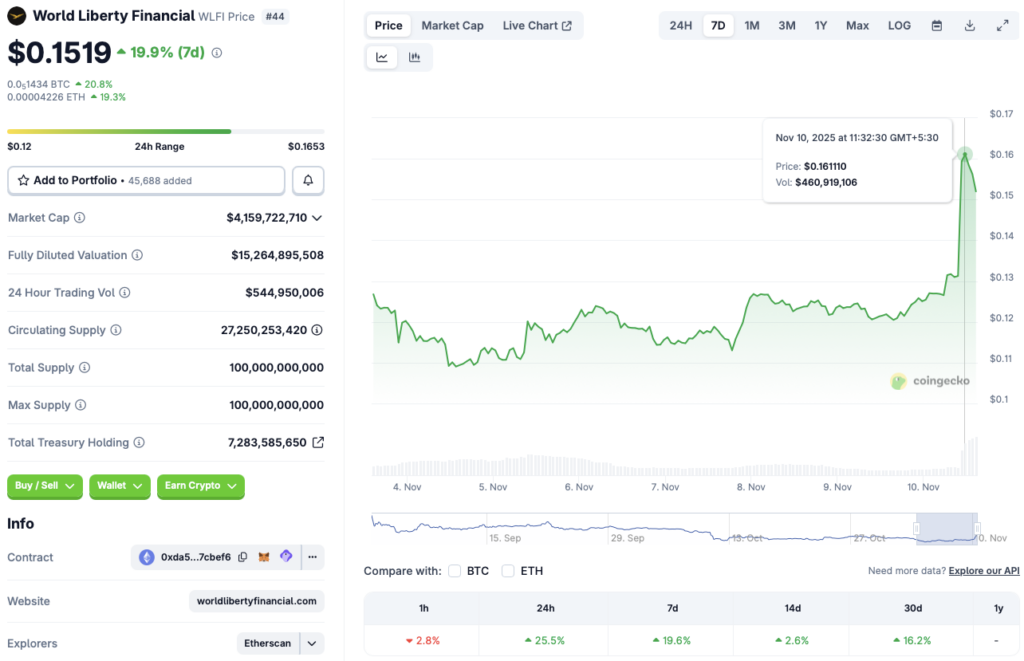

- WLFI is up 25.5% in 24 hours and 19.6% on the week however nonetheless trades 52.7% beneath its all-time excessive from September.

- The rally is using optimism across the U.S. shutdown nearing its finish and Trump’s $2000 dividend announcement, boosting retail threat urge for food.

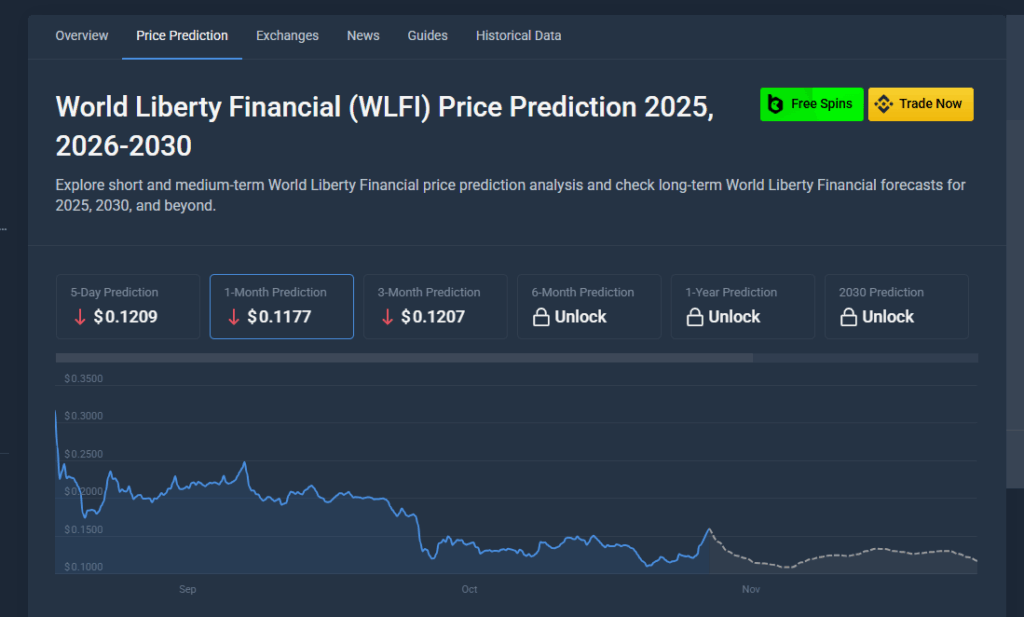

- CoinCodex forecasts a drop towards $0.092 by Nov. 20, signaling {that a} sharp correction stays firmly on the desk regardless of latest beneficial properties.

