- Ethereum is establishing for a possible quick squeeze, with large quick positions stacked above the $3,600 zone and over $10 billion in liquidity clustered between $3,600 and $4,500.

- Whales and establishments are going lengthy on ETH, together with a 40,000 ETH 5x leveraged place (~$138M) and BlackRock reportedly shopping for $35M value of Ethereum, hinting ETH may outperform Bitcoin within the quick time period.

- If momentum holds and key resistance ranges at $3,460, $3,900, and $4,200 are cleared, a squeeze may push ETH towards and even past the $4,500 mark.

Ethereum’s been shifting, however not in a loopy method simply but. After the newest market bounce, ETH solely managed a couple of 5% push increased, despite the fact that a bunch of late shorts acquired worn out close to the underside. Beneath the floor although, issues are beginning to look much more fascinating – particularly for anybody watching liquidity, leverage, and sentiment all of sudden.

Proper now, there’s a giant pocket of quick positions stacked above value, whereas whales and establishments quietly load up on the lengthy facet. Whenever you combine that form of setup with rising optimism, you get one phrase floating round quite a bit: squeeze.

Is Ethereum’s quick squeeze truly shut? And extra importantly – can it actually punch via $4,500 if it fires?

Enormous Brief Positions Sitting Above Value

On the time of writing, Ethereum has already flushed out a variety of late quick sellers who jumped in under the $3,600 stage after value briefly dumped to round $3,200. These reactive shorts? Largely gone.

However right here’s the place it will get spicy:

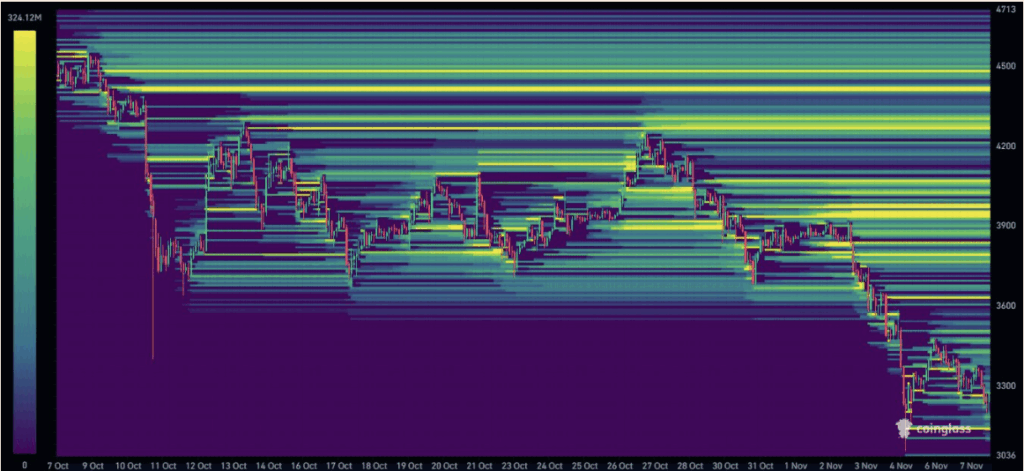

Massive quick positions have been constructing simply above that $3,600 space, and on prime of that, there’s round $10 billion in ETH liquidity clustered between roughly $3,600 and $4,500. In different phrases, there’s a giant wall of positions and liquidity sitting proper above the place value is now.

If purchase orders handle to push value cleanly via the $3,600 zone, that’s the place issues may actually speed up. Shorts caught offside could also be pressured to shut in a rush, which simply provides extra shopping for stress on the best way up. With liquidity packed tightly in that band, a transfer may occur quicker than many merchants are ready for.

If the squeeze actually kicks off, a quick drive towards, and even past, $4,500 isn’t off the desk. Nevertheless it wants follow-through, not only one good candle.

Whales And Establishments Quietly Loading Up

The squeeze setup isn’t nearly shorts being trapped. It’s additionally about who’s on the opposite facet.

Whales and institutional gamers have been profiting from the latest dip, accumulating ETH largely within the $3,000 to $3,400 vary. One instance that stood out was a so-called “Bitcoin insider whale” who beforehand shorted BTC proper earlier than the tariff-driven dump. This time, as a substitute of leaning into Bitcoin, they flipped and went lengthy on Ethereum.

