- UNIfication lastly activates Uniswap’s protocol charges after 5 years, provides a deflationary burn mannequin, and even merges Labs with the Basis, triggering a 44% one-day surge in UNI’s worth.

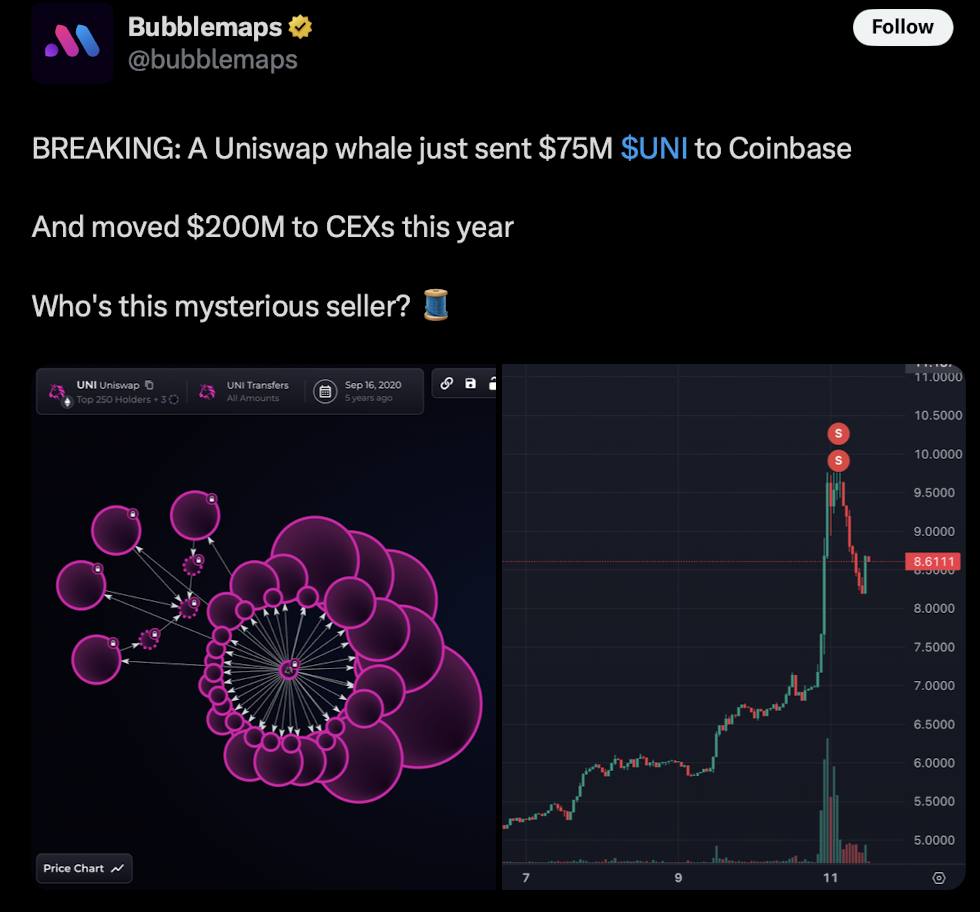

- On-chain sleuths tracked a 2020-era whale cluster that moved roughly $200 million in UNI to exchanges in 2025, together with a $75 million dump completely timed with the UNIfication pump, elevating critical insider-dump suspicions.

- Whereas the proposal boosts worth seize for UNI holders through payment burns, critics warn of a possible “demise spiral” for LPs and rising centralization danger, arguing the rally seems extra like distribution by early whales than natural long-term development.

Uniswap’s UNI token ripped about 44% in simply 24 hours after founder Hayden Adams rolled out a brand new governance proposal referred to as “UNIfication” on November 10. On the floor, the story sounds clear and bullish: after 5 years of operation, Uniswap lastly strikes to activate protocol charges, introduce a deflationary burn, and tighten the connection between Uniswap Labs and the Uniswap Basis. The plan contains turning on protocol charges for the primary time, burning 100 million UNI from the treasury, and principally reshaping how worth flows again to token holders. It’s no shock the market reacted quick. However in the midst of all that hype, some very previous cash quietly headed for the exit.

