Be a part of Our Telegram channel to remain updated on breaking information protection

The Bitcoin worth plunged 6.4% over the previous 24 hours to commerce at $97,297 as of two:21 a.m. EST on buying and selling quantity that soared 47% to $110 billion.

The hunch got here as BTC led the broader crypto market capitalization down 6% to $3.37 trillion with the Crypto Concern & Greed Index displaying ”excessive worry” out there.

US spot BTC ETFs (exchange-traded funds) bled $869.9 million in web outflows on Thursday, their second-largest on file, acccording to Coinglass. The most important outflow occurred on February 25, once they misplaced $1.14 billion.

Bitcoin feeling the warmth!

🔴 Spot ETFs noticed $866.7M in outflows yesterday, the second highest in historical past.

Keep robust and HODL! 💪 pic.twitter.com/05oG86HPp0

— Carl Moon (@TheMoonCarl) November 14, 2025

Grayscale’s Bitcoin ETF led the outflows with $318.2 million, adopted by BlackRock’s IBIT ($256.6 million) and Constancy’s FBTC ($119.9 million).

Because the BTC worth dropped, so Bitcoin mining agency CleanSpark spent $460 million to repurchase 30.6 million shares.

“Our repurchase of greater than 10% of our excellent shares for roughly $460 million reinforces our confidence within the enterprise we’re constructing and our dedication to long-term worth creation.”

What it isn’t.

Not an ATM.

Not an fairness providing.

No insiders are… https://t.co/ahu88HgWCk— S Matthew Schultz (@smatthewschultz) November 13, 2025

It stated the buyback helps its technique of enhancing shareholder worth and optimizing its capital construction.

With Bitcoin down greater than 13% within the final month, can the bearish pattern proceed or will the bulls regain management?

