- Older Dogecoin provide is re-entering circulation as long-term holders take revenue, dragging down Imply Coin Age and hinting at a deeper correction part.

- Derivatives information exhibits declining DOGE futures Open Curiosity, reflecting a risk-off temper and weaker bullish conviction amongst merchants.

- Technically, failure on the $0.18527 zone places $0.15704 and presumably $0.12896 in danger, until bulls can reclaim resistance and push towards the 50-day EMA close to $0.19914.

Dogecoin’s latest worth motion is beginning to look fairly shaky, with outdated cash shifting once more and merchants quietly stepping again from danger.

Dogecoin slips towards $0.17 as promoting strain builds

Dogecoin (DOGE) is drifting again towards the $0.17000 area on Wednesday, after dropping round 5% the day prior to this. This marks the third straight week of losses, and the construction is starting to seem like a deeper correction quite than only a fast dip. On-chain information exhibits older DOGE provide coming again into circulation, which often means long-time holders are locking in earnings.

On the identical time, derivatives markets are exhibiting fading enthusiasm. DOGE futures exercise has been cooling off as merchants lean right into a risk-off temper. When each spot holders and futures merchants begin to trim publicity, it usually units the stage for steeper strikes, particularly in a risky meme coin like Dogecoin.

Previous DOGE provide wakes up as buyers offload

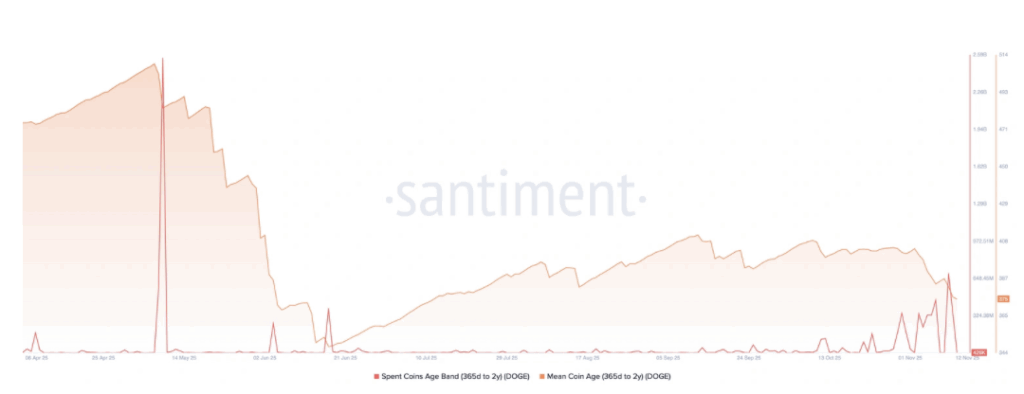

Dogecoin, nonetheless the biggest meme coin by market cap, is seeing clear indicators of decreased conviction amongst long-term holders. Provide that has been sitting nonetheless for over a yr is now re-entering circulation. Information from Santiment exhibits that the Imply Coin Age — which tracks the common age of tokens, focusing right here on cash held between three hundred and sixty five days and two years — has fallen to about 375 days, down from 404 days on November 2.

That drop would possibly sound small at first look, nevertheless it’s significant. It means that older, beforehand dormant cash are being moved into new wallets, seemingly by holders taking revenue or exiting their positions. In different phrases, the “affected person cash” isn’t fairly as affected person anymore, and that’s usually a warning flag for pattern sustainability.

The Spent Cash Age Band for the 365-day to two-year vary provides extra weight to this concept. This metric tracks how a lot of that older provide is being spent every day. In November, there have been repeated spikes, with a significant leap to round 693.07 million DOGE on Monday — the biggest single-day wave of promoting because the 2.56 billion cash spent on Could 9. That form of spike doesn’t occur accidentally; it often displays coordinated or broad promote choices from seasoned holders.

As dormant cash get activated and offered, the general imply age of cash on the community falls. This reset in age construction can act like a canary within the coal mine, hinting that the market could also be transitioning into, or deepening, a corrective part quite than gearing up for a powerful continuation rally.

Futures information hints at fading danger urge for food in DOGE

It’s not simply on-chain information telling this story. The derivatives facet is echoing the identical sentiment. Retail and leveraged merchants appear much less prepared to wager aggressively on Dogecoin within the brief time period. Information from CoinGlass exhibits a persistent downtrend in DOGE futures Open Curiosity (OI). OI has slid to roughly $1.43 billion, down from $1.48 billion on Tuesday.

