The Bitcoin worth might have crashed to beneath $95,000, however even central banks are shopping for the dip.

The Czech Nationwide Financial institution has turn out to be the primary in Europe to substantiate a $1 million Bitcoin buy as a part of a pilot venture to check digital asset custody and settlement.

The transfer marks a exceptional turning level in establishing Bitcoin’s credibility, contemplating that central banks are essentially the most risk-averse entities in world finance, historically steering away from unstable property and dismissing crypto completely.

With CNB disclosing its Bitcoin funding, different central banks, establishments and agnostic mainstream buyers may comply with swimsuit.

With BTC’s fundamentals frequently bettering, sensible cash buyers proceed to purchase the dip, regardless of the short-term bearishness. Altcoins like XRP, privateness cash akin to Zcash and Sprint and layer-2 cash like Starknet and Bitcoin Hyper are additionally among the many greatest crypto to purchase now.

Bitcoin Worth Crashes, However Central Banks and Establishments Are Shopping for The Dip

The Bitcoin worth continues to face robust headwinds from the broader macroeconomic outlook. The shortage of transparency relating to the October US financial information has created promoting stress on monetary markets, pushing shares and cryptos decrease.

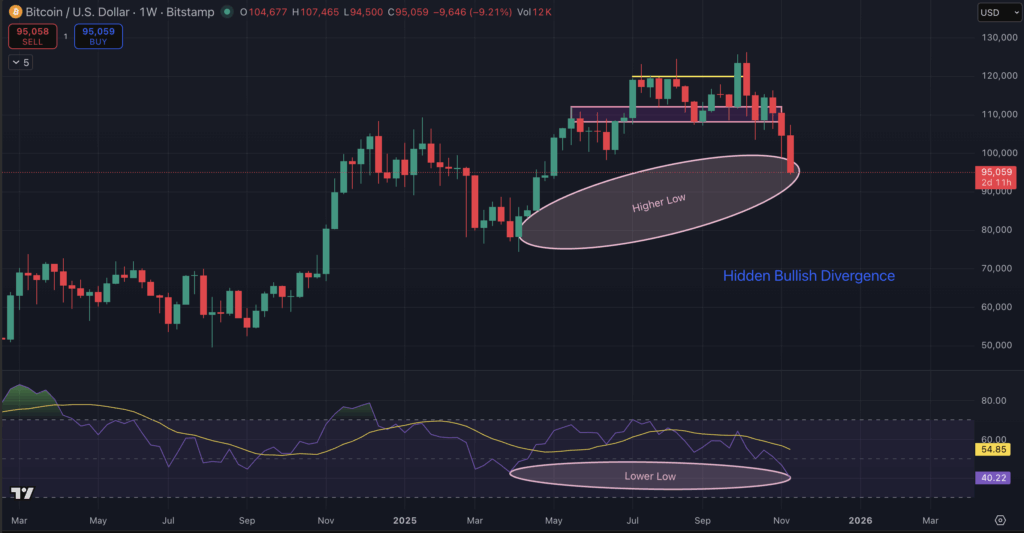

The BTC worth is buying and selling at $94,500 at press time, down almost 8% over the previous 24 hours. Notably, it’s now buying and selling beneath the 50-week exponential transferring common, a key assist degree that the bulls would look to reclaim.

CoinGlass information reveals that over $1.4 billion has been liquidated from the crypto market over the previous 24 hours.

But, establishments are shopping for the dip. The Czech Nationwide Financial institution introduced a $1 million funding in Bitcoin. CNB officers acknowledged that digital property are evolving and more and more being included into institutional portfolios, and that the financial institution intends to be ready for these developments.

Equally, on-chain information evaluation platform Lookonchain flagged that establishments are shopping for the dip. Anchorage Capital bought $405 million price of BTC from a wide range of exchanges after the Bitcoin worth fell.

Equally, JPMorgan analysts proceed to be bullish on BTC. Of their opinion, the Bitcoin worth may backside out at $94k, adopted by an enormous bullish reversal to $170,000.

Technically, Bitcoin may fall to $92,000 to shut a CME Hole earlier than its bounce again.

BTC’s technical evaluation additionally helps this thesis. The most important crypto has shaped an enormous hidden bullish divergence towards its RSI in its 2-week timeframe, which signifies that the bull market isn’t over.

Finest Crypto To Purchase Now: XRP, Privateness Cash, Bitcoin Hyper

Moreover Bitcoin, XRP might be the opposite large-cap asset that’s firmly among the many greatest crypto to purchase now.

Canary Funds’ new spot XRP ETF, $XRPC, recorded $58 million in complete buying and selling quantity, the best of any ETF launch this 12 months. It additionally recorded over $245 million price of inflows.

This means that XRP has robust institutional and mainstream demand and that it may hit a brand new all-time excessive later this 12 months.

In the meantime, privateness cash proceed to face out within the inexperienced amongst a sea of crimson. Each Zcash and Sprint are optimistic on Friday, with the previous up by almost 8% over the previous 24 hours. This implies robust latent demand.

Layer-2 cash are additionally dominating the scene. Ethereum layer-2 coin Starknet (STRK) is up by almost 10% over the previous 24 hours, buying and selling at $0.155 with an over $700 million market cap.

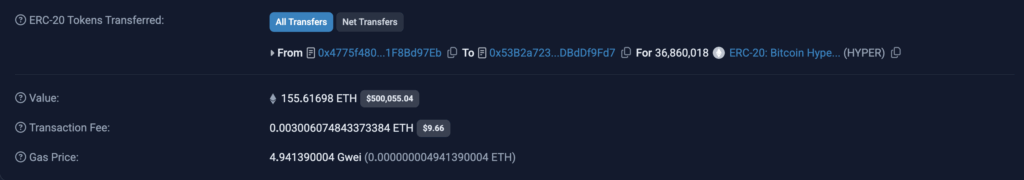

In the meantime, the brand new BTC layer-2 coin, Bitcoin Hyper (HYPER), is stealing the headlines even earlier than its launch. Regardless of the market crash, a whale swapped 155 ETH for HYPER, investing $500k into the brand new crypto.

Bitcoin Hyper is nearing the $28 million mark in presale investments, because of a wave of excessive six-figure investments from whales.

The robust demand, nevertheless, isn’t shocking. Layer-2 cash are considered as leveraged bets on their respective layer-1s, which bodes nicely for HYPER’s long-term trajectory.

JPMorgan analysts are nonetheless projecting that the Bitcoin worth will hit $170,000, which makes a BTC layer-2 coin like HYPER a sound wager for outsized returns following its launch.

Prime analysts and crypto influencers are amongst its early consumers, with many publicly backing Bitcoin Hyper as the subsequent 10x crypto.

This publication is sponsored. CryptoDnes doesn’t endorse and isn’t accountable for the content material, accuracy, high quality, promoting, merchandise or different supplies on this web page. Readers ought to do their very own analysis earlier than taking any motion associated to cryptocurrencies. CryptoDnes shall not be liable, immediately or not directly, for any harm or loss brought about or alleged to be attributable to or in reference to use of or reliance on any content material, items or providers talked about.