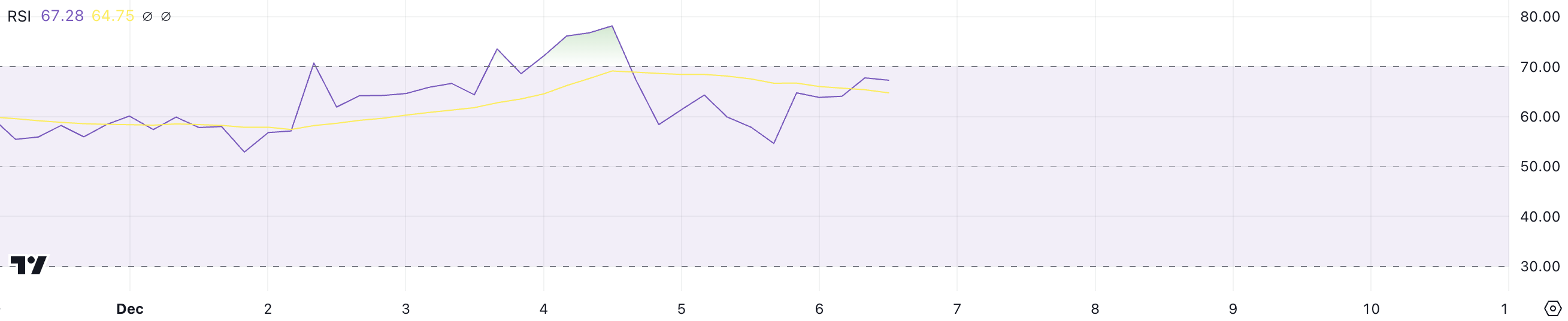

Uniswap (UNI) worth has seen spectacular development, crossing the $10 billion market cap and rising 80.44% within the final 30 days. With the value presently at 67 on the Relative Power Index (RSI), UNI is approaching overbought territory however nonetheless has room to develop earlier than signaling a direct correction.

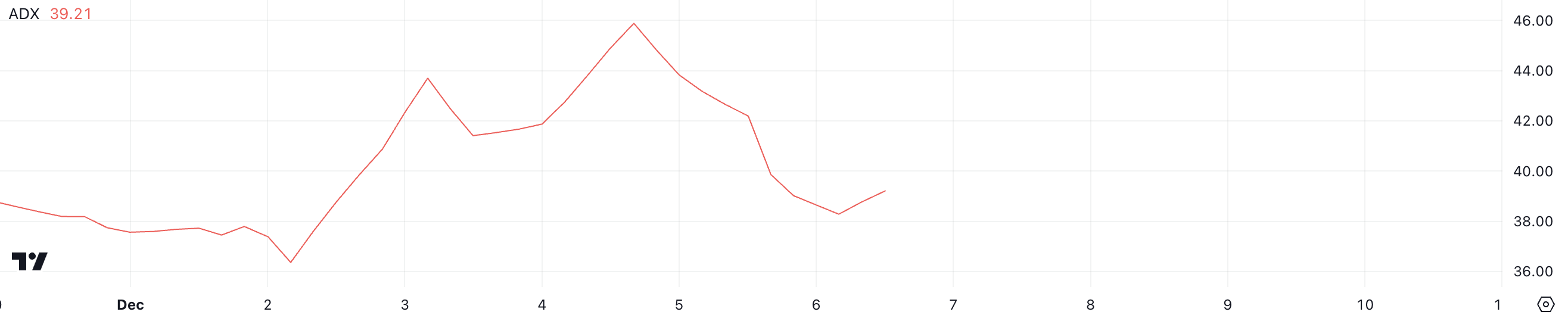

Regardless of a slight dip within the Common Directional Index (ADX) from 46 to 39, UNI stays in a robust uptrend with a pattern power above 25. If the uptrend continues, UNI might take a look at the resistance at $17.39, doubtlessly reaching $20, its highest worth since 2021.

UNI RSI Is Nonetheless Beneath Overbought Zone

Uniswap RSI is presently at 67, that means it’s approaching overbought territory however hasn’t but reached the 70 mark.

RSI values above 70 usually counsel the asset is overbought, however at 67, UNI nonetheless has room to develop with out signaling a direct correction.

RSI measures worth momentum on a scale from 0 to 100, with values above 70 indicating overbought circumstances and under 30 suggesting oversold circumstances.

Since UNI RSI stayed above 70 throughout latest worth spikes, the present degree of 67 exhibits there’s nonetheless potential for development earlier than a correction may happen.

Uniswap ADX Reveals the Present Uptrend Is Sturdy

UNI’s ADX is presently at 39, down from 46 simply two days in the past, indicating a slight lower in pattern power.

Whereas this drop suggests a discount in momentum, the ADX nonetheless stays above 25, which alerts that UNI worth is in a robust pattern, regardless of the latest pullback.

The Common Directional Index (ADX) measures the power of a pattern, with values above 25 indicating a robust pattern and values under 20 suggesting weak or no pattern.

Since UNI’s ADX is at 39, it exhibits that the asset remains to be in a robust uptrend, though the latest lower suggests a possible slowdown in momentum. The ADX at 39 signifies that UNI bullish pattern stays intact, however there could also be a short consolidation earlier than additional positive aspects.

UNI Worth Prediction: Can It Rise Again to $20 After 3 Years?

If the uptrend continues, UNI worth might take a look at the resistance at $17.39 and doubtlessly rise as much as $20, marking its highest worth since 2021.

This may sign a robust continuation of the bullish momentum, with Uniswap worth aiming for vital positive aspects.

Nevertheless, if the present pattern reverses, Uniswap worth might take a look at the primary help degree round $13.5. If this help fails to carry, the value might drop additional, doubtlessly reaching as little as $12.4, indicating a bearish shift if the pattern doesn’t regain power.

Disclaimer

According to the Belief Mission tips, this worth evaluation article is for informational functions solely and shouldn’t be thought-about monetary or funding recommendation. BeInCrypto is dedicated to correct, unbiased reporting, however market circumstances are topic to alter with out discover. All the time conduct your personal analysis and seek the advice of with knowledgeable earlier than making any monetary choices. Please notice that our Phrases and Situations, Privateness Coverage, and Disclaimers have been up to date.