- Crypto analyst STEPHISCRYPTO shared a “worst-case state of affairs” chart for XRP that exhibits a attainable deeper dip into decrease assist earlier than a pointy reversal towards the $4 area, emphasizing it as a state of affairs, not a assure.

- The main target of the evaluation is psychological and emotional preparedness — staying disciplined by means of volatility so merchants and holders are nonetheless positioned if a powerful restoration ultimately performs out.

- Group responses ranged from calling $4 “too conservative” to suggesting a $5 worst-case goal, with many citing Ripple’s rising funds quantity, acquisitions, and RLUSD stablecoin as assist for a extra bullish long-term outlook.

Crypto analyst STEPHISCRYPTO has laid out what he calls a structured “worst-case state of affairs” for XRP — and curiously, it’s not all doom and gloom. His chart doesn’t simply present draw back; it maps out a possible deep pullback adopted by a powerful restoration that would ship XRP towards a lot greater ranges afterward.

As a substitute of shouting predictions or calling precise tops and bottoms, the entire thought of his submit is completely different: it’s about serving to merchants mentally put together for volatility. Not simply emotionally survive it, however plan for it.

What the Situation Really Exhibits

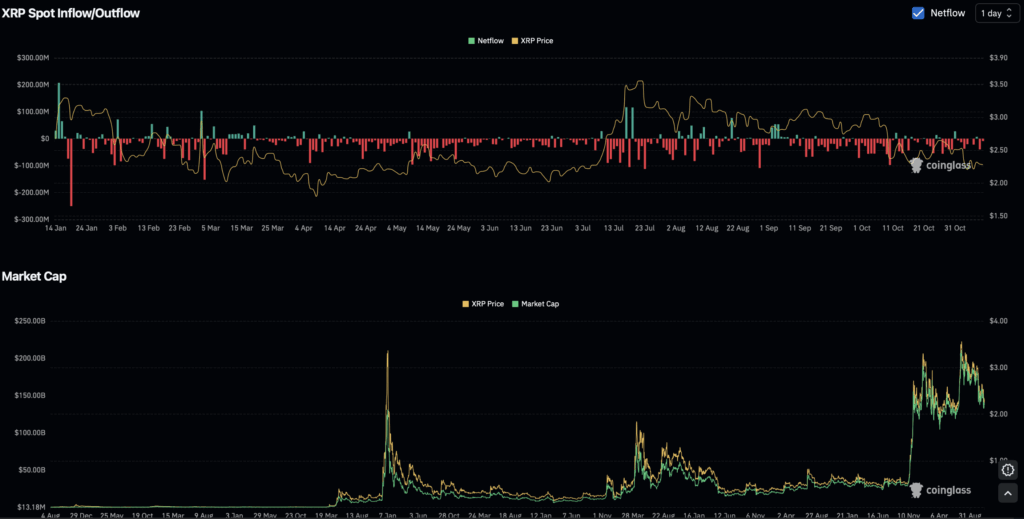

Within the chart he shared, XRP is proven consolidating for a bit, transferring sideways in a decent vary, earlier than taking one other leg down right into a decrease assist zone. It’s the type of transfer that normally shakes out impatient holders and late consumers who weren’t prepared for extra ache.

From that decrease zone, although, the roadmap flips. The mannequin suggests a pointy reversal, nearly like a snapback rally, that pushes XRP into an accelerated uptrend. In his sketch, that transfer ultimately drives worth towards the world close to 4 {dollars}.

The important thing factor: he’s not saying “this can occur,” he’s saying “this might occur.” It’s a stress-test path — what the market may seem like if issues get tough earlier than momentum actually comes again.

The message beneath is fairly easy however harsh: for those who can’t keep constant when the chart appears to be like ugly, you won’t be round when it appears to be like superb once more.

It’s About Mindset Extra Than Targets

One of many details in STEPHISCRYPTO’s submit is psychological, not technical. He leans onerous into the concept of psychological readiness — being ready, forward of time, for deeper drawdowns, fake-outs, and irritating sideways chop.

He implies that the individuals who survive these phases with a transparent head are sometimes the identical ones who’re positioned when the large restoration lastly exhibits up. The market likes to check conviction, and XRP has a reasonably lengthy historical past of doing precisely that.

So as an alternative of promising a moonshot, his chart works extra like a rehearsal. “If this occurs, how will you react?” is mainly the query between the traces.

How the Group Reacted

As traditional, crypto X (Twitter) didn’t keep quiet. The state of affairs pulled in replies from different merchants and XRP watchers, some agreeing, some pushing again, some leveling issues up.

AltcoinsBitcoin, one other consumer on X, argued that individuals ought to weigh in additional than simply the chart. He pointed at Ripple’s rising function, future utility, and broader growth round XRP as the reason why a high round $4 may really be underestimating issues.

He mainly questioned whether or not the market remains to be underpricing what XRP might develop into — or if everybody’s merely working with incomplete info.

Then you definately had The Runaway Princess coming in much more bullish. From her perspective, the “worst case” isn’t $4 in any respect — it’s XRP hitting $5 inside the 12 months. That type of remark exhibits a slice of the group that also expects sturdy efficiency within the medium time period, even when the trail getting there may be messy and full of faux scares.

So whereas STEPHISCRYPTO framed his chart as a cautious, disciplined state of affairs, others spun it as nearly conservative.

Fundamentals Nonetheless Feeding the Lengthy-Time period Story

Behind all this chart discuss, there’s additionally the elemental facet that some traders hold pointing to. Ripple has continued pushing ahead on the company and community fronts:

- Rising fee volumes throughout its fee corridors

- Strategic acquisitions

- Extra exercise round its stablecoin efforts by means of RLUSD

Supporters are likely to deal with this stuff as constructing blocks. Not prompt worth rockets, however bricks in a longer-term story of adoption and actual utilization.

In fact, none of that ensures worth efficiency. Fundamentals can look nice whereas the chart nonetheless chops and even bleeds out for some time. However when individuals speak about future restoration eventualities, they hold coming again to those developments as a part of the justification for anticipating greater ranges down the road.

A Map, Not a Prophecy

In the long run, STEPHISCRYPTO’s “worst-case state of affairs” is much less of an omen and extra of a psychological framework. It sketches one attainable path the place XRP dips tougher earlier than it rips greater — and it stresses that the way you behave throughout the dip may resolve whether or not you’re even round for the rip.

The replies from AltcoinsBitcoin and The Runaway Princess present simply how huge the vary of expectations nonetheless is: some suppose $4 is conservative, others suppose $5 is a low bar. However they’re all touching the identical core thought — keep conscious, keep life like, and don’t get blinded by both worry or euphoria.

As a result of in a market like XRP’s, the story can change quick… however your mindset must be prepared earlier than the chart does.

Disclaimer: BlockNews supplies impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding selections. Some articles might use AI instruments to help in drafting, however each piece is reviewed and edited by our editorial workforce of skilled crypto writers and analysts earlier than publication.