Tron (TRX) has been round lengthy sufficient to outlive a number of market cycles, however as November kicks off, it’s all of the sudden drawing recent eyes once more. October was a blended month for the token, and now merchants are watching intently to see if TRX can lastly flip its latest momentum into one thing extra convincing — perhaps even outperform final month’s numbers if market sentiment doesn’t shift too harshly.

TRX slows down volatility, hinting at quiet consolidation

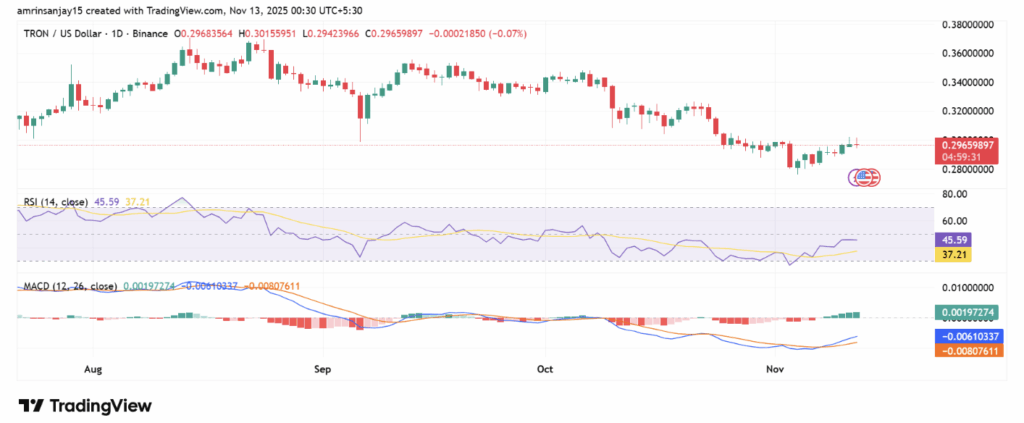

This month, Tron has calmed down rather a lot in comparison with October’s uneven value motion. Proper now, TRX is hovering near the $0.297 stage, dipping solely about 0.14%, which suggests the market’s getting into a consolidation part as a substitute of a selloff. It is a large distinction to October, when the token slid about 5.6%, reflecting a lot heavier promoting strain again then.

If TRX can reclaim the $0.30 mark with actual quantity behind the transfer, that might shift momentum in its favor. A breakout above that zone may push the token towards $0.31–$0.32 earlier than November ends, giving bulls a purpose to remain optimistic after weeks of muted motion.

TRX market construction: tight resistance, cautious help

As of now, Tron’s market capitalization sits round $28.07 billion, with 24-hour buying and selling quantity close to $752 million. The value has dipped about 1.22% over the previous day, sitting round $0.29 at press time.

Structurally, TRX remains to be leaning barely bearish on the short-term chart and is testing resistance close to $0.297. If it manages to interrupt by, $0.30 turns into the subsequent crucial stage — the true gateway for any significant upside pattern.

On the draw back, help sits close to $0.290. A clear break under that might drag TRX towards the $0.28 space, the place consumers have stepped in earlier than however not all the time with sturdy conviction. The chart is displaying a really tight vary, which normally hints {that a} decisive transfer may very well be coming sooner slightly than later.

Indicators present early bullish sparks

Regardless of the gradual value motion, a few technical indicators are flashing some early bullish alerts. The MACD simply flipped right into a bullish crossover, with the MACD line lifting above the sign line. It’s not a powerful surge but, but it surely does counsel that momentum may tilt upward if shopping for quantity will increase even barely.

The RSI, sitting round 45–37, stays in a neutral-to-lightly oversold area. Which means the token nonetheless has room to maneuver upward earlier than bumping into overbought circumstances. In easy phrases: there’s house for a rally if the market decides to get up.

Key resistance zone will determine the breakout

The extent everyone seems to be watching is $0.301. TRX has tapped that resistance a number of occasions this month however hasn’t managed to interrupt above it with conviction. If Tron lastly closes above $0.301 on sturdy quantity, it may open the door to a transfer towards $0.315–$0.325, confirming that upward momentum is returning.

If not, the token may keep caught in the identical tight vary till whales or broader market sentiment shift the momentum needle.

Disclaimer: BlockNews gives unbiased reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles could use AI instruments to help in drafting, however every bit is reviewed and edited by our editorial group of skilled crypto writers and analysts earlier than publication.