For practically a decade, it appeared inevitable that Ethereum would turn out to be the institutional spine of blockchain finance.

Its dominance in good contracts, developer tooling, and DeFi ecosystems made it the protected, predictable alternative for any large-scale integration. However 2025 has introduced a twist: because the tokenization of conventional belongings accelerates, Solana – as soon as seen as a playground for retail hypothesis — is rising as a reputable various.

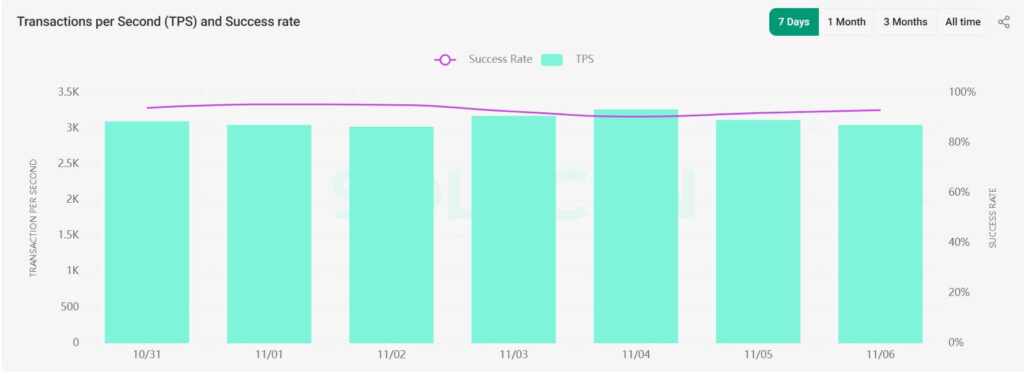

The chain that constructed its fame on meme cash and fast-paced buying and selling is now being reconsidered as a possible settlement layer for monetary establishments. Solana’s strengths – pace, effectivity, and sub-cent transaction charges – are starting to look much less like novelties and extra like infrastructure. Analysts argue that its design, constructed for high-frequency execution, may match extra naturally into markets that demand throughput and low latency.

Nonetheless, Solana’s ambitions stay removed from realized. The community’s actual buying and selling exercise is a fraction of its technical capability, and it strikes nowhere close to the dimensions of exchanges like Nasdaq, which handles trillions in month-to-month quantity. Builders are working to shut that hole with upgrades geared toward stabilizing validators and enhancing block scheduling – steps meant to make Solana much less experimental and extra industrial.

The financial potential, nonetheless, is difficult to disregard. Artemis CEO Jon Ma estimates that the worldwide tokenization market may attain $10–16 trillion by 2030. If Solana have been to seize even a small share – say, 5 % – its market cap may climb towards $880 billion. His mannequin values blockchains much less as speculative belongings and extra as digital infrastructure, the place effectivity and payment seize matter greater than narrative.

Whether or not that imaginative and prescient turns into actuality will depend on whether or not establishments can belief a blockchain initially constructed for merchants and builders moderately than regulators. Ethereum nonetheless holds that benefit: mature, battle-tested, and compliant by design. But Solana’s evolution hints at a brand new risk — that the quickest community in crypto may someday energy the slowest-moving establishments on Earth.