High Tales of The Week

Ripple rejects IPO plans regardless of SEC case victory: Right here’s why

Ripple, the US blockchain firm behind the XRP cryptocurrency, is not going to pursue an preliminary public providing following the conclusion of its years-long authorized battle with the US Securities and Alternate Fee.

Ripple president Monica Lengthy mentioned the corporate has no plans or timeline for an IPO, in response to a Bloomberg report on Wednesday.

“We’re in a lucky place the place we’ve been capable of be very effectively capitalized and fund all of our natural progress, inorganic progress, strategic partnerships, something we wish to do,“ Lengthy mentioned.

Ripple’s resolution to forgo an IPO ends years of hypothesis, after a number of executives had hinted at one. The corporate was hit with a $1.3 billion SEC lawsuit in late 2020.

Bitcoin bull run hasn’t began but: Jan3’s Samson Mow

Samson Mow, the CEO and founding father of Bitcoin expertise infrastructure firm Jan3, argues the Bitcoin bull run is but to start, as Bitcoin fell to simply below $100,000 earlier this week.

“The Bitcoin bull run hasn’t began but. We’re simply marginally outperforming inflation at this worth vary,” he mentioned on Wednesday.

Bitcoin and the broader cryptocurrency market continued to hunch this week, with analysts attributing the decline to commerce tensions between the US and China, in addition to different macroeconomic components. Bitcoin promoting intensified on Tuesday, and CoinGecko information exhibits the value dipped to $99,607 on Wednesday.

Nonetheless, Mow, in a sequence of bullish X posts, predicted the market nonetheless has loads of upside on the horizon as Bitcoin continues to outperform the US inflation charge of three%.

FBI can’t be blamed for wiping onerous drive with $345M BTC, say judges

A person convicted of identification theft, who claims his onerous drive with over 3,400 Bitcoin was seized and wiped by the FBI, has misplaced his lawsuit towards the federal government in a US appeals courtroom.

A 3-judge panel on the Eleventh Circuit Court docket of Appeals discovered on Tuesday that Michael Prime can’t sue the federal government over the lack of a key to entry round 3,443 Bitcoin, now value $345 million, as he beforehand claimed he didn’t personal that quantity of crypto.

Prime requested a courtroom after he was launched from jail in July 2022 for a tough drive containing the Bitcoin to be returned, however the FBI had wiped it as a part of its commonplace procedures, which Prime claimed was unlawful; the judges mentioned.

“For years, Prime denied that he had a lot bitcoin in any respect. And bitcoin was not on the checklist when he sought to get better lacking property after his launch from jail,” the judges wrote. “Solely later did Prime declare to be a bitcoin tycoon.”

Reality behind comeback of privacy-focused protocol Zcash in 2025

Privateness is in vogue, and there was an outsized winner available in the market. The Zcash protocol has been the discuss of the crypto group on X, and the value of its native token, Zcash, has mirrored that narrative.

Zcash’s token has been buying and selling above $500 for the primary time since 2018, pushed by an intriguing development of help from among the business’s hottest commentators.

The likes of Arthur Hayes, Naval Ravikant, Mert Mumtaz, Ansem, Threadguy and different notable accounts have been advocating for the privacy-first advantages of Zcash for months. Lofty worth predictions interlaced with privacy-praising takes have performed their half in ZEC’s outsized returns compared to the broader altcoin panorama.

Polymarket rife with ‘synthetic buying and selling,’ Columbia College researchers discover

The speedy progress of the prediction market Polymarket will not be completely natural however as an alternative inflated by synthetic buying and selling exercise, in response to analysis revealed by Columbia College.

In an 80-page paper titled “Community-Primarily based Detection of Wash-Buying and selling,” which has not but undergone peer assessment, Columbia researchers recognized in depth wash-trading exercise on Polymarket starting in July 2024. That month, they discovered that wash trades accounted for almost 60% of the platform’s complete buying and selling quantity.

“This exercise endured by late April 2025 earlier than subsiding considerably, and as soon as once more elevated to about 20 % of quantity in early October 2025,” they wrote.

The researchers decided that 25% of Polymarket’s complete buying and selling quantity over the previous three years was attributable to synthetic buying and selling.

