- TRON’s TRX has proven relative power, trending increased towards $0.30 whereas many altcoins keep uneven and Bitcoin fails to reclaim increased ranges.

- On the day by day chart, a detailed above roughly $0.298 would mark a bullish construction shift, whereas decrease timeframes already present robust shopping for strain and an uptrend, so long as $0.296 holds as help.

- Liquidity clusters close to $0.303 and $0.328 counsel TRX could possibly be drawn towards these ranges quickly, however bulls should overcome these resistances with strong quantity to maintain a real uptrend.

TRON has been transferring in its personal lane these days, quietly grinding increased whereas numerous different altcoins chop round with out course.

Why TRON is catching merchants’ consideration proper now

Whereas hottest altcoins have been caught in messy volatility, TRON’s native token TRX has been making an attempt to construct a cleaner bullish pattern. Value has been pushing towards and making an attempt to interrupt previous the psychological $0.30 stage, which naturally pulls within the consideration of merchants searching for relative power performs.

Regardless of broader uncertainty, TRX has managed to pattern increased over the previous few days, at the same time as Bitcoin [BTC] tried and didn’t reclaim the $108k space. That distinction alone makes it attention-grabbing: when a coin strikes up whereas the market chief stalls, it typically alerts that there’s centered demand or rotation into that asset. For merchants, that type of divergence tends to behave like a magnet.

TRX day by day chart: construction near flipping bullish

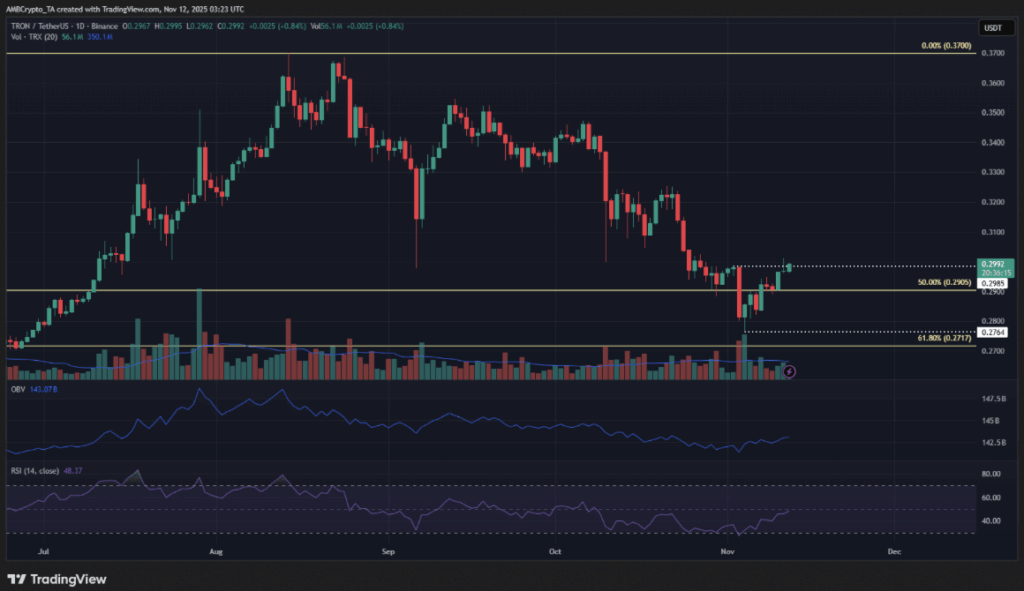

On the 1-day timeframe, TRON seems to be prefer it’s sitting proper on the sting of a possible construction shift. For the reason that remaining week of August, TRX has been caught in a sample of decrease highs and decrease lows, which is traditional downtrend conduct. The current motion, nonetheless, is urgent towards that sample.

Key current swing factors have been sitting round $0.276 and $0.298, highlighted as necessary reference ranges. On the time of writing, TRX is buying and selling close to $0.299, which suggests worth is hovering simply above the newest low of the downtrend. A day by day shut above roughly $0.298 would mark a clear bullish break of that construction. The try and lock this in on Tuesday fell brief, with solely the candle wick poking above that space, however no decisive shut. That leaves the door open for Wednesday to supply that affirmation, if consumers can observe by means of.

