The crypto market began the week on unsure footing, with main belongings extending losses and sentiment sliding deeper into concern territory.

The overall crypto market capitalization fell to $3.44 trillion, down about 1% over the previous 24 hours, in accordance with market knowledge.

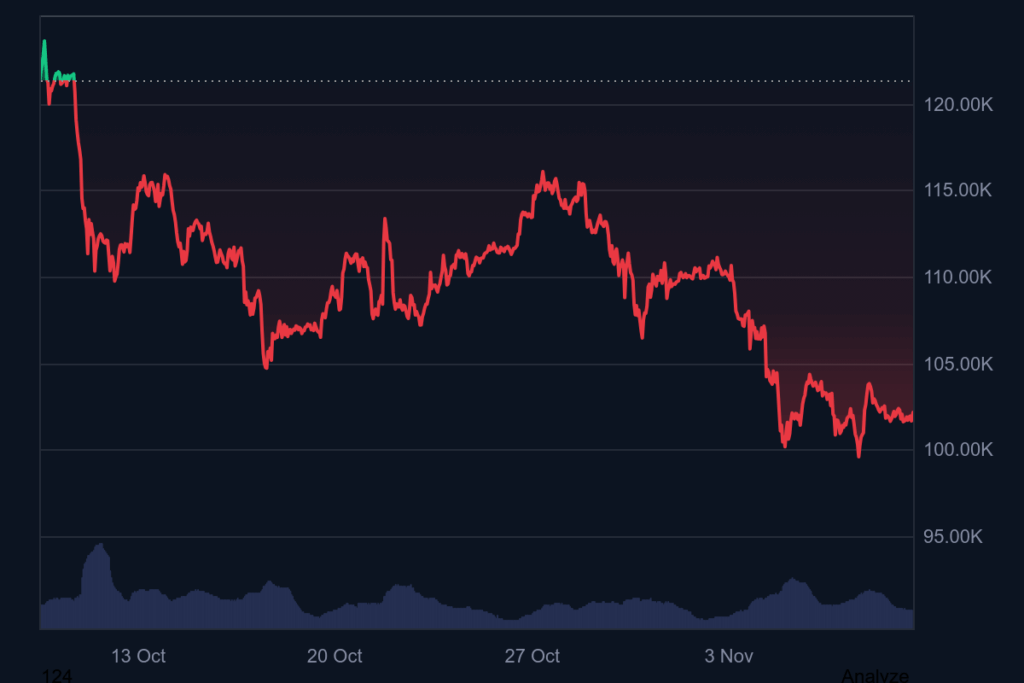

Bitcoin (BTC) continues to commerce simply above the $102,000 mark, down 0.9% on the day and roughly 7% decrease for the week. The market’s largest cryptocurrency has seen muted volatility as merchants hesitate to take new positions amid broader risk-off sentiment.

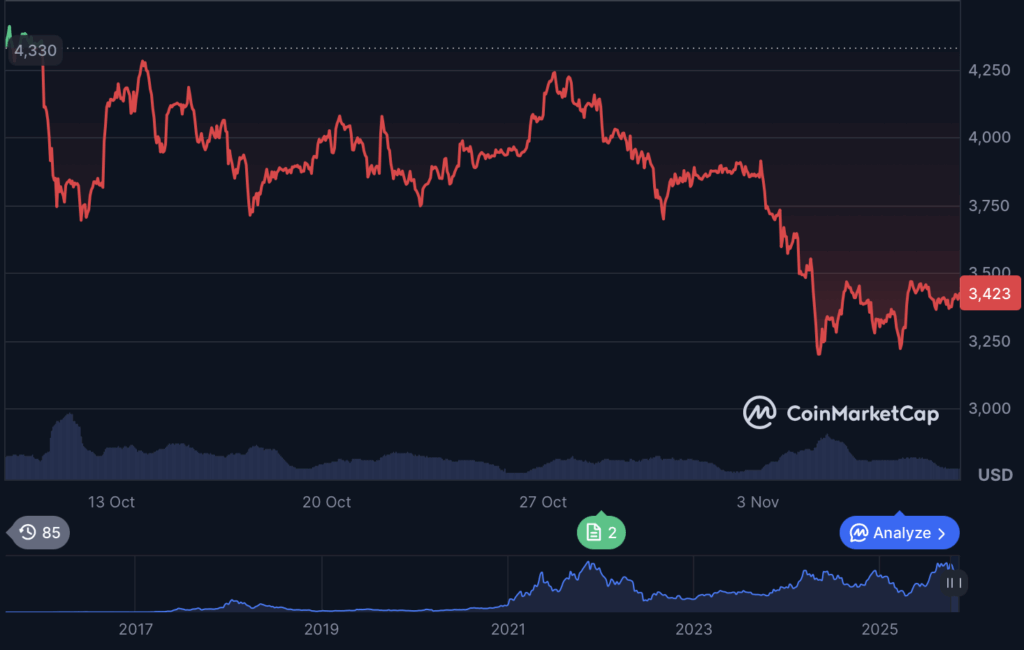

Ethereum (ETH) mirrored Bitcoin’s sluggish efficiency, slipping 0.8% in 24 hours to $3,400, extending its weekly decline to over 12%. In the meantime, BNB hovered close to $990, and Solana (SOL) fell one other 2.3% to $157, marking a 15% weekly drop – the steepest among the many prime ten belongings.

Stablecoins remained regular, with Tether (USDT) and USD Coin (USDC) holding their pegs round $1, underscoring a short-term flight to security. The Concern & Greed Index fell to 25 (“Concern”), reflecting cautious market sentiment, whereas the Altcoin Season Index stayed low at 29/100, signaling continued Bitcoin dominance and restricted threat urge for food for various belongings.

The market’s common Relative Power Index (RSI) sits close to 54.7, hovering in impartial territory, suggesting merchants are ready for a decisive breakout after weeks of sideways buying and selling. Analysts observe that durations of low volatility and declining sentiment have traditionally preceded main worth swings – although whether or not the following transfer might be upward or downward stays unsure.

For now, Bitcoin’s potential to carry the $100,000–$102,000 vary will seemingly decide short-term path, as buyers stay on edge forward of key macroeconomic knowledge and continued ETF outflows.