Market Overview

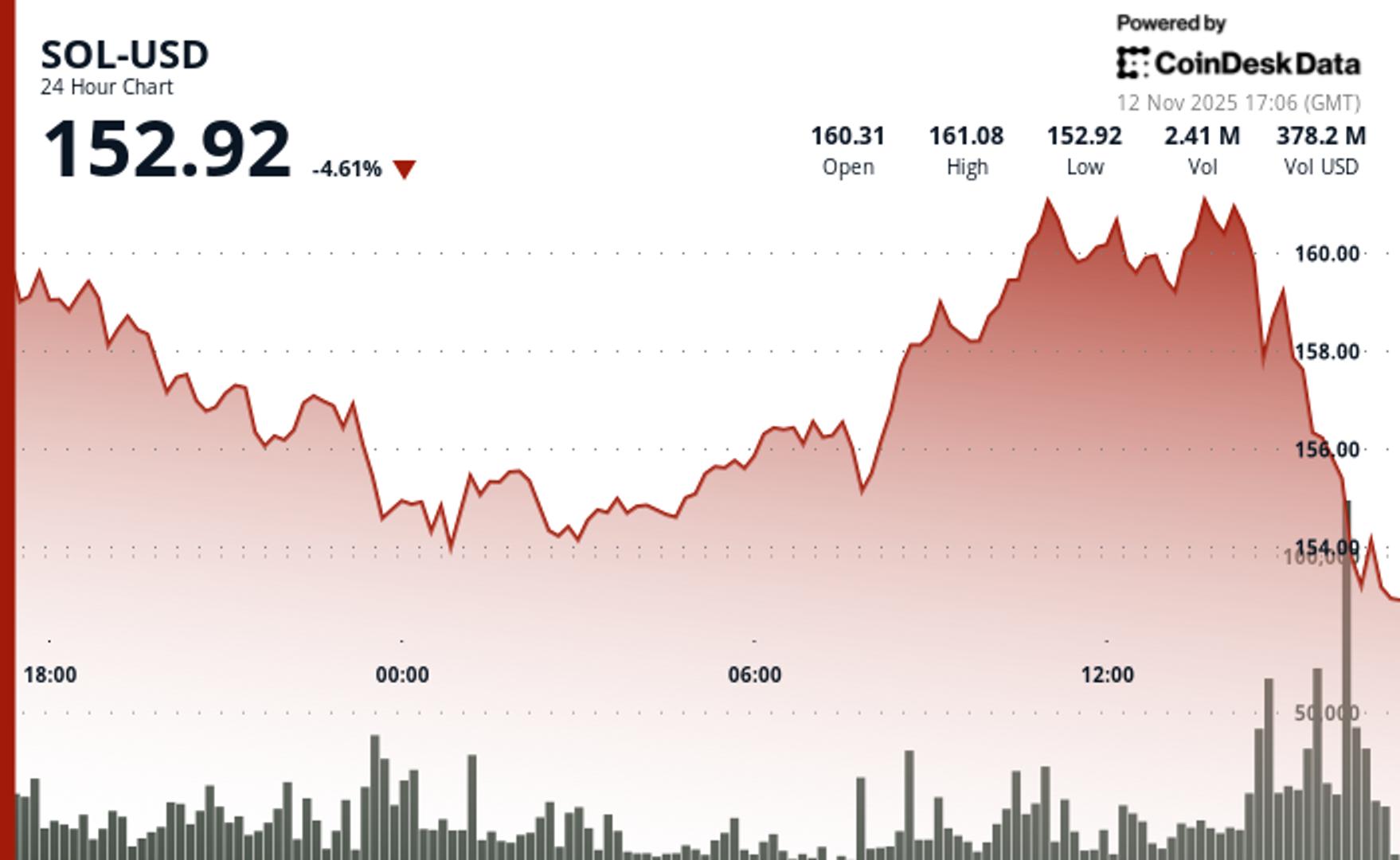

Solana faces renewed promoting strain because the token tumbles from $160.72 to $152.81, posting a 4.9% decline regardless of continued institutional help by way of exchange-traded fund merchandise. The drop happens on elevated quantity working 17.25% above the seven-day common. Lively repositioning dominates relatively than passive drift.

Promoting intensifies following one other scheduled token unlock from bankrupt Alameda Analysis and the FTX property on November 11. Analyst MartyParty stories roughly 193,000 SOL tokens value $30 million get launched as a part of ongoing month-to-month vesting. This system has been progressively distributing over 8 million tokens since November 2023. These structured releases, managed underneath chapter oversight, sometimes circulation to main exchanges for creditor compensation.

Institutional demand stays sturdy with solana spot ETFs recording their tenth consecutive day of inflows totaling $336 million for the week. Main monetary establishments together with Rothschild Funding and PNC Monetary Providers disclosed new holdings in Solana-based merchandise. Grayscale launched choices buying and selling for its Solana Belief ETF (GSOL) to offer extra hedging instruments for institutional merchants.

Provide Strain vs Institutional Demand: What Merchants Ought to Watch

Alameda’s systematic token releases create predictable promoting strain whereas institutional flows present underlying help. SOL finds itself caught between opposing forces. The chapter property maintains roughly 5 million tokens in locked or staked positions. Smaller month-to-month unlocks proceed by way of 2028 primarily based on pre-2021 funding agreements.

The 60-minute evaluation reveals accelerating bearish momentum as SOL breaks important help at $156 amid explosive promoting quantity. The breakdown happens throughout 15:00-16:00 UTC when worth collapses from $155.40 to $152.86 on 212,000 quantity—123% above the hourly common.

This technical failure confirms the sooner help breach and establishes a descending channel concentrating on the $152.50-$152.80 demand zone. Nonetheless, underlying energy in ETF flows suggests institutional accumulation at decrease ranges. Bitwise’s BSOL leads weekly inflows with $118 million whereas sustaining its yield-focused technique by way of staking rewards averaging over 7% yearly.

Key Technical Ranges Sign Consolidation Section for SOL

Help/Resistance: Major help establishes at $152.80 demand zone with secondary ranges at $150; instant resistance at $156 (former help) and $160

Quantity Evaluation: 24-hour quantity surges 17% above weekly common throughout breakdown, confirming institutional repositioning relatively than retail capitulation

Chart Patterns: Descending channel formation with decrease highs at $156.71 and $156.13; break above $160 wanted to invalidate bearish construction

Targets & Threat/Reward: Bounce potential towards $160-$165 resistance if $152.80 holds; breakdown beneath $150 accelerates towards $145 help ranges

CoinDesk 5 Index (CD5) Drops 1.85% in Risky Session

CoinDesk 5 Index fell from $1,792.49 to $1,759.24, declining $33.25 (-1.85%) throughout a $74.31 whole vary as robust bearish momentum emerges after failing resistance at $1,824.82, with important institutional quantity through the 15:00-16:00 selloff confirming the downward break beneath key help at $1,767.

Disclaimer: Components of this text have been generated with the help from AI instruments and reviewed by our editorial staff to make sure accuracy and adherence to our requirements. For extra info, see CoinDesk’s full AI Coverage.