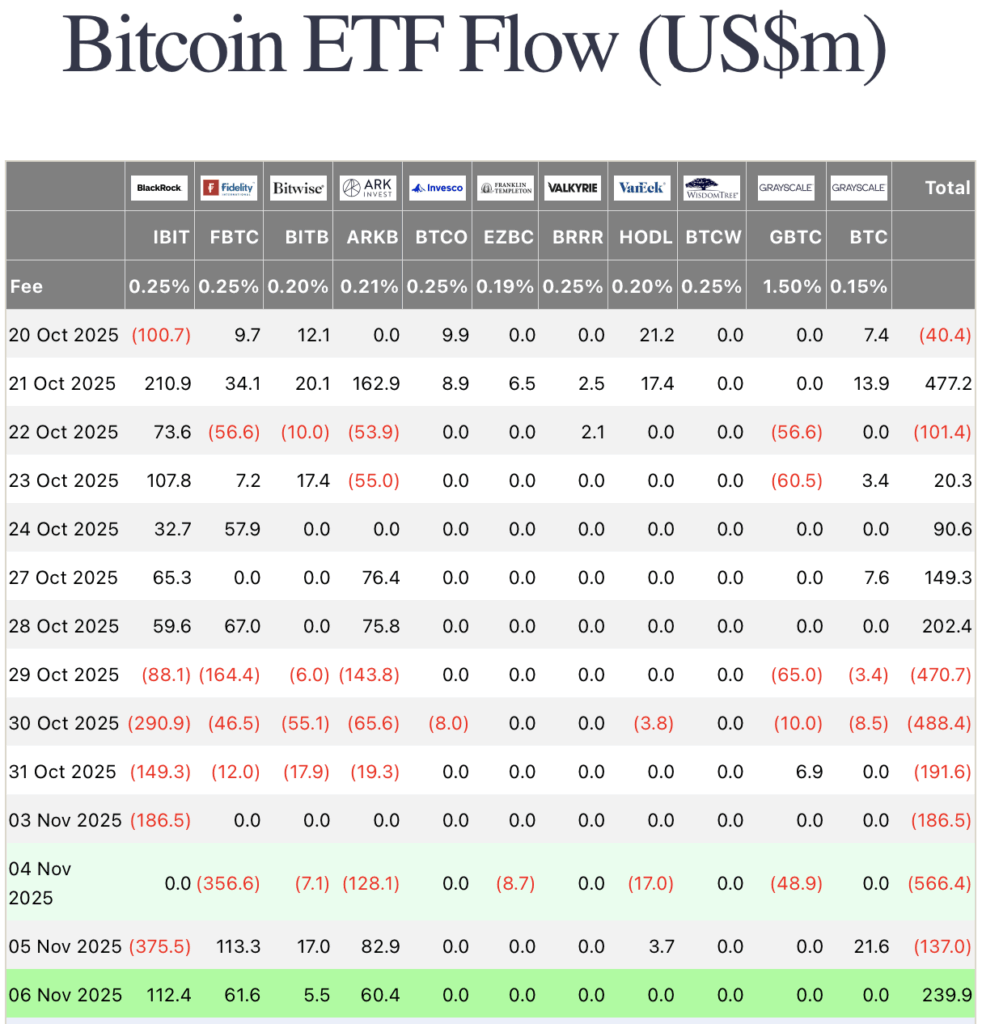

After almost every week of withdrawals, Bitcoin spot ETFs have swung again into optimistic territory, recording $240 million in web inflows and ending a six-day outflow streak, in accordance with Farside Buyers knowledge.

The turnaround was led by the market’s two largest issuers – BlackRock and Constancy – which noticed a surge in investor curiosity. BlackRock’s IBIT ETF introduced in $112 million, whereas Constancy’s FBTC added $61.6 million in inflows. Analysts say the renewed shopping for exercise alerts strengthening long-term conviction amongst institutional traders, at the same time as volatility stays excessive throughout the crypto market.

