Dogecoin’s largest non-exchange holders have accelerated accumulation into early November at the same time as worth stays subdued, in accordance with a Santiment chart shared by crypto analyst Ali Martinez.

Dogecoin Whale Holdings Leap By 4.72B DOGE

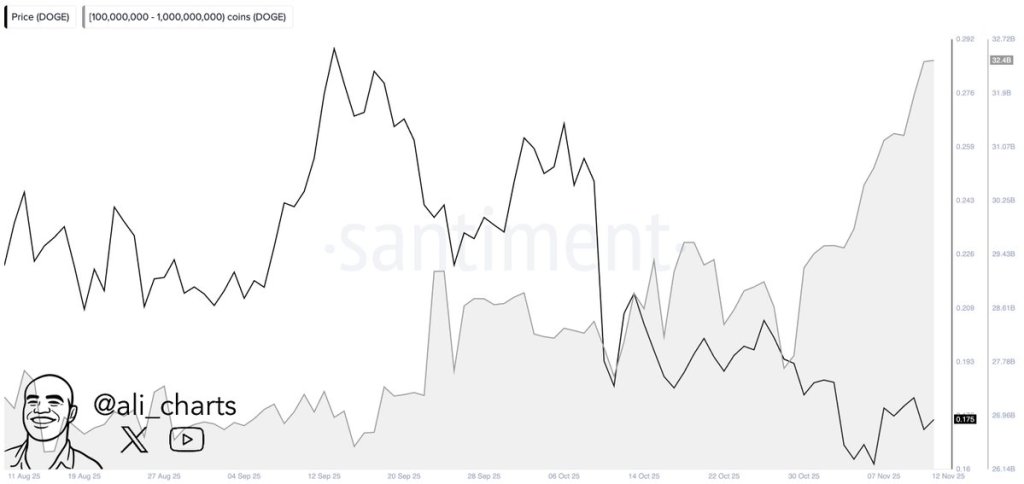

The graphic tracks two collection from August 11 by way of November 12, 2025: DOGE’s spot worth (black line, right-axis in USD) and the combination holdings of addresses with 100 million to 1 billion DOGE (shaded space, right-axis in cash). Over the latest two-week window the whale cohort added roughly 4.72 billion DOGE, lifting their stack to about 32.4 billion cash on the newest studying.

Value motion over the identical interval exhibits a transparent lack of momentum from the late-summer rally. After a mid-September push that printed close to the highest axis mark round $0.30, DOGE rolled over right into a sequence of decrease highs by way of early October earlier than a pointy mid-October drawdown.

Associated Studying

The road carves out a capitulation by way of near the $0.16 gridline in early November, adopted by an anemic rebound that stalled beneath successive axis bands and slipped once more into early November. The ultimate plot on November 12 sits close to $0.175, noticeably beneath the September peak and nonetheless hugging the decrease certain of the chart’s labeled vary.

In opposition to that backdrop, the whale collection presents a contrasting staircase. Holdings had been comparatively flat and uneven by way of September, with temporary step-ups round late September and early October that rapidly light.

The decisive transfer started within the remaining days of October: the shaded space arcs increased in a near-continuous climb from the ~27.7 billion area towards 32.4 billion by November 12. The magnitude of that rise aligns with Martinez’s word of 4.72 billion DOGE accrued in roughly two weeks, concentrated completely inside the 100M–1B deal with tranche ($17.5 – $175 million at present worth) specified on the chart.

The juxtaposition establishes a simple divergence: whereas worth traced new native lows into late October and struggled to reclaim misplaced floor in early November, massive holders expanded their positions and now management the very best share proven on the show interval.

Associated Studying

The chart doesn’t attribute causality or forecast path, nevertheless it clearly paperwork the place flows have been concentrated. Key worth landmarks on the panel stay the mid-September swing excessive close to $0.30 and the late-October low close to $0.16.

DOGE Bulls Should Act Now

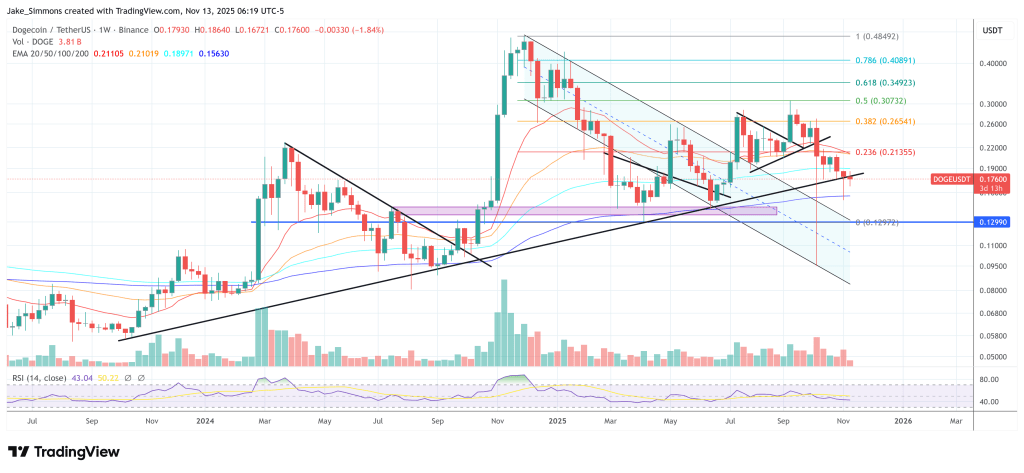

On the weekly DOGE/USDT chart, worth remains to be buying and selling beneath the rising black trendline that supported the advance from October 2023 till the clear breakdown in early November 2025, and that line now acts as overhead resistance within the upper-$0.18 space.

DOGE is at present round $0.1766, capped beneath the 0.236 Fibonacci retracement at $0.2136 and the 20/50-week EMAs clustered close to $0.2111–$0.2102, whereas resting above the 200-week EMA at $0.1563 and the key horizontal help highlighted close to $0.1299.

Till the market can reclaim that former main uptrend line on a weekly foundation, the chart construction stays certainly one of post-breakdown retests from beneath, with key upside reference ranges marked on the trendline itself, then $0.2136 (0.236 Fib), and better Fibonacci checkpoints at $0.2654, $0.3073, $0.3492 and $0.4089

Featured picture created with DALL.E, chart from TradingView.com