- On-chain evaluation suggests Paradigm is the biggest HYPE holder, controlling over 19.14 million tokens value about $763 million.

- Their estimated entry worth is round $16.46 per HYPE, placing Paradigm up roughly $440 million in unrealized good points at present costs.

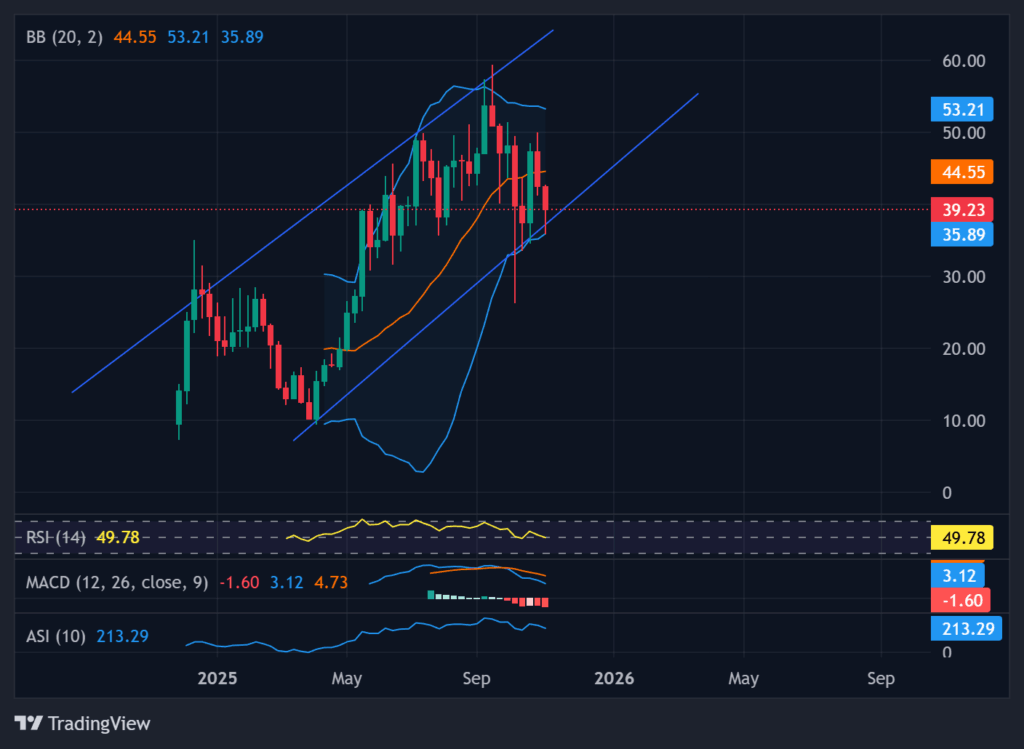

- HYPE is consolidating inside a rising channel, sitting ~33% beneath its all-time excessive, with potential to retest $53 if shopping for returns—or slide towards ~$35.9 if assist weakens.

For months, folks in crypto circles have been quietly asking the identical factor: is Paradigm secretly loading up on HYPE? Properly, on-chain information has mainly answered that query. In response to recent evaluation, Paradigm is now believed to be the biggest holder of HYPE, the native token of the Hyperliquid DEX, with greater than 19.14 million tokens underneath its management. At present costs across the low $40s, that stash comes out to roughly $763 million. That’s not only a informal place; that’s a “we actually consider on this factor” type of guess.

How Paradigm’s HYPE Place Was Pieced Collectively

On-chain analytics agency MLM experiences that Paradigm’s stack represents about 1.91% of HYPE’s complete provide and 5.73% of the circulating provide, which formally makes them the highest holder. Issues bought actually fascinating on November 7, when that HYPE was reportedly consolidated into 19 new wallets — a transfer some analysts suppose is said to the upcoming SONN occasion that’s set to wrap up in about 11 days. The path, although, goes again additional. Since August, MLM has been monitoring hints that Paradigm was scooping up HYPE, first through Wintermute shortly after the TGE, and later by FalconXGlobal on Gate.io. These transfers lined up neatly with Paradigm’s personal public feedback about holding HYPE since final November, which just about ties the bow on the speculation.

Following the On-Chain Footprint and the Revenue Math

The deeper you look, the clearer the sample will get. Again in December, round 4.18 million HYPE moved from Wintermute to a recent tackle, which then break up the tokens into 10 sub-wallets holding between 150,000 and 840,000 HYPE every. Extra chunks moved once more in February and April, and altogether these transfers added as much as greater than 15 million tokens. MLM estimates Paradigm’s price foundation at round $16.46 per HYPE, suggesting an preliminary outlay near $315 million. With the token now buying and selling close to $39–$40, that place can be sitting on greater than $440 million in unrealized good points — roughly a 2.5x paper revenue. Paradigm hasn’t formally confirmed any of this, however the addresses and flows inform a fairly loud story on their very own.

HYPE Value Motion: Consolidation Now, Breakout Later?

Even with a big-name backer within the background, HYPE hasn’t been proof against market chop. The token is down about 15% over the previous month and sits roughly 33% beneath its all-time excessive at $59.39. Nonetheless, it stays the Eleventh-largest cryptocurrency by market cap, hovering round $13.24 billion. On the weekly chart, HYPE is trending inside a rising parallel channel, with the RSI parked close to 49.78 — mainly impartial, not overheated and never washed out.

The MACD line is flattening too, which inserts the narrative of a consolidation part fairly than a full-blown development reversal. If consumers step again in, worth might make one other run towards the higher channel resistance round $53. But when momentum fades once more, a drop towards the decrease Bollinger Band close to $35.89 can also be on the desk. For now, the market appears to be catching its breath whereas certainly one of crypto’s largest funds quietly sits on a mountain of HYPE.

Disclaimer: BlockNews offers unbiased reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles could use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial group of skilled crypto writers and analysts earlier than publication.