A 2020-era whale that “knew an excessive amount of”

Behind the scenes, on-chain knowledge began flagging a 2020-era whale that, frankly, appeared to know method an excessive amount of at precisely the appropriate time. Utilizing Bubblemaps evaluation, researchers traced 4 wallets that have been initially funded from Uniswap’s investor contract again in 2020. These wallets have been all tied to a single Coinbase deposit deal with and collectively funneled 36 million UNI into exchanges. That’s a critical stack.

In 2025 alone, this similar entity has already shipped roughly $200 million value of UNI to exchanges. On Might 14, they offered 12 million tokens. Then, on November 10, simply hours earlier than Adams’ UNIfication announcement, one other 9 million UNI hit the market. And proper because the proposal pumped worth and buying and selling quantity, the whale despatched in a ultimate blast — round $75 million value — completely synced with the surge. Exhausting to name that “random,” actually.

Extra whales dashing for the exit

It didn’t cease with only one entity both. Lookonchain picked up extra suspicious flows across the similar window. One whale moved 2.8 million UNI into Coinbase Prime minutes after the proposal went public, nearly like they’d been ready for that precise headline. One other long-term holder determined to ship 1.7 million UNI (round $15 million) to Binance, even locking in a $1.45 million loss simply to exit into the energy.

On X, the response was blunt. One consumer summed it up as: whales pump UNI and retail strains as much as get dumped on. Others referred to as it precisely what it seemed wish to them: “not accumulation, however distribution with a storyline,” and “the right narrative to exit on.”

What UNIfication really modifications

Beneath all of the drama, UNIfication itself is definitely an enormous shift for Uniswap. For years, the protocol generated billions in charges for liquidity suppliers with out directing something explicitly to UNI holders. The brand new proposal flips that logic.

It introduces protocol charges that skim round 16.7–25% of LP charges on Uniswap v3 swimming pools, plus 0.05% on v2. As a substitute of going into some treasury to sit down round, all these captured charges are used to purchase and burn UNI, making a steady deflationary strain. On high of that, there’s a one-time burn of 100 million tokens from the treasury, and primarily based on present volumes, ongoing month-to-month burns might hit one thing like $38 million.

With v4, Uniswap can also be speaking about “aggregator hooks” to seize exterior income and auctions that permit merchants bid for low cost home windows with decrease or zero protocol charges. On paper, it’s a fairly highly effective value-capture improve for token holders.

Distribution disguised as development

The end result? Buying and selling quantity exploded over 500% to roughly $4 billion, sending UNI to round $9 and pushing market cap to about $5.6 billion. That’s the bullish, headline-friendly half. However whenever you stack that in opposition to the roughly $200 million in UNI that whale clusters have pushed onto exchanges this 12 months, the image begins to look much less like pure natural development and extra like a fastidiously timed exit.

Critics fear that siphoning 16.7% of LP charges to token burns might finally create a “demise spiral” for liquidity suppliers, who may really feel their returns getting squeezed. There are additionally rising issues that merging Labs and the Basis beneath a five-person board led by Adams will increase centralization danger, even because the proposal claims to create extra worth for holders.

So, UNIfication does what UNI holders have been asking for: it lastly offers them a direct worth loop through protocol charges and burns. But when the on-chain knowledge is something to go by, the primary group to actually money in on that pleasure weren’t smallholders or late consumers — it was well-positioned insiders and early whales utilizing the right narrative to lighten their baggage right into a freshly pumped market.

Disclaimer: BlockNews offers unbiased reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding selections. Some articles might use AI instruments to help in drafting, however each piece is reviewed and edited by our editorial staff of skilled crypto writers and analysts earlier than publication.