As Wednesday begins, Bitcoin sits at $104,100 after 24 hours of compelled promoting that erased $408 million in positions and trimmed whole open curiosity by nearly $1 billion. Ethereum’s chart reveals liquidations price $103 million, confirming broader stress within the altcoin area.

Widespread cryptocurrency XRP is flat round $2.40, with a number of ETFs on it anticipated to start buying and selling this week, however the coin faces technical stress from the Bollinger Bands that often break violently. The indications on the every day and weekly frames present that patrons are dropping their grip close to the $2.40-$2.50 ceiling.

TL;DR

- XRP setup factors to a drop underneath $2 earlier than month’s finish if the midband fails once more.

- Bitcoin printed a 400% long-to-short liquidation imbalance with $408 million whole.

- Satoshi-era whale Owen Gunden cashed out about $1.5 billion BTC after 15 years of silence.

Put together to see XRP underneath $2, Bollinger Bands warn

Trying on the every day chart, XRP is buying and selling inside a spread of about $2.17 to $2.70, with the worth holding regular on the midpoint of $2.44. Every retest of that line has been rejected for 3 weeks straight. The decrease band is at $2.17; if that breaks, there may be room to go as little as $1.94 and even $1.80.

The weekly construction stays bearish too. The worth is beneath its 20-week shifting common at $2.82 and has not been capable of get again above the August vary prime round $2.60. That retains the short-term bias damaging till a robust shut above $2.55 seems.

within the month-to-month view, XRP has printed two decrease highs because it peaked at $3.40 in July. The present candle is -4% and sits proper on the 20-month common close to $2.40. If this month closes beneath that line, it’s seemingly that the market will proceed to drop towards the $1.70-$1.80 zone.

The vary of costs has hit its lowest level for the reason that first quarter of 2024. Up to now, this type of compression has led to strikes of 25-40% in only a matter of weeks.

Thus, if the subsequent leg breaks south, the chart has targets of $1.92 within the brief time period and $1.65 within the medium time period.