That whale opened a 5x leveraged lengthy place on ETH – about 40,000 ETH, value roughly $138 million. That’s not some tiny directional guess. It’s a press release. And shutting the earlier BTC lengthy in favor of stacking ETH suggests they anticipate Ethereum to maneuver quicker than Bitcoin within the present atmosphere.

They’re not alone, both. In line with experiences, BlackRock additionally picked up round $35 million value of ETH, including extra weight to the concept that bigger gamers see a rebound forming in Ethereum particularly, not simply within the general market.

Sentiment Turning Bullish – Particularly From “Good Cash”

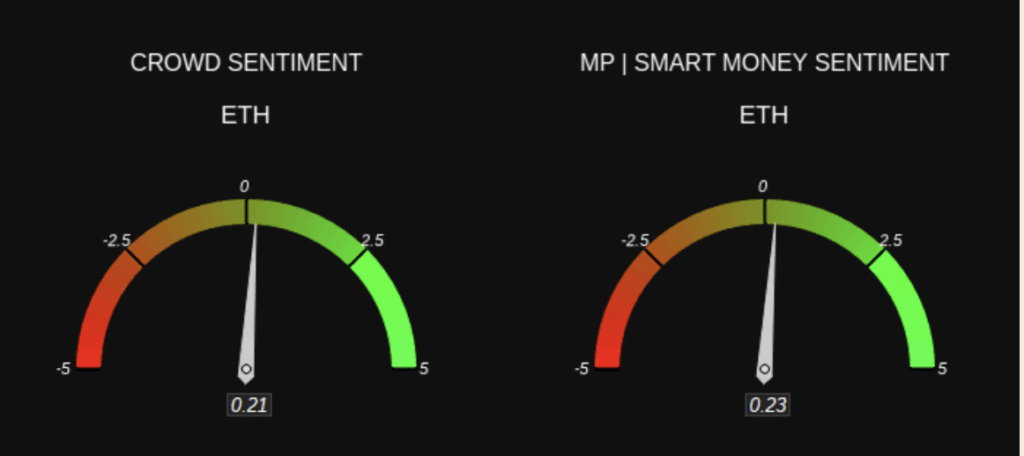

On the sentiment facet, issues are leaning inexperienced too. Each the gang and so-called sensible cash are typically bullish on Ethereum – however curiously, the knowledgeable cash is barely extra optimistic than retail.

Sentiment gauges confirmed a studying of round 0.23 for sensible cash versus 0.21 for retail merchants. It’s not a large hole, nevertheless it does trace that larger, extra data-driven gamers are a bit extra satisfied about ETH’s upside than the common dealer scrolling via value charts on their cellphone.

This shift isn’t occurring in isolation both. The broader crypto market was up round 1.35% on the similar time, displaying that threat urge for food generally is choosing again up.

Can Ethereum Truly Push Previous $4,500?

So, is all this sufficient to blast ETH past $4,500?

Perhaps – however there are a number of hurdles in the best way.

On the charts, Ethereum nonetheless has to clear a collection of shorter-term resistance ranges earlier than $4,500 turns into life like. Key zones round $3,460, $3,900, and $4,200 will probably act as checkpoints. If value stalls or will get closely offered at any of these ranges, the transfer may fizzle into only a sharp bounce quite than a full-on breakout.

But when momentum holds, purchase orders hold flowing, and ETF / institutional participation stays sturdy, these resistance ranges may get taken out one after the other. In that case, a brief squeeze may very simply act because the gasoline that sends ETH sprinting towards $4,500 and probably past.

For now, all of the components are there:

- Shorts stacked above value and susceptible

- Whales and establishments going lengthy on ETH

- Sentiment turning bullish, particularly from smarter capital

The one query left is whether or not the market pulls the set off.

Disclaimer: BlockNews supplies unbiased reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding selections. Some articles could use AI instruments to help in drafting, however each piece is reviewed and edited by our editorial crew of skilled crypto writers and analysts earlier than publication.