- Ethereum broke beneath $3,500, confirming a bearish development and flipping EMAs into resistance.

- On-chain knowledge exhibits lively distribution, rising brief publicity, and lengthy liquidations.

- Key draw back targets lie close to $3,150 and $2,900 until bulls reclaim the $3,500 zone.

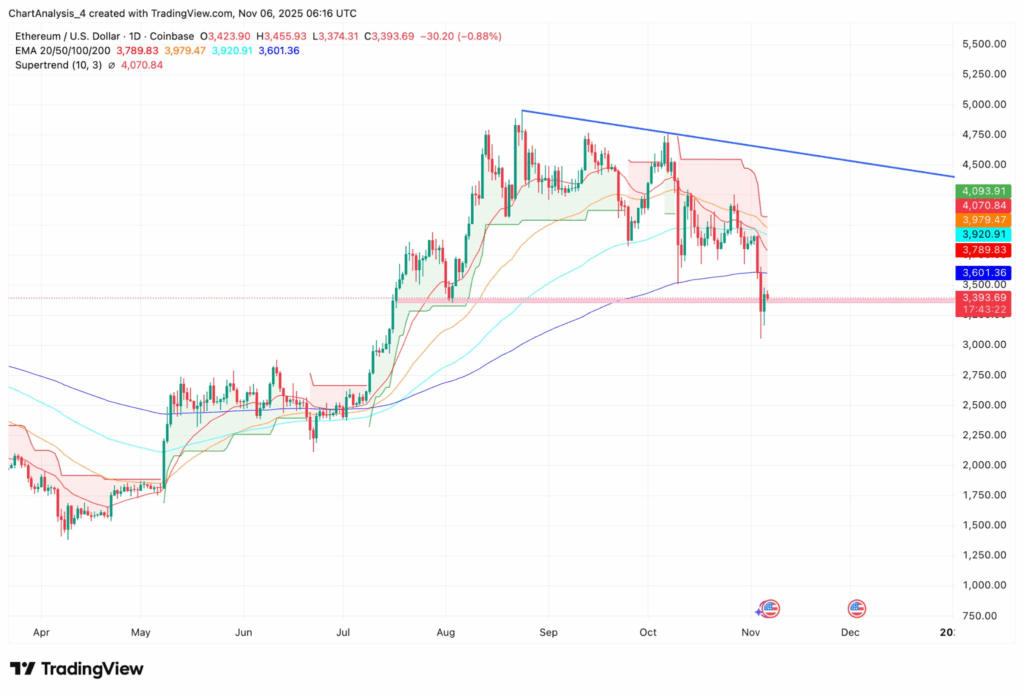

Ethereum (ETH) prolonged its decline this week, slipping to round $3,390 after breaking beneath the crucial $3,500 help, which has now flipped into agency resistance. The transfer confirms a bearish shift in market construction, with ETH buying and selling beneath all main exponential transferring averages (EMAs) — every now appearing as overhead resistance.

Technical Breakdown Confirms Bearish Momentum

Ethereum’s drop beneath the 200-day EMA close to $3,600 signaled that sellers had absolutely regained management. Since then, each rebound try has been met with decrease highs, whereas the supertrend indicator has turned bearish for the primary time in months.

On the every day chart, ETH trades beneath a descending trendline drawn from the April highs, and rallies into that zone have constantly triggered recent promoting. The present battle lies between $3,350–$3,500, a fading demand zone that would quickly give strategy to deeper liquidity ranges close to $3,150 and $2,900 — the latter marking a robust accumulation space seen in July.

Until bulls reclaim $3,500 with robust shopping for quantity, value motion will seemingly stay corrective relatively than structural, retaining the broader development tilted decrease.

On-Chain and Derivatives Knowledge Reinforce Bearish Tone

Trade circulation knowledge from Coinglass exhibits constant spot outflows of –$74.22 million on November 6, signaling lively distribution as tokens transfer onto exchanges. Such sustained outflows usually precede prolonged selloffs relatively than accumulation phases.

In the meantime, open curiosity climbed 2.19% to $39.59 billion, whilst costs fell — suggesting that brief positions are getting into the market. Choices quantity, nevertheless, plunged greater than 50%, exhibiting merchants shifting away from hedging to extra aggressive directional brief publicity.

Liquidation knowledge additionally confirms extra longs being worn out than shorts, a basic signal of pressured promoting stress. Notably, top-trader ratios stay internet lengthy, indicating some massive holders have but to unwind positions — a possible setup for a remaining capitulation flush towards $3,150 and even $2,900.

Outlook and Key Value Zones

For Ethereum bulls, the roadmap is evident: reclaim $3,500 and break above the clustered EMAs to shift sentiment again towards impartial. Doing so might reopen targets round $3,920 and $4,100, each aligning with the descending trendline resistance.

Till that occurs, ETH stays in a liquidity-seeking part, the place leverage and sentiment dominate over fundamentals. Rising brief publicity and heavy trade flows recommend additional draw back danger earlier than a significant base varieties.

Disclaimer: BlockNews gives impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles might use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial staff of skilled crypto writers and analysts earlier than publication.