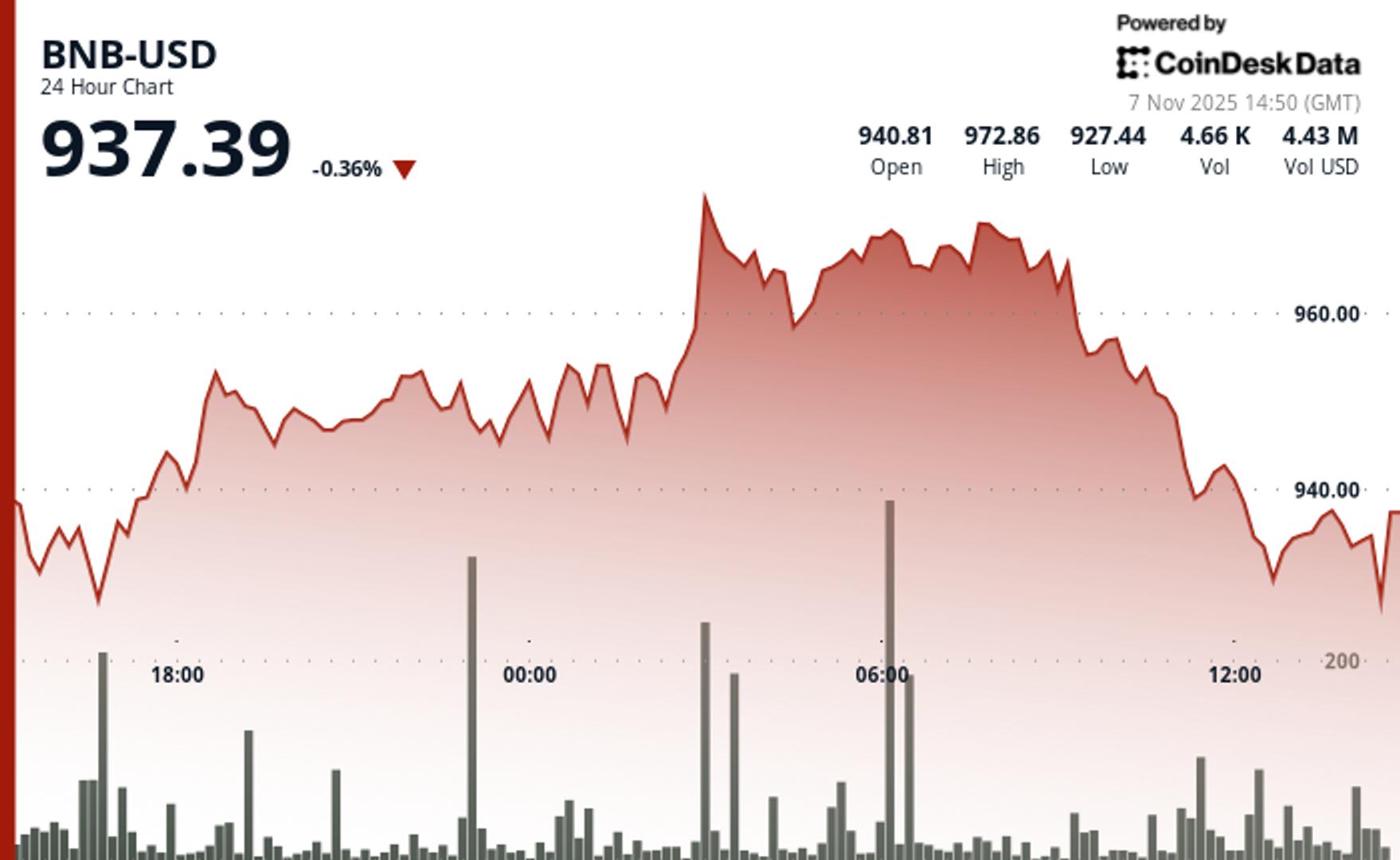

The native token of the BNB Chain, BNB, slipped barely during the last 24-hour interval, shifting to $933 after briefly surging to $974, as broader crypto markets confirmed indicators of stress tied to tightening monetary situations.

The token’s worth motion performed out in a slim $46 vary. Quantity rose sharply through the morning’s transfer larger, 71% above the 24-hour common, however cooled into the shut in response to CoinDesk Analysis’s technical evaluation information mannequin.

The rejection close to $975 marked a technical ceiling, whereas BNB discovered help as soon as once more close to $930.

“BNB’s skill to carry help mirrors the broader power we’re seeing on-chain,” Johnny B., the founding father of BNBPad.ai, informed CoinDesk in an emailed assertion. “Regardless of the market headwinds, BNB Chain noticed 82 million lively addresses in October, a brand new all-time excessive, whereas DEX volumes neared $120 billion primarily based on DeFiLlama.”

BNB’s muted efficiency got here alongside a wider market drawdown. The broader market, as measured by way of the CoinDesk 20 (CD20) index, is down 0.9% within the final 24 hours whereas bitcoin is struggling to stay above $100,000.

A U.S. Treasury money rebuild and falling financial institution reserves, down an estimated $500 billion since July, have drained capital from markets and made danger property much less engaging, in response to a current report from Citi.

That has seen shares fall as effectively, with the tech-heavy Nasdaq 100 seeing a 4.7% decline this week, and the S&P 500 dropping by 2.7%.

On this atmosphere, BNB’s skill to remain above its key $930 help degree could mirror confidence within the community’s adoption and the efficiency of newer decentralized functions like Asper, even because the broader outlook dims.

A break above $975 might reopen the trail towards current highs, however additional draw back in main property might take a look at consumers’ resolve. BNB stays tied to technical setups for now, however broader market forces are beginning to name the pictures.

Disclaimer: Elements of this text had been generated with the help from AI instruments and reviewed by our editorial staff to make sure accuracy and adherence to our requirements. For extra data, see CoinDesk’s full AI Coverage.