Hong Kong prices crypto influencers over JPEX shilling

Hong Kong authorities on Wednesday formally charged influencers linked to the defunct crypto change JPEX.

Amongst these charged are Joseph Lam Chok, a lawyer-turned-influencer, and Chan Yee, a distinguished key opinion chief (KOI) within the cryptocurrency neighborhood. Prosecutors say they promoted JPEX whereas both figuring out or ignoring that the platform had no approval to function in Hong Kong. Below Hong Kong’s Anti-Cash Laundering Ordinance, it’s an offense to fraudulently or recklessly induce others to spend money on crypto.

Six core members of the alleged JPEX group and 7 operators of over-the-counter crypto outlets have been additionally charged, together with three people accused of serving as entrance account holders.

JPEX launched in 2020 and relied closely on influencer endorsements and social media advertising and marketing. Following the Securities and Futures Fee’s public warning in September 2023, the platform considerably elevated withdrawal charges, leaving many customers unable to recuperate their funds. Police say greater than 2,700 victims have reported losses totaling round 1.6 billion Hong Kong {dollars} (about $205 million).

“Within the JPEX fiasco, the case towards KOLs is clear-cut: they paddled claims that JPEX is secure, was licensed, or quickly to be licensed, in Hong Kong or Dubai have been repeatedly flagged as manifestly false by the SFC,” Joshua Chu, a co-advocate within the first civil motion towards JPEX, tells Journal.

“If these influencers knew JPEX lacked such a license, their conduct is plainly fraudulent inducement; in the event that they didn’t confirm such an simply checked truth, they’re equally uncovered for reckless misrepresentation. In both state of affairs, legal responsibility is nearly inescapable,” he provides.

Whereas Hong Kong’s prices are particular to the JPEX case, they align with a broader regional development focusing on promotional exercise round crypto.

Within the Philippines, selling unlicensed crypto and firms by means of paid social posts can result in fines or jail time. In Singapore, MAS guidelines prohibit the promotion of crypto companies to most of the people, successfully inserting limits on influencer advertising and marketing. On Wednesday, Singapore expanded penalties for fraud, which now embrace a compulsory minimal of six smacks with a cane.

The anti-corruption blockchain invoice preps for plenary debate

A Philippine Senate committee has completed deliberating on a proposal that will require authorities companies to publish price range and procurement paperwork on a blockchain.

The proposed legislation, titled the Citizen Entry and Disclosure of Expenditures for Nationwide Accountability (CADENA) Act, seeks to make it simpler for the general public to trace how authorities funds are allotted and spent. The invoice was beforehand known as the Price range Blockchain Act.

Drafted by Senator Bam Aquino, the measure goals to curb corruption by making budgeting and contracting data accessible to residents.

“Below Part 5, the invoice transforms transparency right into a authorized obligation, requiring all authorities companies to add price range paperwork to the Cadena system, a blockchain-based platform that ensures knowledge verifiability, traceability and auditability,” the Senate mentioned in a Fb put up.

Bam Aquino belongs to the Aquino political household, which is mostly related to the anti-corruption motion within the Philippines. His uncle, former Senator Benigno “Ninoy” Aquino Jr., was the important thing opposition determine towards dictator Ferdinand Marcos Sr. through the martial legislation period. Ninoy’s assassination in 1983 helped spark the general public stress that led to the 1986 revolution and the top of the Marcos regime.

The Philippines ranked 114th out of 180 international locations in Transparency Worldwide’s 2024 corruption index.

The committee will now finalize its report. Aquino is predicted to sponsor it on the Senate flooring for plenary debate on Nov. 12.

Learn additionally

Options

Practice AI brokers to make higher predictions… for token rewards

Options

When worlds collide: Becoming a member of Web3 and crypto from Web2

Japan’s trade takes first jab at tokenization legislation

Progmat has launched a brand new working group to draft a authorized framework for tokenized securities in Japan, aiming to allow the onchain switch of economic devices, together with shares and funding trusts.

Progmat is a tokenization platform backed by main Japanese monetary establishments. It was developed initially inside Mitsubishi UFJ earlier than being spun out as an impartial firm. Progmat additionally leads the Digital Asset Co-Creation Consortium (DCC), which now consists of 315 member organizations throughout finance, legislation, asset administration and market infrastructure.

The brand new group will research regulatory design and market construction for shifting current securities into digital codecs. The goal is to publish a draft legislation and a remaining report by March 2026, with business product improvement for tokenized equities starting in spring 2026.

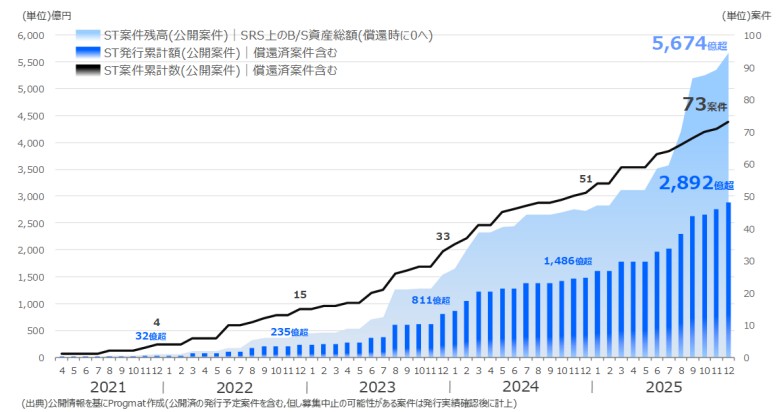

Complete excellent safety token issuance in Japan exceeds 567 billion yen, based on Progmat, whereas cumulative issuance surpasses 289 billion yen. Most exercise up to now has centered on actual property securitization merchandise and tokenized company bonds. Tokenization of funding trusts and equities has progressed extra slowly as a consequence of authorized constraints and the energy of Japan’s current securities infrastructure.

Learn additionally

Options

Crypto scoring large with European soccer

Options

Airdrops: Constructing communities or constructing issues?

Zhaojin Mining to discover gold tokenization with Ant Digital

Zhaojin Mining’s Hong Kong subsidiary has signed a cooperation settlement with SigmaLayer, an organization underneath Ant Digital Applied sciences. The 2 sides plan to collaborate on gold RWA tokenization.

Zhaojin Mining is a significant gold producer in China. It’s backed by Shandong Zhaojin Group, a significant provider within the Shanghai Gold Trade and a certified refiner acknowledged by the London Bullion Market Affiliation.

The cooperation will embrace exploring methods to transform bodily gold into digital tokens and constructing blockchain-based traceability. The businesses additionally plan to make use of AI for provide chain credit score evaluation and danger administration.

Ant Digital Applied sciences is the tech arm carved out of Jack Ma’s Ant Group following regulatory restructuring in China’s fintech sector. The unit has been focusing extra on blockchain and industrial knowledge programs. The Zhaojin partnership comes as Ma-linked corporations present renewed exercise in tokenized property.

Subscribe

Essentially the most partaking reads in blockchain. Delivered as soon as a

week.

Yohan Yun

Yohan Yun is a multimedia journalist overlaying blockchain since 2017. He has contributed to crypto media outlet Forkast as an editor and has coated Asian tech tales as an assistant reporter for Bloomberg BNA and Forbes. He spends his free time cooking, and experimenting with new recipes.