The full belongings below administration (AUM) for Bitcoin ETFs have now reached $135.4 billion, representing roughly 6.73% of Bitcoin’s complete market cap. Consultants consider that the mix of rebounding ETF inflows and rising expectations for a U.S. rate of interest lower helps to revive confidence throughout the digital asset sector.

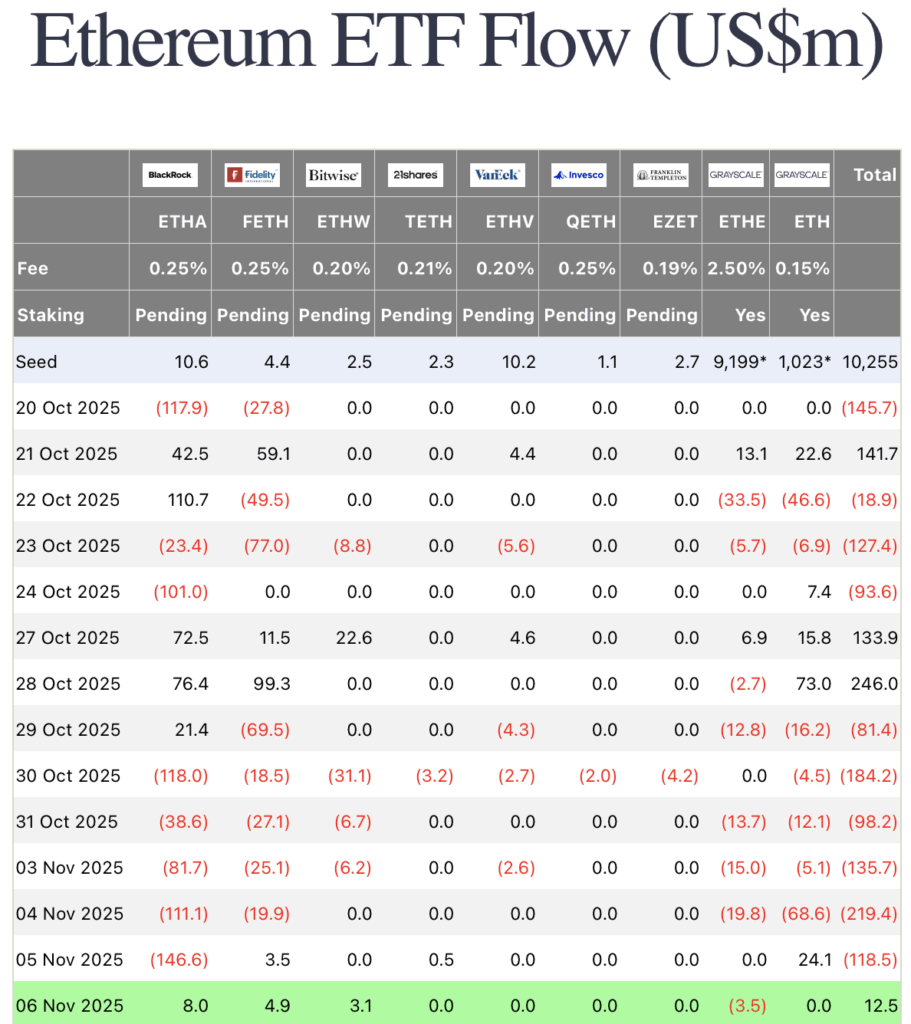

Ethereum ETFs Be part of the Restoration

Ethereum ETFs adopted an analogous trajectory, additionally snapping their six-day outflow pattern. On November 6, Ethereum spot ETFs posted $12.5 million in web inflows, marking renewed urge for food amongst traders.

Main the cost had been BlackRock’s ETHA ETF, with $8 million in inflows, and Constancy’s FETH ETF, with $4.94 million. In distinction, Grayscale’s ETHE recorded outflows of $3.52 million, persevering with to lag behind its newer rivals.

As of the newest replace, Ethereum ETFs maintain $21.75 billion in belongings, accounting for five.45% of ETH’s complete market capitalization.

The synchronized rebound in each Bitcoin and Ethereum ETFs hints at a doable shift in institutional sentiment, as merchants place for potential financial easing and a broader crypto market restoration.