Bitcoin is coming into a consolidation part, holding regular above the $100,000 mark however struggling to interrupt previous $105,000. The market seems to be stabilizing after weeks of volatility, but on-chain knowledge alerts that profit-taking stays energetic. In accordance with prime analyst Darkfost, because the distinctive liquidation occasion in early October, many traders have began to safe income and reduce their publicity as the present cycle nears its finish.

Associated Studying

Information from CryptoQuant reveals a notable uptick in Bitcoin inflows to Binance. The 30-day shifting common of each day inflows has climbed sharply all through October, exhibiting that, on common, roughly 7,500 BTC are being transferred to Binance day by day. That is the best influx charge because the March correction, indicating renewed promoting stress and cautious positioning amongst merchants.

Whereas such inflows typically replicate revenue realization and short-term promoting, Bitcoin’s means to consolidate close to the $100K stage suggests resilient underlying demand. Patrons proceed to soak up the availability coming into the market, stopping a deeper breakdown — not less than for now. Because the cycle matures, this part could show important in figuring out whether or not Bitcoin stabilizes for an additional leg up or faces a extra extended correction.

Quick-Time period Holders Add To Promoting Strain As Bitcoin Consolidates

Darkfost explains that the current surge in Bitcoin inflows to Binance and different exchanges displays rising promoting stress throughout the market. Regardless of this, Bitcoin’s worth continues to consolidate comparatively cleanly across the symbolic $100,000 stage — an indication that current demand stays sturdy sufficient to soak up the elevated provide. This stability between distribution and accumulation signifies that the market is present process a structural reset slightly than a full-blown capitulation.

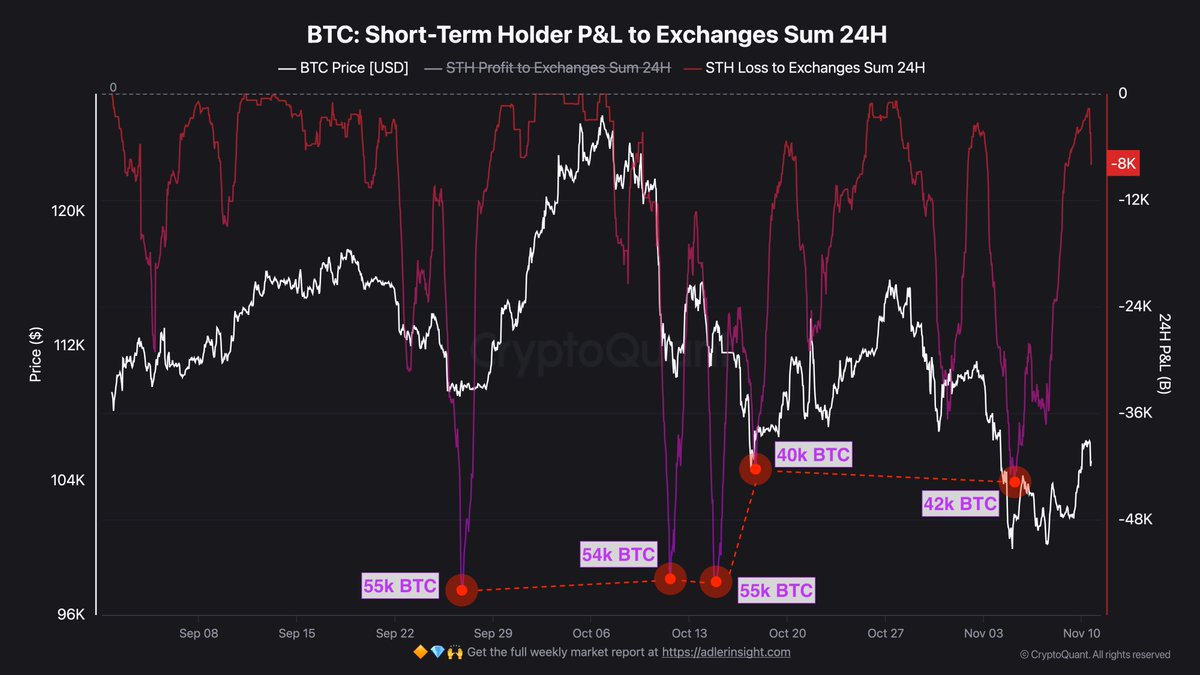

Including to this dynamic, short-term holders (STHs) have turn out to be a significant contributor to the continuing promoting stress. These contributors are usually essentially the most reactive phase of the market, responding shortly to volatility and sentiment shifts. With a realized worth close to $112,000, many STHs have been underwater for a few month, prompting them to ship vital quantities of BTC to exchanges at a loss.

Traditionally, any such habits has coincided with late-stage corrections — what analysts typically name a “cleaning part.” Throughout such phases, speculative capital exits the market whereas long-term traders quietly take up the availability, setting the inspiration for renewed stability and potential future development.

If demand continues to offset this wave of short-term promoting, Bitcoin might quickly kind a stronger base above $100,000 — paving the best way for a gradual restoration as promoting stress fades and confidence returns.

Associated Studying

Weekly Chart: Holding the Line Above Key Help

Bitcoin continues to consolidate inside a decent vary between $102,000 and $107,000, exhibiting resilience across the important $100K psychological stage. On the weekly chart, BTC stays supported by the 50-week shifting common (blue line), which is appearing as a powerful dynamic flooring for worth. Regardless of a number of retests over current weeks, bulls have managed to defend this stage, signaling that underlying demand stays intact whilst profit-taking intensifies.

The broader construction nonetheless factors to a wholesome long-term uptrend. The 100-week (inexperienced) and 200-week (purple) shifting averages proceed sloping upward, confirming that Bitcoin’s macro bias stays bullish. Nonetheless, the shortage of sturdy quantity throughout current rebounds means that market contributors are cautious, awaiting affirmation of renewed momentum earlier than including to positions.

Associated Studying

If Bitcoin manages to reclaim the $110K area, it might invalidate short-term bearish sentiment and set off a restoration towards the $117K–$120K resistance zone. Conversely, a weekly shut beneath $100K would mark a big technical breakdown, doubtlessly opening the door to a deeper retrace towards $92K–$95K.

Featured picture from ChatGPT, chart from TradingView.com