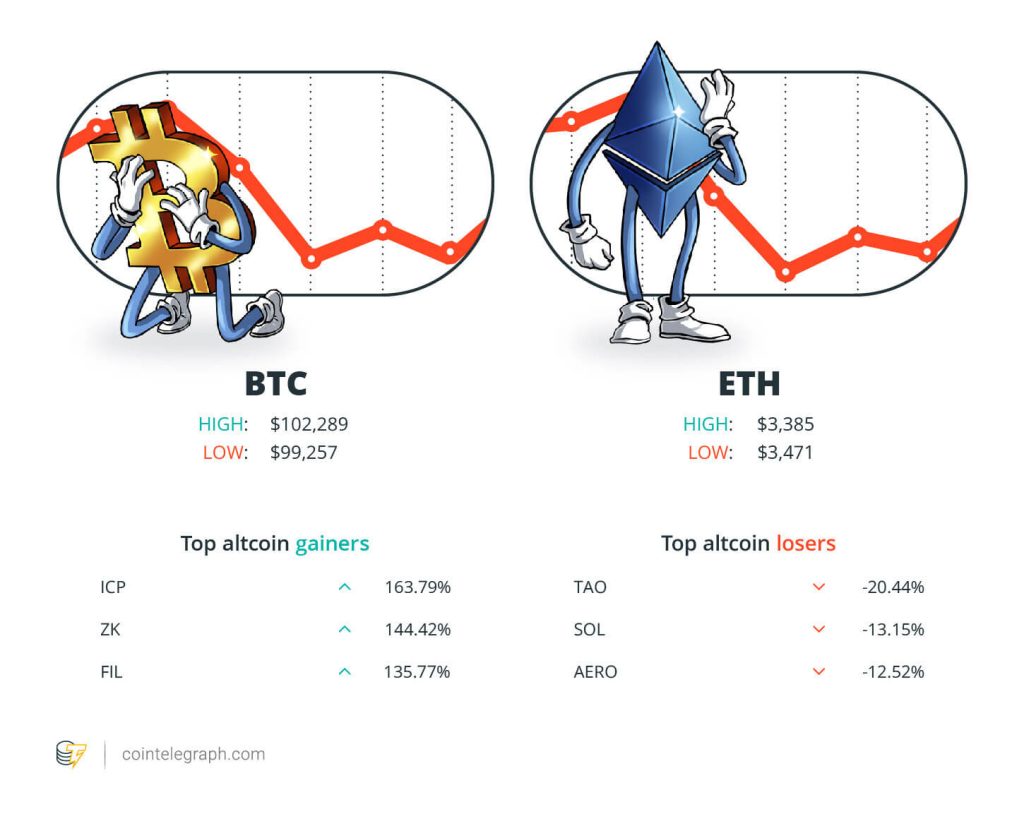

Winners and Losers

On the finish of the week, Bitcoin (BTC) is at $102,289, Ether (ETH) at $3,385 and XRP at $2.30. The full market cap is at $3.44 trillion, in response to CoinMarketCap.

Among the many greatest 100 cryptocurrencies, the highest three altcoin gainers of the week are Web Laptop (ICP) at 163.79%, ZKsync (ZK) at 144.42% and Filecoin (FIL) at 135.77%.

The highest three altcoin losers of the week are Bittensor (TAO) at 20.44%, Solana (SOL) at 13.15% and Aerodrome Finance (AERO) at 12.52%. For more information on crypto costs, be sure that to learn Cointelegraph’s market evaluation.

Most Memorable Quotations

“Given what’s occurring to stablecoins, that are serving rising markets in a method that we thought Bitcoin would, I feel we may take possibly $300,000 off that bullish case, only for stablecoins.”

Cathie Wooden, CEO of ARK Funding Administration

“The Bitcoin bull run hasn’t began but. We’re simply marginally outperforming inflation at this worth vary.”

Samson Mow, CEO of Jan3

“We like alignment with the group. We’re an enormous participant in crypto. We wish to hold doing it. We like that our prospects are engaged in it.”

