- Key threat metrics like Bitcoin’s Sharpe Ratio and Normalized Threat Metric are trending decrease, displaying weaker threat–reward and cooling institutional urge for food, even because the cycle matures.

- Newer whale cohorts are sitting on heavy losses, realizing over $1 billion in simply days, whereas long-term whales have quietly added greater than 36,000 BTC between late October and early November.

- This mixture of fading hype, pressured new cash, and aggressive long-term accumulation mirrors previous pre-recovery phases, hinting that Bitcoin’s strongest arms are nonetheless betting on the lengthy sport.

Bitcoin is in a bizarre spot proper now. On paper, the chance–reward profile is getting weaker, institutional demand appears to be like prefer it’s cooling off, and among the newer large wallets are sitting on brutal, billion-dollar losses. However beneath that mess, the veterans – the actual long-term whales – are quietly loading up like nothing’s mistaken.

So, is BTC really “cooling off”… or simply resetting earlier than the subsequent impolite shock?

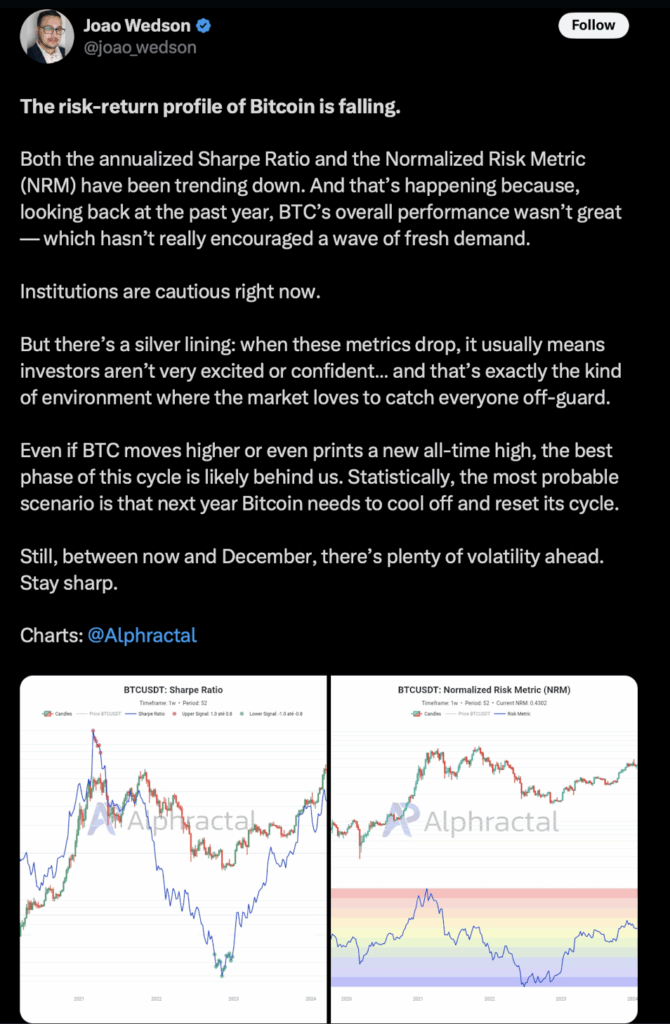

Threat–reward is slipping, and the metrics are calling it

When you have a look at the numbers as a substitute of simply the worth candles, Bitcoin doesn’t look as enticing because it did earlier within the cycle. Two key efficiency metrics – the annualized Sharpe Ratio and the Normalized Threat Metric (NRM) – have been trending down.

Each of those, in their very own approach, principally reply the query: “Am I being pretty rewarded for the chance I’m taking?” And currently the reply has been leaning extra towards “eh, probably not.” Decrease Sharpe and weaker NRM level to underwhelming efficiency and fading enthusiasm, particularly from the extra conservative facet of the market.

Joao Wedson, CEO of Alphractal, summed it up properly in a submit on X: when these metrics drop, it often means buyers aren’t excited or assured. And that’s exactly the sort of surroundings the place markets like to flip the script and catch everybody sleeping.

Even when Bitcoin does go on to place in new highs, there’s an actual argument that probably the most explosive a part of this cycle may already be behind us. From right here, the strikes could possibly be choppier, meaner, and extra selective about who really makes cash.

