- BitGo’s pockets automation brought about about 11,000 failed XRP Ledger transactions after the pockets ran out of XRP.

- The glitch was traced to a lacking steadiness test, not a safety problem, and was fastened after BitGo replenished the pockets with 1,048 XRP.

- The occasion underscores how automation errors can create large-scale disruption on public blockchains if correct safeguards aren’t in place.

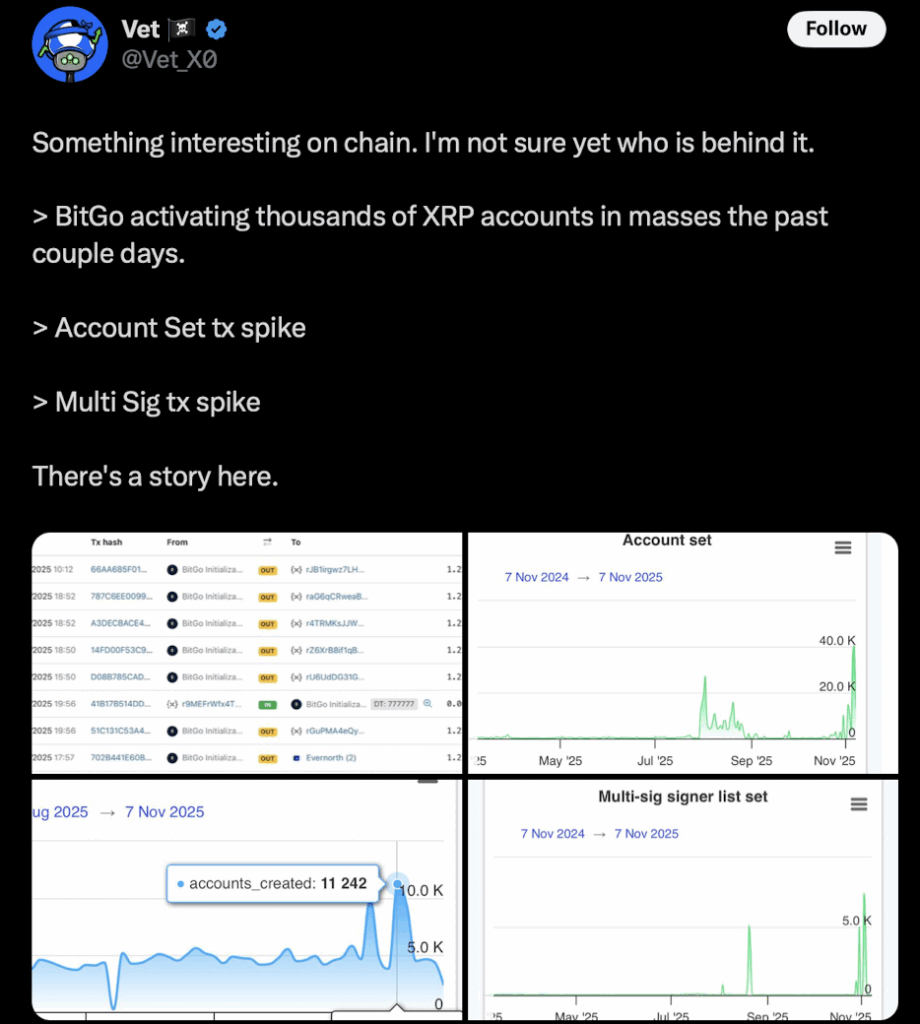

The XRP Ledger bumped into an odd hiccup just lately after a technical error from BitGo, one in all crypto’s largest digital asset custodians, brought about 1000’s of failed transactions to flood the community. The disruption was short-lived, however it served as a reminder that even small automation errors can ripple throughout a whole blockchain.

A pockets runs dry and chaos follows

The entire thing began when BitGo’s automated account administration system saved making an attempt to create new XRP accounts, even after the pockets accountable for these transactions had fully run out of XRP. On the XRP Ledger, creating a brand new account requires a minimal base reserve of 1 XRP, in any other case the transaction will get rejected mechanically.

However BitGo’s automation didn’t cease — it simply saved sending requests into the void. This triggered a cascade of “UNFUNDED_PAYMENT” errors, basically failed makes an attempt to open new accounts with no steadiness to again them up. Blockchain trackers lit up nearly immediately, displaying practically 11,000 account activation makes an attempt in a single day, manner past regular exercise ranges. It didn’t break the ledger’s consensus or safety, however it positive made the community logs messy for some time.

Group spots the issue quick

Members of the XRP group had been fast to flag the anomaly. One XRPL contributor often known as Vet seen the weird burst of failed activations and speculated that some automated course of had gone rogue. Inside hours, builders confirmed that the surge was certainly coming from BitGo’s methods, not a coordinated assault or exploit.

After figuring out the foundation trigger, BitGo ran an inside test and located the perpetrator — a easy automation loop that didn’t have a correct steadiness test coded in. The corporate rapidly added 1,048 XRP again into the affected pockets to revive regular performance. As soon as that deposit landed, the wave of failed transactions got here to a cease, and the XRP Ledger returned to its common rhythm. No consumer funds had been affected, and no malicious exercise was discovered, only a small however loud glitch from an in any other case routine course of.

Classes discovered from a small however noisy bug

Whereas the incident didn’t trigger any monetary harm, it did spotlight a key threat in automated blockchain operations. When custodians or institutional methods work together straight with public ledgers, even a minor scripting oversight can create large-scale noise or short-term pressure on the community.

BitGo’s fast response helped include the problem earlier than it grew worse, however the occasion nonetheless acts as a quiet warning for all the trade. Automated methods want tighter safeguards — issues like steadiness checks, transaction limits, and real-time monitoring — to forestall small code slips from turning into network-wide complications.

Proper now, all the pieces’s again to regular on the XRP Ledger. BitGo’s methods have stabilized, and the corporate says extra fail-safes are being reviewed to forestall one thing like this from occurring once more. However the takeaway is evident: automation is highly effective, positive, however with out cautious oversight, it might probably simply as simply flood a blockchain as it might probably assist run one.

Disclaimer: BlockNews supplies unbiased reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles might use AI instruments to help in drafting, however each piece is reviewed and edited by our editorial group of skilled crypto writers and analysts earlier than publication.