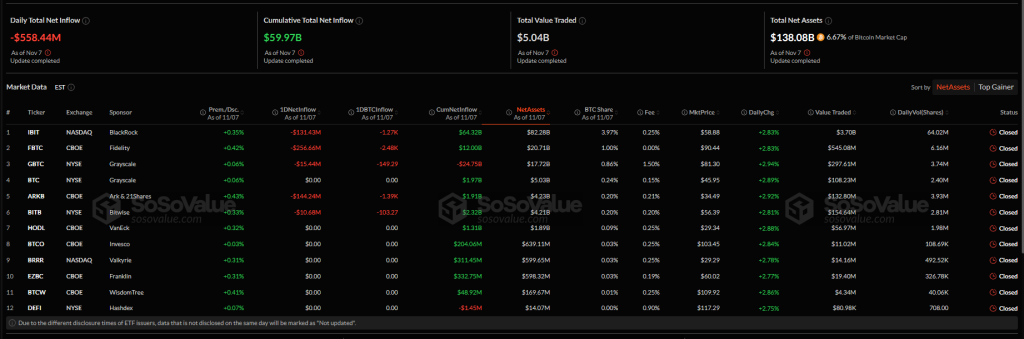

Bitcoin-focused ETFs recorded their largest single-day outflow since August, pulling a mixed $558 million from the market as costs hovered close to $102,000. Information from SoSoValue exhibits the transfer pushed some massive funds into the pink for the day and despatched recent alerts that merchants are rebalancing after current positive factors.

Constancy And Ark Lead Outflows

Constancy’s FBTC noticed the most important withdrawal at $256 million. Ark Make investments And 21Shares’ ARKB adopted with $144 million in redemptions, a file relative to that fund’s measurement. BlackRock’s IBIT additionally recorded $131 million of outflows, marking the seventh day of web withdrawals in eight buying and selling classes.

On the identical time, stories present JPMorgan boosted its stake in BlackRock’s ETF by 64%, bringing its holding to five.28 million shares valued at $343 million as of September 30. The financial institution additionally held $68 million in name choices and $133 million in put positions on the identical date.

Market Individuals Trim Positions Whereas Some Add

Primarily based on stories, the massive every day outflow appears much less like a crash and extra like place shifting. Some managers seem like taking earnings. Others are quietly including publicity, which helps clarify why costs held roughly regular regardless of the redemptions. Merchants watching ETF flows say the strikes replicate rising macro uncertainty quite than a whole lack of religion in Bitcoin.

Whale Promoting And Lengthy-Time period Holders Cashing Out

On-chain trackers present that long-dormant wallets are shifting giant quantities. Gross sales within the $100 million to $500 million vary have been logged from addresses that had been nonetheless for years.

K33 Analysis flagged that 319,000 BTC that had been held for six to 12 months moved into profit-taking. The agency additionally reported that “mega whales” bought roughly $45 billion value of Bitcoin prior to now month. Analysts describe this as a significant, organized exit by early holders.

Value Holds Inside Key Vary As Shifting Averages Cap Features

Bitcoin has been buying and selling in a decent band. Experiences place a requirement block between $100K–$102K and a resistance cluster close to $114K. The 100-day and 200-day shifting averages are above present costs and acted as overhead resistance.

A current rejection across the 100-day MA close to $110K led to a fast retest of the roughly $101K assist, which some merchants interpret as a liquidity sweep.

Value Stabilization May Sign Absorption

What stands out for chart watchers is stabilization at a high-volume node the place previous corrections have discovered a base. There’s an prolonged sequence of equal lows, marked on some charts as assist ranges, suggesting liquidity beneath $100K might have been cleared.

Featured picture from Unsplash, chart from TradingView