Based on AIMA and PwC’s Seventh Annual International Crypto Hedge Fund Report, greater than half of conventional hedge funds now maintain crypto.

The survey reveals 55% have some crypto publicity, up from 47% in 2024. That quantity alone alerts a shift in how mainstream managers deal with these property.

Crypto: Broad Adoption, Small Stakes

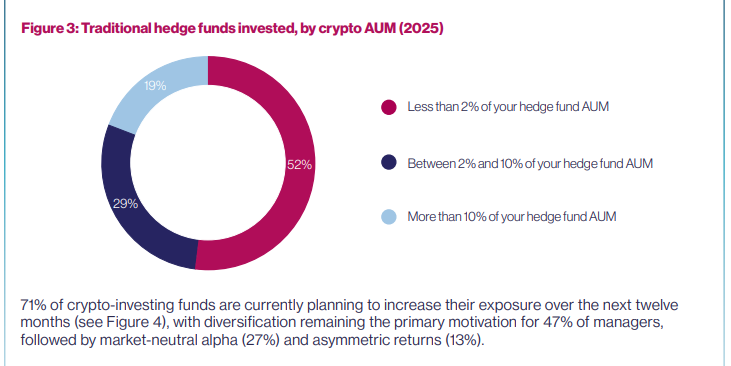

Most managers are being cautious, for now. Many funds hold their digital forex positions tiny. Over half of these with publicity maintain lower than 2% of their portfolios in crypto.

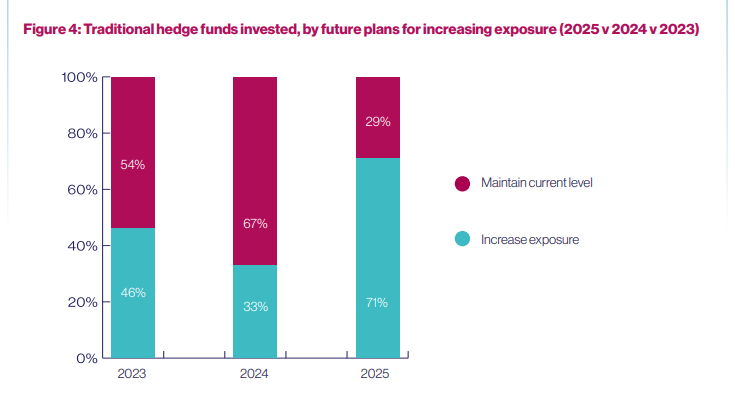

On common, funds put about 7% into crypto-related investments. But plans level upward: 71% of holding funds say they are going to increase their positions over the subsequent 12 months.

Danger is on their minds. Causes given embrace portfolio diversification (47%), market-neutral alpha alternatives (27%), and uneven return potential (13%).

The survey’s scale provides weight to the pattern. The report requested 122 hedge fund managers controlling over $980 billion in property. That pattern reveals a 17% year-over-year improve within the share of funds holding crypto.

Supply: AIMA analysis paper

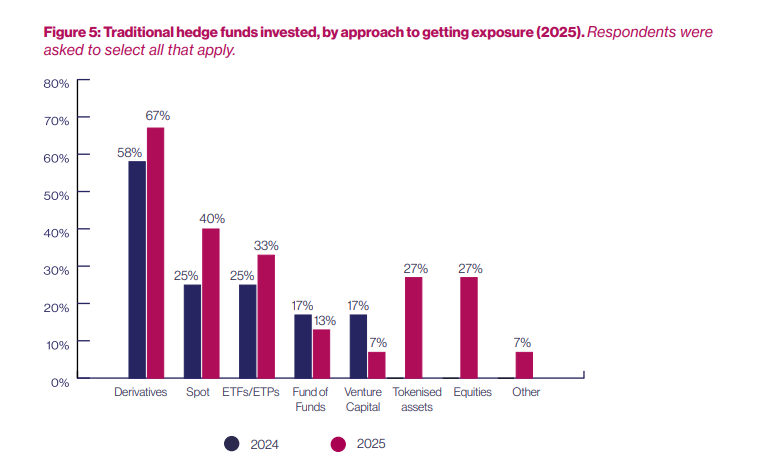

Many managers desire oblique publicity. Based on the findings, 67% use digital forex derivatives — up from 58% in 2024 — which lets them take positions with out holding cash straight.

That method will be safer on paper. However it additionally carries dangers. The October 2025 flash crash induced near $20 billion in liquidations, a stark reminder of what can occur when markets transfer rapidly.

Supply: AIMA analysis paper

How Funds Achieve Market Publicity

Spot buying and selling is rising whereas derivatives stay in style. Spot buying and selling grew from 25% to 40% as a way of entry. Change-traded merchandise account for 33%.

Tokenized property and associated equities every sit at 27%. The numbers present funds need alternative. Derivatives supply flexibility; spot provides direct possession. Each have locations in portfolios, relying on guidelines and threat limits.

Crypto-native funds are getting larger. Pure crypto managers report bigger swimming pools of capital. Common property underneath administration reached greater than $130 million in 2025, in contrast with $79 million in 2024 and over $40 million in 2023.

The cash held most frequently are Bitcoin (86%), Ethereum (80%), Solana (73%), and XRP (37%). Solana’s adoption jumped from 45% final 12 months. Yield methods are widespread too — custodial staking is utilized by 39% of crypto funds and liquid staking by 35%.

Supply: AIMA analysis paper

Institutional Curiosity Up

Institutional curiosity is rising, however boundaries stay. Fund-of-funds participation rose to virtually 40% in 2025 from 21% in 2024. Institutional allocations from pension funds, foundations, and sovereign wealth funds climbed to twenty% from 11%.

Two-thirds of institutional traders surveyed now allocate to digital property. But half of conventional hedge funds with out crypto say they won’t spend money on the subsequent three years.

Featured picture from Unsplash, chart from TradingView

Editorial Course of for bitcoinist is centered on delivering totally researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent overview by our group of high expertise consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.