Shiv Verma, senior vp, finance and technique, and treasurer at Robinhood

“Distributed ledger expertise that facilitates asset tokenisation may essentially rework our capital markets, in the identical method because the introduction of CHESS as soon as did.”

Joe Longo, chair of the Australian Securities and Investments Fee

“Nonetheless a terrific space to build up positions on ETH.”

Michael van de Poppe, founding father of MN Buying and selling Capital

“Crypto retail is in max desperation.”

Matt Hougan, chief funding officer at Bitwise

High Prediction of The Week

Bitcoin crisscrosses $100K as BTC worth ‘bottoming part’ begins

Bitcoin threatened $100,000 help once more Friday as bulls hoped for a better low. Information from Cointelegraph Markets Professional and TradingView confirmed BTC worth motion retreating to close $99,000 across the Wall Avenue open.

After failing to safe a serious aid bounce from multimonth lows, BTC/USD continued to place strain on bulls and late lengthy positions.

Information from monitoring useful resource CoinGlass put 24-hour crypto lengthy liquidations at over $700 million at time of writing.

High FUD of The Week

Bitcoin at $100K is ‘pace bump’ to $56K, however information indicators no indicators of panic

Bitcoin’s worth might decline by nearly 50% if its present downward development over the previous month continues, says a conventional finance analyst.

Learn additionally

Options

Crypto within the Philippines: Necessity is the mom of adoption

Options

Which gaming guild positioned itself finest for the bull market?

Nonetheless, onchain analytics agency Glassnode advised that Bitcoin’s present downtrend will not be as extreme as some market contributors consider.

Bloomberg analyst Mike McGlone mentioned in an X publish on Thursday that Bitcoin hitting $100,000 could possibly be “a Velocity Bump Towards $56,000.”

“My take a look at the chart exhibits how regular it’s been for the first-born crypto to revert to its 48-month shifting common, now round $56,000, after equally prolonged rallies as in 2025,” McGlone added.

Australia dangers ‘missed alternative’ by shirking tokenisation: high regulator

Australia’s capital markets threat being outpaced by different international locations until it embraces new expertise reminiscent of tokenization, says the nation’s head market regulator.

Learn additionally

Options

The blockchain tasks making renewable power a actuality

Options

Crypto critics: Can FUD ever be helpful?

“As different international locations adapt and innovate, there’s an actual threat Australia may turn out to be the ‘land of missed alternative’ or be passive recipients of developments abroad,” Australian Securities and Investments Fee Chair Joe Longo advised the Nationwide Press Membership on Wednesday.

“The selection is innovate or stagnate — to evolve or turn out to be extinct.”

Cathie Wooden drops BTC forecast by $300K, says stablecoins eroding market share

ARK Funding Administration CEO Cathie Wooden lower her long-term Bitcoin worth projection by $300,000, warning that stablecoins are eroding Bitcoin’s function as a retailer of worth in rising markets.

“Stablecoins are usurping a part of the function that we thought Bitcoin would play,” Wooden, who beforehand forecast a high BTC worth of $1.5 million by 2030, advised CNBC on Thursday.

“Given what’s occurring to stablecoins, that are serving rising markets in a method that we thought Bitcoin would, I feel we may take possibly $300,000 off that bullish case, only for stablecoins. Stablecoins are scaling right here, I feel, a lot sooner than anybody would have anticipated,” she mentioned.

High Journal Tales of The Week

Grokipedia: ‘Far proper speaking factors’ or much-needed antidote to Wikipedia?

Elon Musk’s experiment to reshape on-line reality, Grokipedia, is touted as a extra impartial and complete rival to Wikipedia, however is it?

Philippines blockchain invoice to battle corruption, crypto KOLs charged: Asia Categorical

Influencers shilling JPEX charged by Hong Kong police, Philippine’s anti-corruption blockchain invoice set for Senate ground, and extra.

Why AI sucks at freelance work and real-life duties: AI Eye

AI can’t full 97% of Upwork duties and will get the information flawed half the time. Your job is protected for now.

Subscribe

Probably the most partaking reads in blockchain. Delivered as soon as a

week.

Editorial Workers

Cointelegraph Journal writers and reporters contributed to this text.