- The Czech Nationwide Financial institution created a $1M take a look at portfolio containing Bitcoin, a stablecoin, and a tokenized greenback deposit — its first direct crypto buy.

- The mission will run by way of 2027–2028 to review custody, funds, tokenization, and regulatory compliance, with the belongings held outdoors official reserves.

- The initiative comes as European establishments broaden MiCA-aligned crypto providers, signaling rising institutional curiosity in digital belongings.

The Czech Nationwide Financial institution simply made a transfer no one actually anticipated from such a conservative establishment: it purchased Bitcoin. Properly—not a large pile of it, however a $1 million digital asset take a look at portfolio that features BTC, a USD-pegged stablecoin, and even a tokenized greenback deposit. For the CNB, that is its first-ever direct buy of crypto, marking a fairly significant step into the digital asset world even when the quantity seems to be tiny on paper.

Why the CNB Created This Portfolio

The CNB Financial institution Board authorized the portfolio on October 30, however made it very clear that the funds can be held outdoors overseas reserves with no intention of scaling it up—not less than not for now. Governor Aleš Michl really pitched the thought again in January 2025 to assist the financial institution perceive how Bitcoin, tokenization, and different rising fee programs may form the monetary future. It’s much less about hypothesis and extra about studying, testing, and staying forward of no matter digital finance turns into.

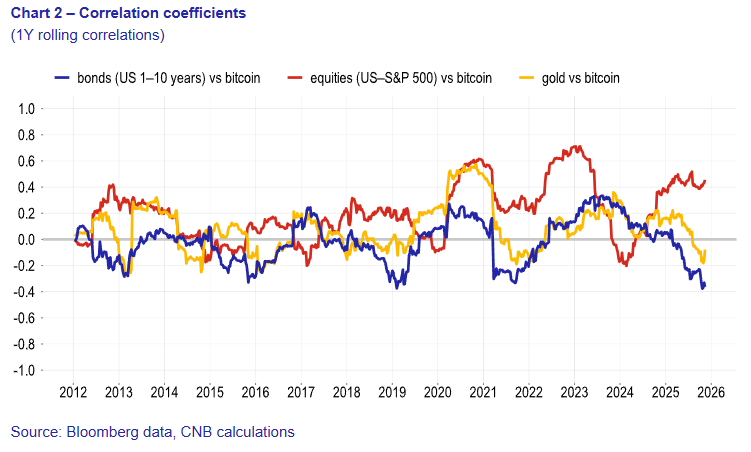

To handle the experiment, the CNB arrange one thing known as the CNB Lab, its personal innovation hub. Moreover the portfolio itself, the lab can also be watching AI use circumstances, new fee rails, and different tech developments. Earlier than going reside, the mission went by way of a full threat evaluation that in contrast totally different crypto classes and the potential exposures they carry. And simply to indicate how small this actually is: the complete portfolio represents solely 0.0006% of the CNB’s whole belongings.

Europe’s Regulatory Backdrop and What’s Being Examined

The CNB’s experiment is unfolding whereas Europe’s regulatory setting shifts quick. Banks like AMINA have already secured MiCA-compliant crypto permissions, and establishments resembling Customary Chartered and OKX are increasing digital asset providers throughout the EEA. So the CNB is stepping in at a second when conventional finance is beginning to mix with tokenized programs extra aggressively.

The analysis itself isn’t nearly worth efficiency. The financial institution needs to check actual operational particulars — custody options, transaction dealing with, safety controls, compliance workflows — principally all of the unglamorous however important elements of operating digital belongings inside a regulated establishment. For accounting functions, the CNB is classifying the portfolio as an intangible asset, conserving it separate from customary reserve administration.

What Occurs Subsequent

This isn’t a brief trial both. The mission runs by way of 2027–2028, after which the financial institution will resolve whether or not the entire thing will get expanded, modified, or quietly shut down. By then, crypto laws in Europe can be clearer, tokenized monetary merchandise ought to be extra mature, and central banks worldwide could have a greater grasp of how digital belongings match into the financial system.

For now, although, the CNB’s transfer stands out: a historically cautious central financial institution shopping for Bitcoin—not for hype, however to grasp what the longer term may demand.

Disclaimer: BlockNews gives impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding selections. Some articles might use AI instruments to help in drafting, however each piece is reviewed and edited by our editorial staff of skilled crypto writers and analysts earlier than publication.