- Bitwise’s Chainlink ETF (CLNK) is now listed on DTCC, signaling progress towards buying and selling approval.

- Sergey Nazarov appeared at a U.S. Federal Reserve fintech panel alongside JP Morgan and Amazon leaders.

- Retail LINK holders proceed promoting, however whales amassed 4M+ LINK in two weeks.

Chainlink simply took a serious step towards mainstream publicity. The long-anticipated Bitwise Chainlink ETF, now listed on the DTCC platform below ticker CLNK, has formally entered the ultimate levels of its pre-approval course of. Though this doesn’t imply the SEC has given the inexperienced gentle but, it alerts the ETF is being positioned for eventual buying and selling — and that establishments are getting severe about LINK.

Chainlink’s ETF inches nearer to actuality

DTCC’s itemizing is a part of the routine clearing and settlement preparation course of, however the timing is fascinating. The infrastructure big lately built-in Chainlink’s CCIP (Cross-Chain Interoperability Protocol) and CRE(Chainlink’s tokenization rail), hinting that Chainlink is slowly embedding itself deeper into the plumbing of world finance.

This isn’t only a “crypto venture getting observed.” It’s a sign that LINK is turning into a structural element in how monetary techniques would possibly switch information and property sooner or later. The CLNK itemizing merely provides yet one more brick to that basis.

Chainlink steps into the Fed’s coverage circle

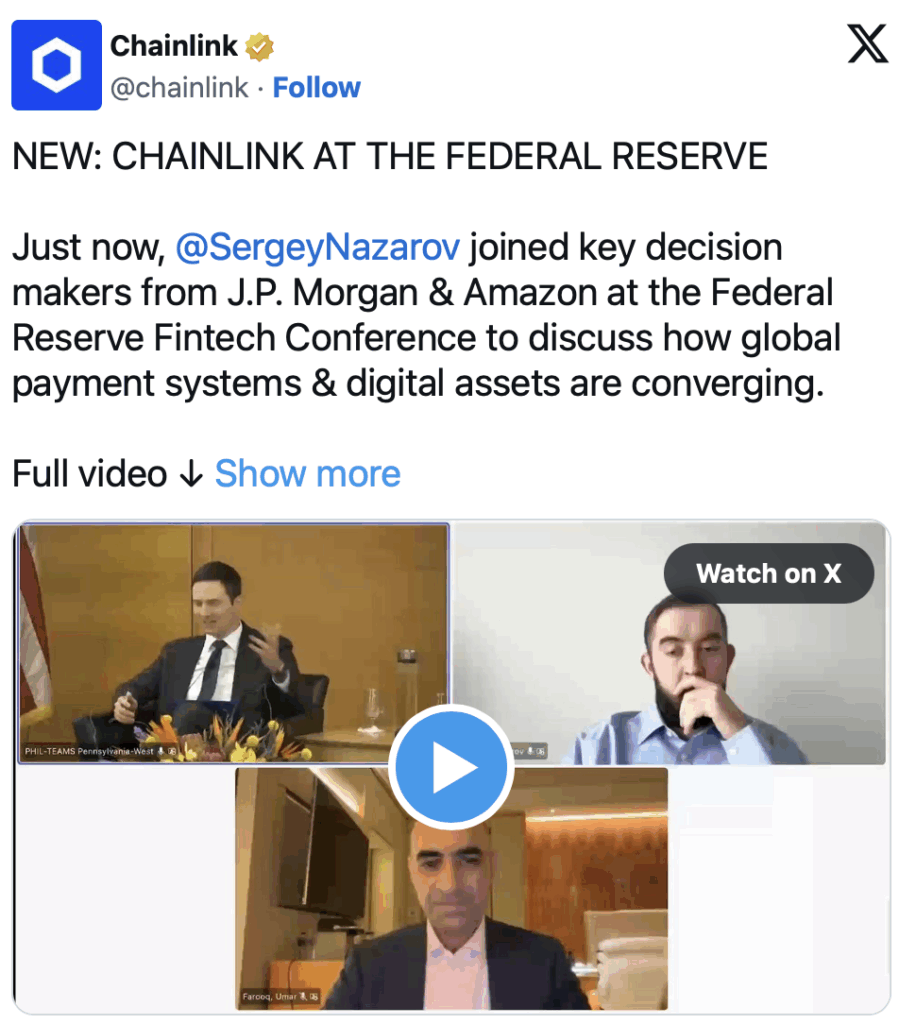

Chainlink co-founder Sergey Nazarov lately appeared alongside executives from JP Morgan and Amazon on the Federal Reserve’s Fintech Convention, the place the dialogue centered round digital asset interoperability and the way forward for world cost rails.

Occasions like this matter greater than folks admit. When a venture begins showing in high-level coverage conversations, it normally marks a shift in how establishments understand its long-term relevance. Chainlink’s presence there suggests it’s turning into a part of the “severe gamers” class — not simply one other blockchain venture.

However regardless of bullish alerts… LINK holders preserve promoting

Right here’s the twist: whereas institutional confidence builds, on-chain information exhibits that common LINK holders have been promoting persistently for the previous month. Sentiment is bizarre proper now — a mixture of frustration, boredom, and “why isn’t LINK pumping but?” vibes.

Analysts be aware this type of conduct is widespread throughout lengthy accumulation phases, the place worth stays sideways, sloppy, and even bearish regardless of robust fundamentals. ClairHawk Capital summed it up completely:

“All of them do the identical actual conduct throughout accumulation… large cash can’t purchase all of sudden. They increase capital by pumping distractions, memes, and rotate income quietly into uneven performs whereas retail stays oblivious. After sufficient accumulation? That’s when worth breaks out and enters discovery.”

In different phrases: retail sells from exhaustion, whales accumulate, and the breakout comes after everybody stops anticipating it.

Whales ramp up shopping for as change provide hits file low

Whereas smaller holders offload their baggage, whales are doing the precise reverse. In accordance with on-chain analyst Ali, massive wallets amassed over 4 million LINK within the final two weeks alone. This pushed the Change Provide Ratio to its lowest stage ever.

Arca Analysis additionally confirmed that LINK balances on exchanges are in freefall, dropping to a contemporary 2-year low — a basic signal that long-term holders are positioning for larger costs. When tokens depart exchanges like this, it normally means they’re being moved into chilly storage, not prepping for a selloff.

LINK worth traits upward as accumulation builds

In the mean time, LINK is buying and selling round $15.93, up practically 3% previously 24 hours. That uptick could look small, however paired with the record-low change provide and the upcoming ETF catalyst, the setup is beginning to look… tight. Strain builds quietly earlier than it explodes.

With the Bitwise Chainlink ETF already listed on DTCC and institutional integration accelerating, sentiment may shift quick — particularly if whales proceed draining provide.

Proper now, it looks like two worlds are colliding: retail confusion and institutional confidence. And traditionally, the latter tends to win the lengthy sport.

Disclaimer: BlockNews gives unbiased reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles could use AI instruments to help in drafting, however each piece is reviewed and edited by our editorial group of skilled crypto writers and analysts earlier than publication.