Shaking off final month’s chaos, World Liberty Monetary (WLFI) has jumped again into the highlight with a pointy transfer to the upside. In accordance with CoinGecko, WLFI has rallied 25.5% within the final 24 hours, 19.6% over the previous week, 2.8% within the final 14 days, and 16.2% over the earlier month. Even with that surge, the Trump-linked token continues to be down 52.7% from its all-time excessive of $0.3313, set on Sept. 1 this 12 months, leaving loads of room for volatility in each instructions.

Curiously, whereas social media continues to model WLFI as a “Trump household coin,” the undertaking’s personal web site distances itself from that label. It explicitly states that none of Donald J. Trump, his relations, nor any officer or worker of the Trump Group or DT Marks LLC is concerned with the token. That hasn’t stopped merchants from tying WLFI to Trump’s model narrative, although, and proper now that narrative is doing a whole lot of the heavy lifting.

Can World Liberty Monetary Maintain Its Rally?

WLFI’s newest transfer greater comes in opposition to the backdrop of a broader market rebound, helped by indicators that the extended U.S. authorities shutdown could lastly be nearing an finish. President Trump has hinted {that a} decision is shut and that extra particulars shall be revealed quickly, and markets are inclined to front-run any sign of political or fiscal aid. Threat property, together with speculative altcoins like WLFI, are naturally catching a few of that optimism.

On prime of that, sentiment has been buoyed by Trump’s just lately introduced $2000 dividend cost to all Individuals, excluding high-net-worth people. Whether or not that cash straight flows into crypto or not, it creates a psychological tailwind: retail traders really feel barely richer, and a few portion of that renewed confidence usually bleeds into high-beta property. For a narrative-heavy token like WLFI, that’s greater than sufficient to spark a pointy short-term chase.

WLFI Worth Outlook: New All-Time Excessive or Bearish Reversal?

From a pure worth motion standpoint, WLFI nonetheless has an extended strategy to go if it desires to reclaim its peak. Sitting 52.7% beneath its all-time excessive of $0.3313, the asset would want an prolonged continuation of the present pattern to print contemporary information. If the present momentum persists, it’s not loopy to think about one other leg greater that checks and even exceeds that stage, particularly if the broader market levels a clear rebound from October’s wipeout.

Nevertheless, not all analysts are shopping for into the continuation story. CoinCodex forecasts a bearish reversal, projecting WLFI to drop to round $0.092 by Nov. 20. From present ranges, that may suggest a pullback of roughly 39.4%. On condition that October delivered the most important single-day liquidation occasion in crypto historical past, it’s truthful to say the market continues to be on edge. Any renewed risk-off wave or disappointment across the shutdown final result might hit speculative names like WLFI first and hardest.

Volatility Forward As Market Tries To Recuperate

The broader crypto market continues to be attempting to wash up after a brutal month. October, normally remembered as a bullish interval, as a substitute was a minefield of compelled liquidations and cascading leverage unwinds. In that type of setting, rallies are usually fragile, and narrative-driven tokens transfer in exaggerated vogue as merchants pile out and in at excessive pace.

WLFI sits proper at that intersection of politics, macro headlines, and speculative urge for food. If the shutdown actually ends, if the $2000 dividend fuels extra risk-on conduct, and if the general market stops bleeding, WLFI might squeeze greater and doubtlessly revisit its peak. But when concern returns or profit-taking hits the tape, the CoinCodex situation of a pointy correction all of the sudden seems to be very practical. For now, WLFI is buying and selling extra on narrative and sentiment than on fundamentals, which suggests one factor above all: anticipate extra volatility.

Disclaimer: BlockNews offers impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles could use AI instruments to help in drafting, however each piece is reviewed and edited by our editorial crew of skilled crypto writers and analysts earlier than publication.