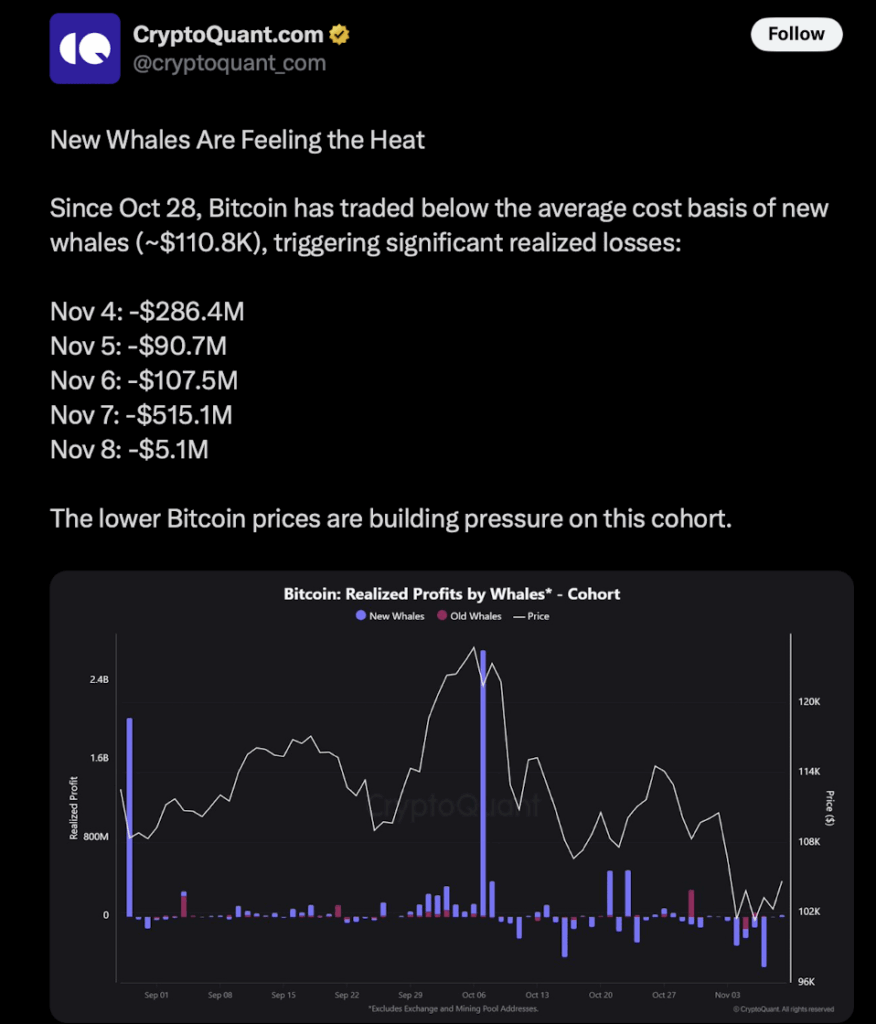

New whales are getting cooked

Then there’s the “new cash” – the newer whale cohorts that got here in nearer to the highest, most likely feeling fairly sensible on the time.

In keeping with knowledge from CryptoQuant, this contemporary group of huge holders is beneath severe strain. Since late October, Bitcoin has traded under their Common Value Foundation, which sits someplace round $110.8K on this dataset. Which means quite a lot of these newer whales are deep within the crimson, not simply barely underwater.

The numbers are tough. This cohort has realized greater than $1 billion in losses over just some days, with round $515 million flushed out on the seventh of November alone. That sort of ache doesn’t go unnoticed – and it places their conviction to the take a look at.

Proper now, there’s a sort of quiet tug-of-war between previous and new cash. The important thing query is straightforward: do these newer whales grit their enamel and maintain, or do they capitulate and dump into weak point? Whichever approach that steadiness tilts may closely affect how BTC strikes subsequent – whether or not we see a chilly, grinding drawdown or a pointy, reflexive rebound fueled by brief overlaying and compelled re-entries.

The previous guard whales are doing the alternative

Whereas newer whales are bleeding, the older, extra entrenched gamers are doing one thing very completely different: they’re shopping for. And never small quantities both.

Between the twenty fourth of October and the seventh of November, wallets holding greater than 10,000 BTC greater than doubled their stack. In that brief window, they added over 36,000 BTC. That’s not an off-the-cuff DCA; that’s a press release.

This sort of aggressive accumulation is eerily much like patterns seen earlier than main recoveries in earlier cycles, like again in 2020. When everybody else was nervous, the largest and slowest arms have been quietly hoovering up provide, making ready for what got here subsequent whereas the remainder of the market argued about tops and crashes..

Proper now, it appears to be like like the identical playbook: retail and new whales really feel squeezed, establishments calm down, threat–reward metrics fade… and the deepest pockets deal with all of it as a reduction rack.

Underneath the noise, the strongest arms are nonetheless all-in on the lengthy sport

When you simply have a look at worth volatility and social sentiment, it’s simple to assume Bitcoin is caught in some tiring mid-cycle stall. Metrics are gentle, institutional urge for food isn’t as loud, and among the greatest newer wallets are nursing large realized losses. It doesn’t precisely scream “all-time-highs tomorrow.”

However the story beneath the floor is completely different. Lengthy-term holders usually are not simply staying put; they’re actively rising their publicity. They’re treating this part as an accumulation window, not a hazard zone. Traditionally, that sort of habits from LTHs has not often been noise.

So whereas the market feels cautious and a bit drained on the skin, Bitcoin’s strongest arms are quietly positioning for no matter comes subsequent – whether or not that’s a sluggish, grinding climb or one other a kind of strikes that makes everybody say, “I can’t consider I didn’t purchase extra down there.”

Disclaimer: BlockNews offers unbiased reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles could use AI instruments to help in drafting, however each piece is reviewed and edited by our editorial staff of skilled crypto writers and analysts earlier than publication.