Bitcoin Worth: A Wholesome Correction

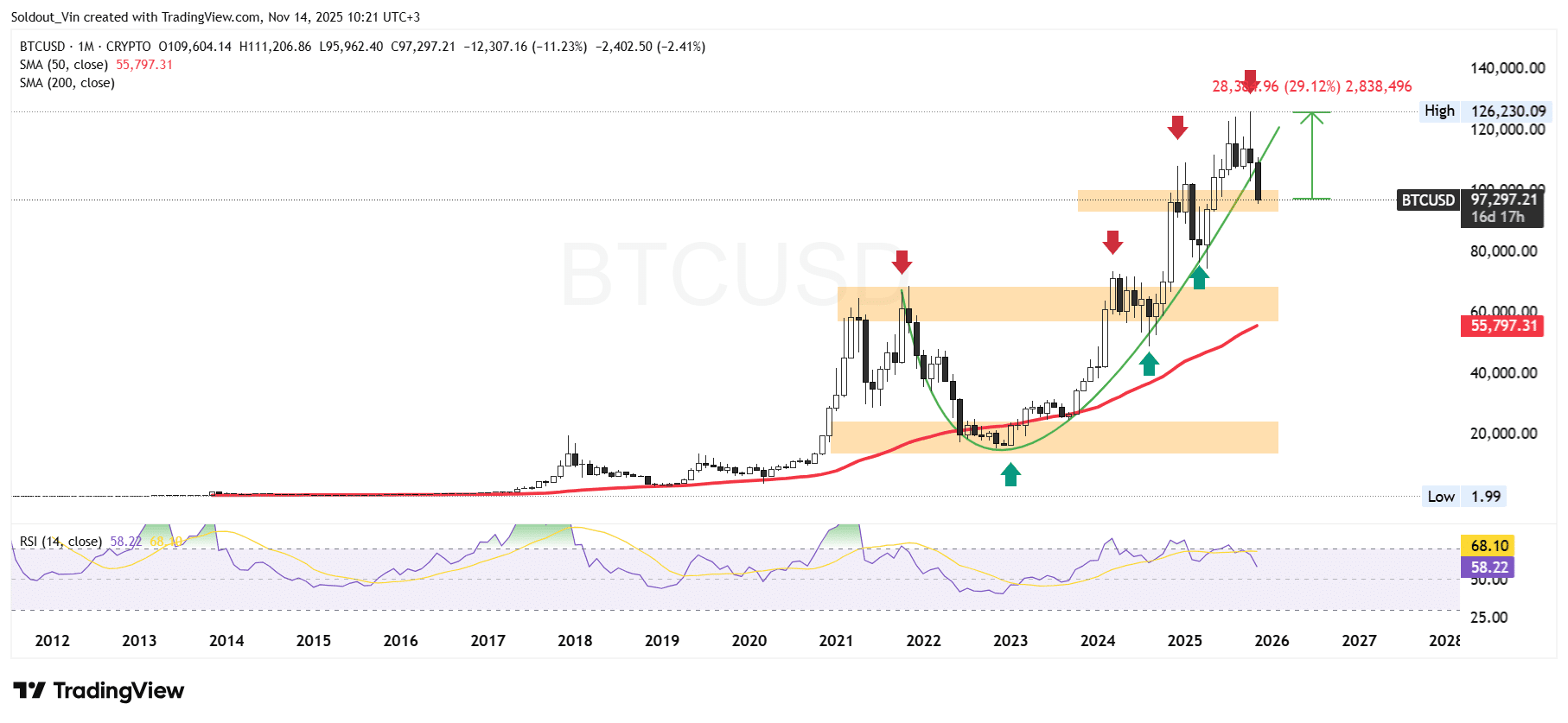

After hitting the $68,500 resistance in 2021, the BTC worth corrected to search out help round $15,600 in 2022.

The Bitcoin bulls have been in management since overcoming the $25,000 resistance stage and the $58,000 and $92,000 demand zones.

Because of the surge, the worth of Bitcoin has maintained its place inside a well-defined parabolic curve.

The continued surge has saved the BTC worth above the 50-day Easy Shifting Common (SMA) on the month-to-month chart.

Nonetheless, after hitting the $126,230 all-time excessive (ATH), Bitcoin’s worth seems to be present process a wholesome correction, with the latest candle falling under the curve’s boundary.

With the market dealing with bearish strain, the Relative Energy Index (RSI) can also be reacting to this transfer, falling from the 70-overbought zone to 58.

Because the RSI strikes decrease, the Bitcoin worth could proceed to drop. The subsequent attainable help zone is at $81,479. If the bears breach this stage, the subsequent help zone is on the 50-day SMA at $55,797.

In line with standard crypto analyst Ali Martinez on X, if BTC drops under $95,930, the subsequent key help ranges are at $82,045 and $66,900.

Under $95,930, the subsequent key help ranges for Bitcoin $BTC sit at $82,045 and $66,900. pic.twitter.com/EmxusQlQde

— Ali (@ali_charts) November 14, 2025

Conversely, if the bulls defend the $94,000 help zone, Bitcoin might get well again to its ATH ($126,230), a 29% surge from the present stage.

Michaël van de Poppe, a preferred analyst on X with over 814K followers, BTC must reclaim the $101K stage for any rally to occur.

To be able to have a trendswitch, markets must bounce above the earlier help stage to reclaim that stage for help.

In fact, $BTC is displaying weak spot right here, and it is sub $100K, so then you definitely’d wish to see a reclaim of $101K to consider any upwards rally.

Key purpose for… pic.twitter.com/WsJA5ZwHBZ

— Michaël van de Poppe (@CryptoMichNL) November 14, 2025

A lot will depend upon whether or not the Federal Reserve cuts rates of interest subsequent month. Proper now, the percentages that it’s going to have tumbled to only 49.6%, in accordance with CME Group’s FedWatch Instrument.

Associated Information:

Greatest Pockets – Diversify Your Crypto Portfolio

- Simple to Use, Characteristic-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Energetic Customers

Be a part of Our Telegram channel to remain updated on breaking information protection