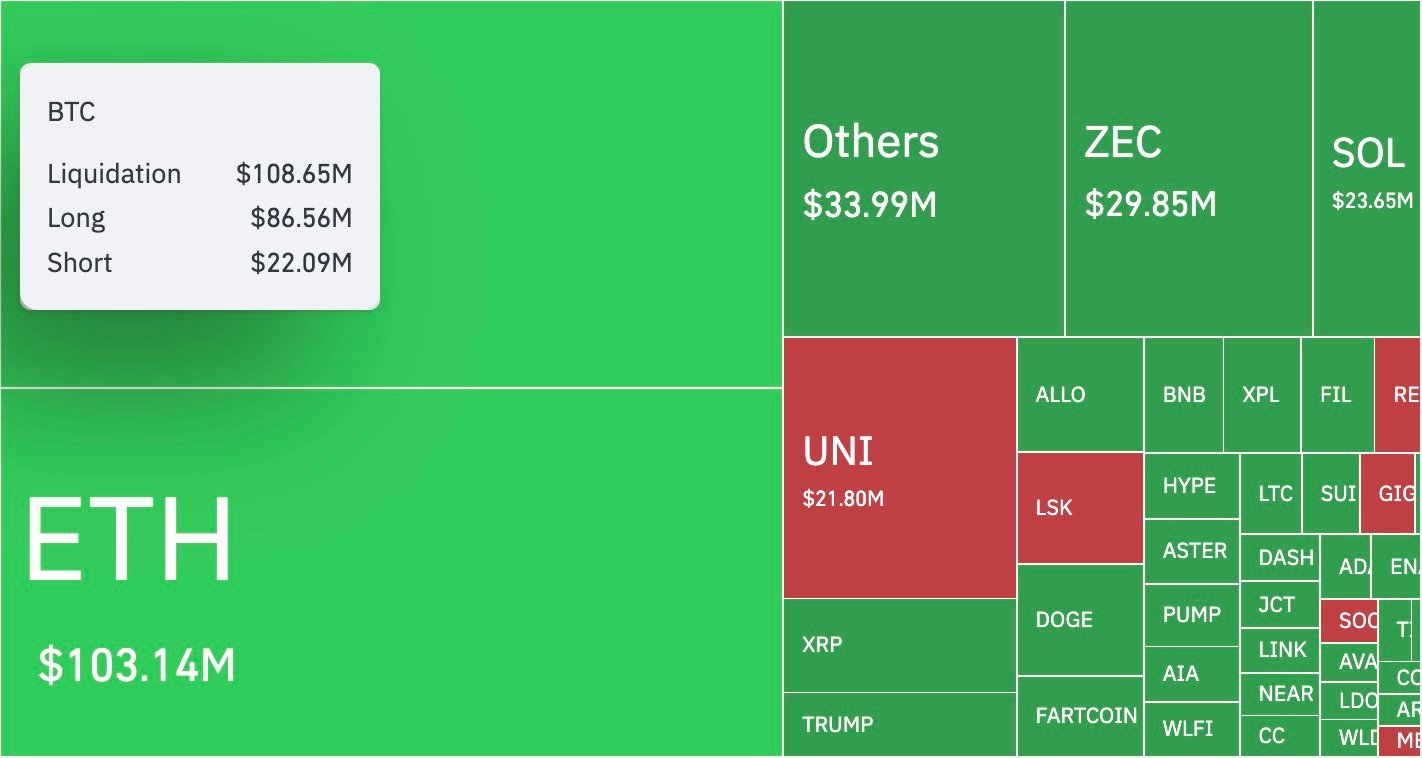

Bitcoin prints 400% liquidation imbalance

CoinGlass’s knowledge reveals that $408.13 million have been liquidated in 24 hours — $321.26 million from longs versus $86.87 million from shorts, for a ratio of about 4 to 1. BTC alone accounted for $108.65 million of these losses — $86.56 million longs, $22.09 million shorts. Ethereum added one other $103 million, whereas ZEC and SOL noticed $29.8 million and $23.6 million, respectively.

The sell-off began late Tuesday when BTC fell via $105,000 and triggered stop-losses round $104,500. Costs hit $103,000 earlier than recovering to $104,100. Funding charges have dropped by half since then, which is an indication that extreme leverage was lastly cleared.

If Bitcoin doesn’t handle to remain above $103,000, there may very well be one other wave of liquidations hitting the $101,500 and $99,000 zones — the subsequent two main liquidity swimming pools. But when it closes over $105,500, it might result in brief overlaying towards $108,000.

The market’s ache has been reset, so it’s potential for it to bounce again over the weekend, so long as the macro knowledge doesn’t trigger any main shocks to danger belongings.

Satoshi-era whale sells all his BTC for $1.5 billion

Arkham knowledge reveals that early miner Owen Gunden offered most of his long-dormant holdings — about 5,350 BTC, price about $1.5 billion at present costs. There have been transfers to Kraken and a number of other OTC desks over the previous two weeks.

His pockets steadiness dropped from about $1.4 billion to $556 million, with the remainder of the cash priced at $104,924 every. This is likely one of the greatest actions of pre-2011 BTC we’ve got ever seen.

Persons are speculating concerning the sale for all kinds of causes, like quantum safety issues and tax-year rebalancing. Regardless of the purpose, if a 15-year holder cashes out on the cycle peak, it provides psychological stress and will sign an intermediate prime forming round $107,000-$110,000.

If follow-through promoting from comparable classic wallets reveals up, Bitcoin might revisit its September base round $95,000 earlier than new institutional demand absorbs provide.

Crypto market outlook

The mid-November setup factors to extra volatility earlier than issues calm down, particularly this Friday’s U.S. PPI print, adjustments how dangerous the market feels.

XRP: Key set off at $2.18, dropping it unlocks $1.80-$1.92 zone.

BTC: Defend $103,000 or danger one other $99,000 sweep, upside capped at $108,000.

ETH: Steady above $3,000, however break beneath $2,940 opens brief window.

Proper now, derivatives leverage is being burned off, whale wallets are shifting and the market feels prepared for yet one more flush earlier than any December rally try.