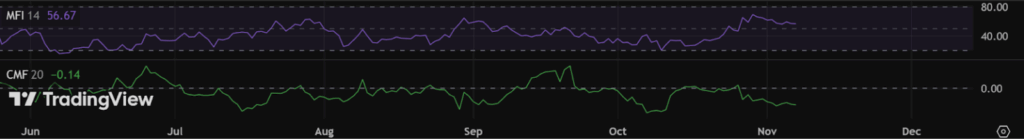

- Pi Coin’s indicators present quiet underlying power, with the MFI close to 56.7 hinting at regular accumulation since early October.

- A divergence between MFI (neutral-bullish) and CMF (damaging) exhibits a tug-of-war between patrons and sellers, with a CMF transfer above zero probably confirming a bullish shift.

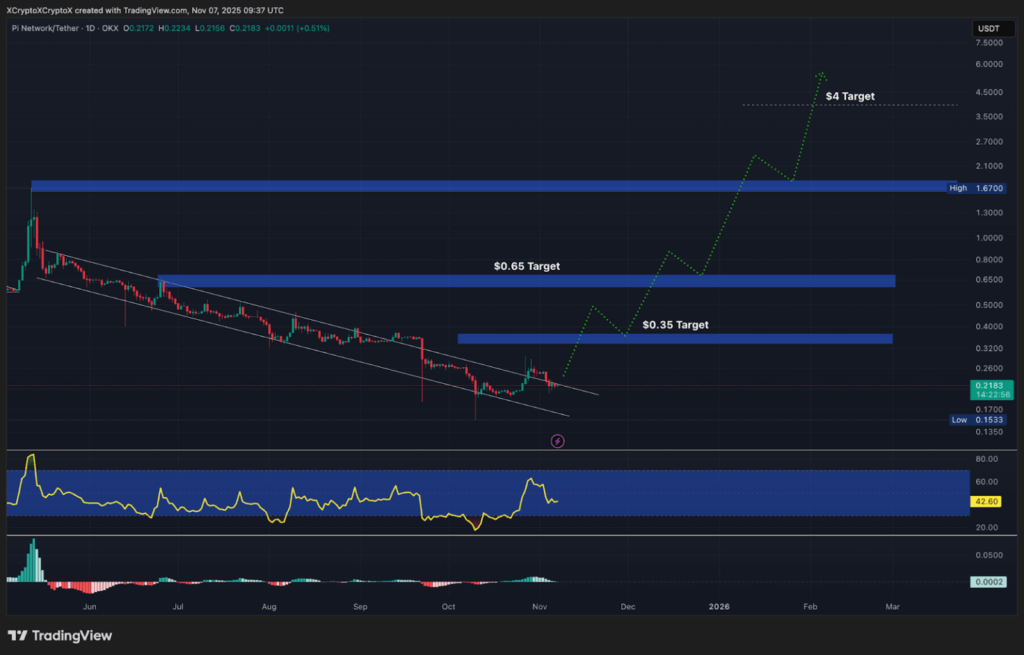

- Pi is buying and selling inside a falling channel sample, and a breakout with sturdy quantity may goal $0.35, then $0.65, and doubtlessly as excessive as $4 in a bigger multi-month reversal.

Pi Coin has been shifting underneath the radar recently, however the charts are beginning to whisper a unique story. Whereas value motion appears to be like calm on the floor, a number of the underlying indicators are hinting at a sluggish build-up of power, the type that may generally come earlier than a a lot larger transfer. It’s not screaming “breakout” simply but, however the construction forming proper now could be the type that merchants don’t ignore for lengthy.

Cash Stream Exhibits a Tug-of-Battle

The Cash Stream Index (MFI) is at present sitting round 56.67, which places Pi in that neutral-to-bullish vary — not overheated, not oversold, simply quietly leaning to the upside. This type of studying normally means patrons have been stepping in regularly, with out turning it right into a full-on FOMO rush. Since early October, inflows have stayed fairly regular, suggesting that accumulation has been taking place within the background whereas most individuals weren’t actually paying consideration.

However it’s not all one-way visitors. The Chaikin Cash Stream (CMF) continues to be damaging at about -0.14, which tells us that some capital continues to be leaking out of the asset. That mismatch between MFI and CMF paints an image of a market in steadiness, or perhaps in battle — patrons attempting to construct positions whereas others quietly promote into power. If CMF manages to flip again above zero, that will be a robust sign that cash is lastly flowing in additional decisively on the bullish aspect.

A Uncommon Falling Channel Sample Takes Form

On the each day chart, Pi is at present buying and selling inside a long-term falling channel, a construction that’s usually seen as a bullish reversal setup fairly than only a bleed-out. Worth has tapped the decrease trendline a number of instances, however what’s attention-grabbing is that the RSI has been placing in increased lows on the similar time. That form of divergence hints that draw back momentum is fading, even when the value doesn’t look spectacular but. It’s just like the engine is revving quietly whereas the automotive nonetheless appears to be like parked.

If Pi can lastly punch by means of the higher boundary of this channel with a correct quantity spike behind it, the primary large check sits close to the $0.35 degree. Clear that, and the subsequent hurdle strains up round $0.65. Past these resistance zones, a sustained breakout may unlock a a lot bigger push towards the $4 area, which might mark a severe multi-month development reversal as an alternative of simply one other short-lived bounce. For now, it’s nonetheless early — however the items are beginning to line up in a method that might shock individuals who stopped watching.

Disclaimer: BlockNews gives unbiased reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles might use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial crew of skilled crypto writers and analysts earlier than publication.