A decline in OI means there are fewer open futures contracts, which generally factors to merchants closing out positions as a substitute of including new ones. When this contraction in open positions occurs whereas worth is underneath strain, it usually alerts that bullish conviction is weakening. The market shifts right into a risk-off posture, with merchants preferring to de-leverage quite than “purchase the dip” with leverage, which is what you’d anticipate in a powerful uptrend.

Briefly, each spot and futures individuals are quietly stepping away on the identical time. That combo can go away worth extra weak as a result of there’s much less recent demand to soak up any new waves of promoting.

Key ranges to look at as Dogecoin dangers a deeper correction

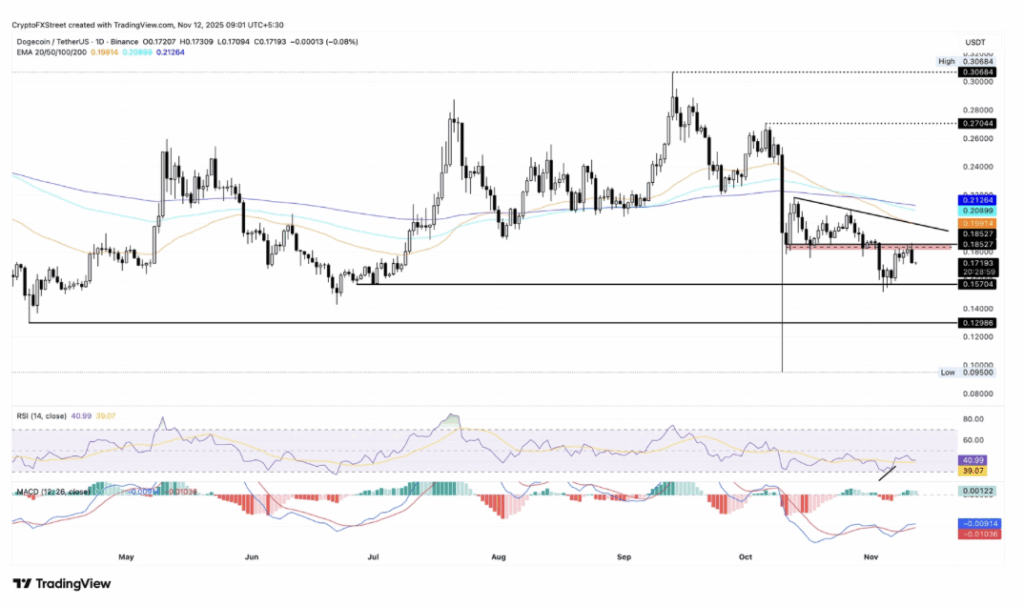

From a technical standpoint, Dogecoin just lately failed to interrupt via a key provide zone close to the $0.18527 shut from October 11. That rejection triggered Tuesday’s 5% pullback. As of now, DOGE is struggling to carry above the psychological $0.17000 mark, whereas bears seem like eyeing the following main help round $0.15704, which strains up with the June 27 low.

If confidence doesn’t return — particularly from the long-term holders and leveraged merchants who’ve been scaling out — the corrective part might prolong additional. The following notable draw back goal sits close to $0.12896, outlined by the April 7 low. A transfer towards that space would characterize a a lot steeper reset of the latest rally and would possibly flush out quite a lot of late patrons.

Momentum indicators usually are not precisely serving to the bullish case both. On the day by day chart, the Relative Power Index (RSI) is hovering close to 40 after pulling again from the midline. That exhibits rising draw back momentum and suggests sellers are gaining the higher hand once more. On the identical time, the Transferring Common Convergence Divergence (MACD) is curving again towards the sign line, flirting with a possible bearish crossover that may additional reinforce the concept of renewed promoting strain.

There’s nonetheless a possible upside situation, nevertheless it requires power to really present up. If DOGE can reclaim and maintain above the $0.18527 degree, patrons would possibly regain some management and open the door for a push towards the 50-day Exponential Transferring Common (EMA) round $0.19914. Clearing that zone wouldn’t magically repair every little thing, however it will at the very least sign that bulls aren’t carried out but and that the correction is likely to be dropping steam.

Disclaimer: BlockNews supplies unbiased reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles could use AI instruments to help in drafting, however each piece is reviewed and edited by our editorial group of skilled crypto writers and analysts earlier than publication.