On the indicator facet, the On-Stability Quantity (OBV) has been creeping increased in current days, displaying that there was extra shopping for than promoting total. Nonetheless, it hasn’t but damaged above the earlier decrease highs from the final leg down, so the quantity image is enhancing however not totally convincing. The day by day Relative Power Index (RSI) is telling an analogous story: it’s leaning towards bullish momentum however hasn’t firmly established it but. You might say TRX is “nearly there,” however not fairly totally flipped.

Decrease timeframes level to stronger bullish momentum

Zooming into the 1-hour chart, the image seems to be extra energetic. Right here, each the OBV and RSI paint a a lot clearer bullish narrative. Over the previous week, they’ve signaled robust shopping for strain and regular upward momentum, which traces up with the seen uptrend on this timeframe.

Value just lately broke above the $0.29 space, which had been appearing as an area resistance, after which got here again to retest that zone as help — a traditional bullish sample. A short dip all the way down to round $0.296 truly arrange an honest shopping for alternative for short-term merchants, because it tagged an necessary near-term help with out breaking it. Nonetheless, the $0.30 area has been cussed, appearing as a key resistance band during the last week. For a convincing breakout, TRX actually must clear this space on robust buying and selling quantity. If worth breaks under $0.296 once more, that might begin to invalidate the bullish short-term concept and counsel the transfer was extra of a fake-out.

Liquidity clusters and upside targets for TRX

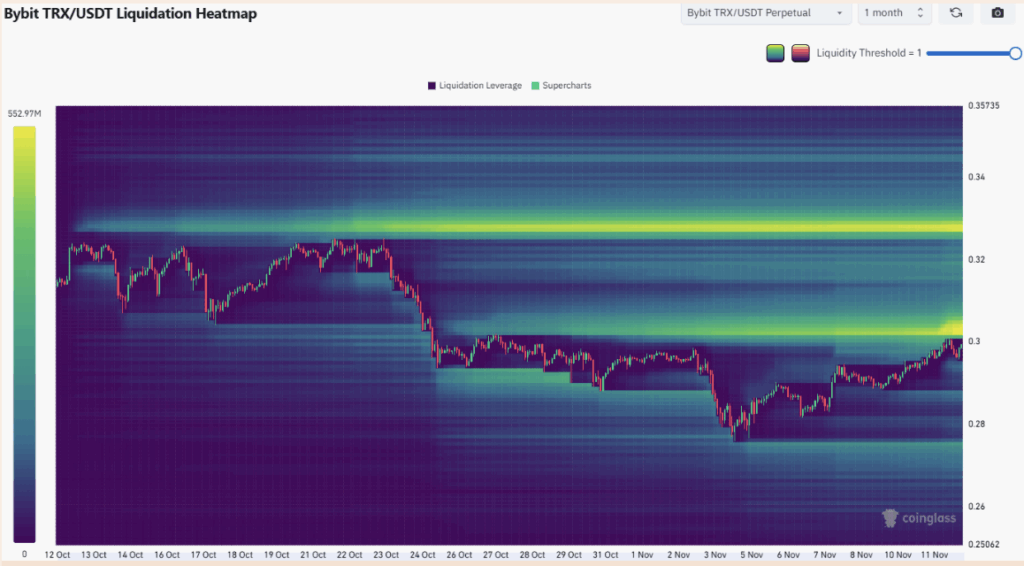

Trying on the liquidation heatmap, the $0.303 and $0.328 zones stand out as close by liquidity clusters. These are areas the place numerous leveraged positions could get triggered, which frequently pulls worth towards them like gravity within the brief time period. Due to this, a bounce or push from present ranges up into the $0.303–$0.328 vary appears fairly believable if consumers keep strain.

If TRX can break by means of $0.303 with momentum, the trail towards $0.328 turns into rather more life like within the coming days. That $0.328 stage may act as an even bigger choice level for the pattern: both it rejects there and cools off, or a robust breakout by means of it may encourage much more merchants to pile in. For now, the principle threats going through TRX bulls are easy however necessary — the $0.303 and $0.328 resistance zones, and the necessity for sustained shopping for strain to substantiate that this isn’t only a non permanent bounce, however the begin of a extra sturdy uptrend.

Disclaimer: BlockNews offers unbiased reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding selections. Some articles could use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial staff of skilled crypto writers and analysts earlier than publication.