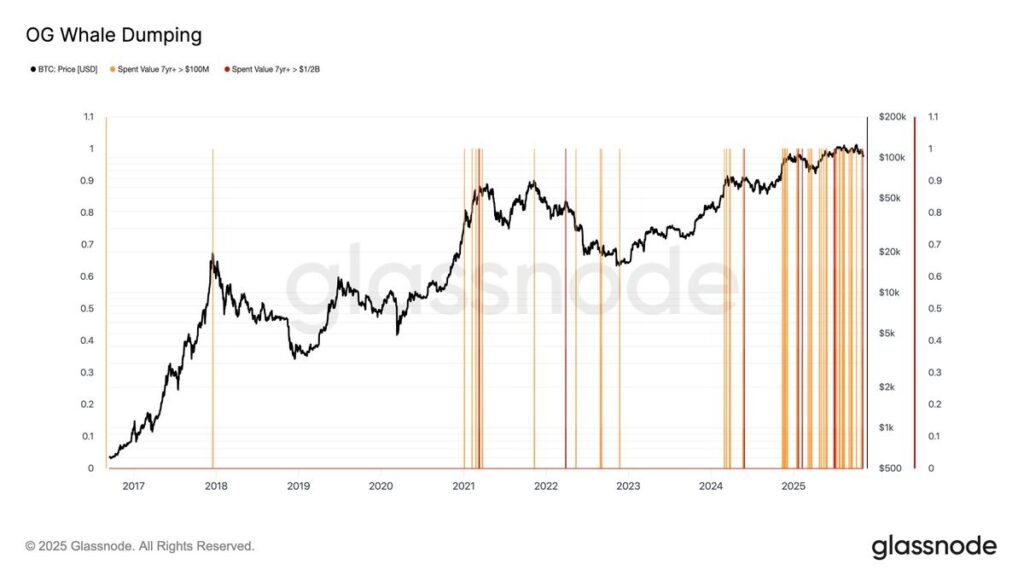

Bitcoin’s value restoration faces new headwinds as long-term holders – or “OG whales” – have been unloading huge quantities of BTC all through 2025, sparking renewed fears of a deeper correction.

Based on Capriole Investments co-founder Charles Edwards, these “tremendous whales” have been liquidating their holdings at an unprecedented tempo, spending over 1,000 BTC per hour since early 2025. Edwards shared on-chain information displaying heavy promoting from wallets dormant for seven years or extra, describing the yr’s exercise as “very colourful” because of the surge in giant transactions exceeding $100 million and even $500 million.

Bitcoin is presently buying and selling practically 19% under its October all-time excessive of $126,000, with analysts divided over whether or not the decline marks a wholesome bull-cycle pause or the beginning of a extra critical retracement pushed by whale promoting. Information from Glassnode confirms that long-term holders have been constantly transferring giant quantities of BTC since November 2024, suggesting a gentle sample of distribution slightly than remoted profit-taking.

One main whale, recognized by Lookonchain as “Bitcoin OG Owen Gunden,” lately moved 3,600 BTC (round $372 million), together with 500 BTC deposited to Kraken, doubtlessly signaling lively liquidation.

Nevertheless, not all analysts see these strikes as outright promoting. On-chain researcher Willy Woo urged that among the giant transfers may very well be non-selling occasions, reminiscent of migrating funds to Taproot addresses for enhanced safety or custody reshuffling amongst institutional treasuries.

Technically, Bitcoin’s value construction isn’t serving to confidence. A break under the $100,650 assist line might ship BTC tumbling towards $89,600, representing a roughly 12% drop from present ranges.

Analysts warn that Bitcoin should maintain above its 50-week exponential transferring common (EMA), presently close to $100,900, to keep away from a sharper correction towards $92,000 or decrease.

Whereas Bitcoin stays resilient in comparison with earlier cycles, the persistent motion of cash from the oldest wallets provides a layer of uncertainty – and for merchants eyeing new highs, the actions of those early adopters could show to be one of many greatest obstacles standing in the way in which.