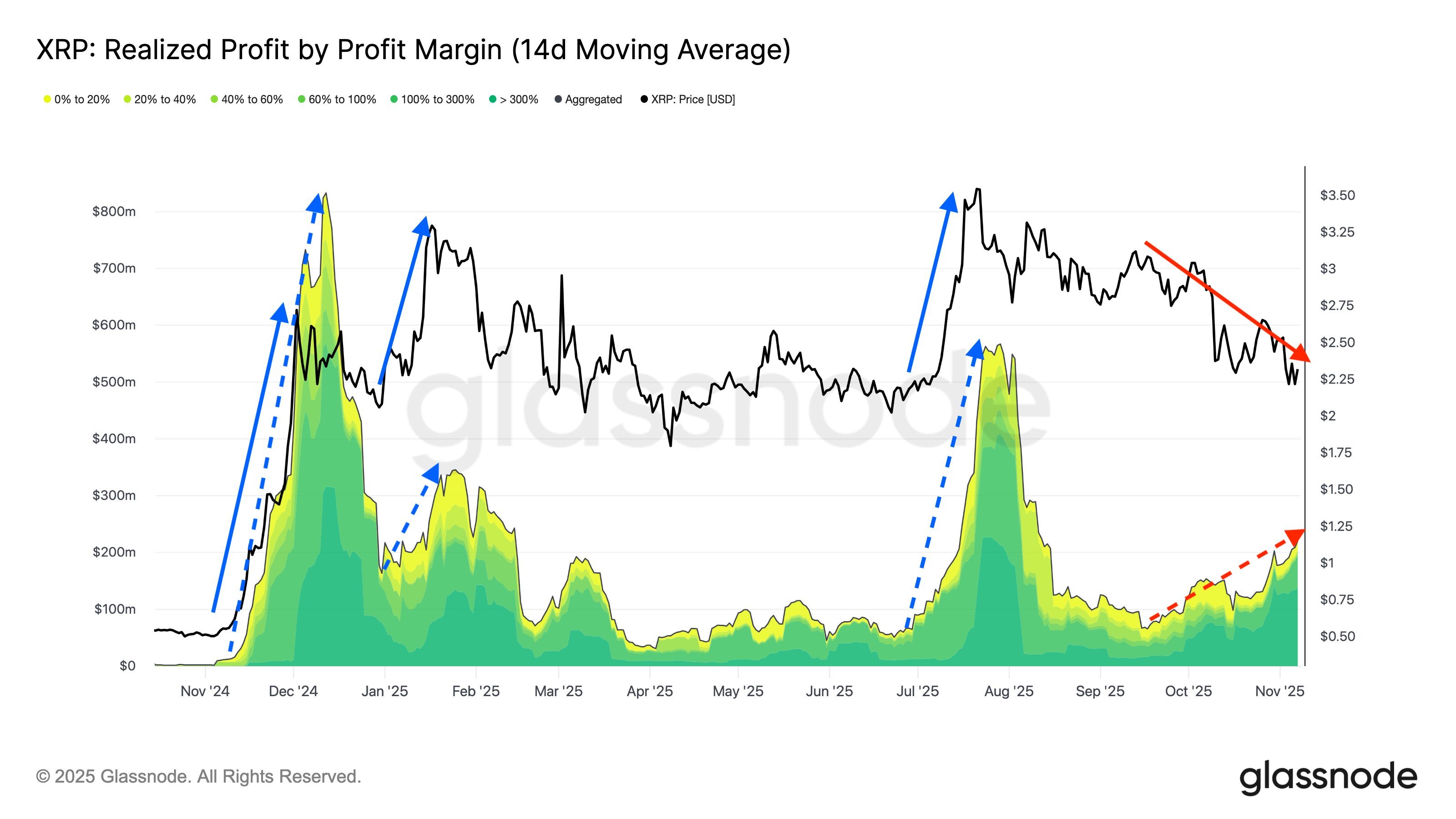

Current Glassnode information reveals that XRP traders are within the strategy of locking in beneficial properties en masse.

The agency’s “Realized Revenue” metric determines the overall revenue of a digital asset primarily based on the distinction between the “purchase” and “promote” costs for the tokens, the place the latter is increased. The metric is especially helpful for figuring out how realized earnings are literally concentrated at totally different ranges.

Glassnode has famous that the token’s earlier revenue realization waves really aligned with value rallies: long-term holders had been tempted to safe vital beneficial properties.

This time, nevertheless, revenue realization soared throughout a major correction. The value of the token has plunged from $3.09 to $2.3 since late September, as famous by Glassnode. In the course of the plunge, the 7-day transferring common of XRP’s revenue realization quantity has soared from $65 million per day to $220 million per day, surging by 240%.

In late October, Glassnode additionally revealed that seasoned merchants had began offloading the token en masse.

Bullish information fails to elevate XRP

At press time, the XRP token is altering arms at $2.29, in response to CoinGecko information, after plunging by greater than 9% over the previous week.

The value of the token is within the pink on a weekly foundation regardless of the latest Ripple Swell occasion, which included Nasdaq CEO Adena Friedman in addition to U.S. digital asset advisor Patrick Witt amongst its high-profile audio system.

Such large bulletins as Ripple’s $500 million funding spherical, the acquisition of crypto custody agency Palisade, and the XRP Ledger-focused collaboration with Mastercard did not elevate the worth of the struggling token.

Franklin Templeton and different ETF issuers updating their S‑1 varieties for spot XRP ETFs additionally didn’t handle to place the bulls again within the driver’s seat.

Judging by the latest information, intense profit-taking stays a significant headwind for XRP, and even a bevy of bullish catalysts to date make it extraordinarily difficult to trip it out.