Be a part of Our Telegram channel to remain updated on breaking information protection

Ledger, the French {hardware} crypto pockets producer, is contemplating a New York itemizing because it prepares to lift new capital in 2026 amid surging demand for safety units.

That’s in line with a Monetary Occasions report that stated Ledger CEO Pascal Gauthier is exploring each a possible itemizing within the US and a non-public funding spherical for the following capital increase.

“Cash is in New York right now for crypto, it’s nowhere else on this planet, actually not in Europe,” Gauthier stated, including that investor urge for food for digital asset infrastructure stays stronger within the US.

Ledger Posts Its Strongest Monetary Yr On Document

If Ledger does rating a list in New York, it can come following what Gauthier stated is the corporate’s strongest yr on document.

Already, revenues for 2025 have hit triple-digit thousands and thousands, and they’re anticipated to develop much more as Ledger enters its peak season throughout Black Friday sale and the vacation purchasing interval.

Ledger was based in 2014, and at present secures roughly $100 billion price of crypto on behalf of consumers. Following a funding spherical that passed off in 2023, which was led by 10T Holdings and True International Ventures, the crypto {hardware} pockets firm was valued at $1.5 billion.

A number of Crypto Corporations Go Public Amid Friendlier Regulatory Local weather

A pleasant regulator atmosphere within the US has prompted a collection of crypto companies to go public.

USDC stablecoin issuer Circle raised $1.05 billion in its New York Inventory Trade (NYSE) itemizing earlier this yr whereas digital buying and selling agency Bullish, backed by former PayPal govt Peter Thiel, additionally raised over $1 billion.

Crypto change Gemini listed on the NASDAQ beneath the ticker image “GEMI” in September, elevating round $425 million at a valuation of about $3.33 billion.

Crypto Traders Are Turning To Chilly Storage Options Amid Surge In Crypto Crime

Ledger’s record-breaking yr comes as extra crypto traders shift towards chilly storage options to safeguard their property amid a surge in digital theft.

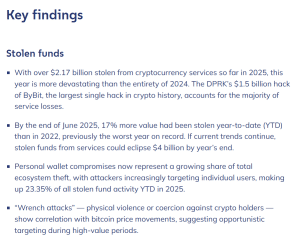

Within the first half of 2025 alone, criminals have stolen $2.17 billion price of crypto, greater than the entire in 2024, in line with Chainalysis.

Over $2.17 billion stolen from crypto within the first half of 2025 (Supply: Chainalysis)

“We’re being hacked increasingly more every single day . . . hacking of your financial institution accounts, of your crypto, and it’s not going to get higher subsequent yr and the yr after that,” Gauthier instructed FT.

The rising safety considerations prolong past the digital realm. Earlier this yr, Ledger co-founder David Balland was kidnapped in France together with his captors demanding a €10 million crypto ransom earlier than being captured in Morocco.

Amid the rising demand for chilly storage options, Ledger has been increasing its product line. It lately launched an iOS app for enterprise customers and in addition added native help for the TRON blockchain.

4. @Ledger Enterprise has built-in with the TRON community.

Extra particulars from @ledger_business 👇https://t.co/tpeJfqwP87

— TRON DAO (@trondao) October 16, 2025

Nonetheless, not all of Ledger’s new merchandise have impressed the market. The corporate’s multisig pockets function, for example, has drawn blended suggestions from builders and long-time clients over its transaction charges.

Ledger additionally confronted backlash earlier this yr when it began phasing out help for its Nano S gadget, which is retired in 2022.

Associated Articles:

Greatest Pockets – Diversify Your Crypto Portfolio

- Simple to Use, Characteristic-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Lively Customers

Be a part of Our Telegram channel to remain updated on breaking information protection