Ethereum is buying and selling at a vital juncture after briefly shedding the $3,200 degree, with bulls struggling to defend it amid rising promoting stress. The broader crypto market stays on edge, as worry and uncertainty proceed to weigh on sentiment following days of regular declines throughout main property. Merchants are watching carefully to see if Ethereum can stabilize above this key assist zone — a failure to take action might set off a deeper correction towards the $3,000 space.

Associated Studying

Regardless of the mounting stress, one distinguished Ethereum whale — identified for a sequence of large-scale purchases this month — continues to build up aggressively. This investor has constantly added to their place whilst the worth fell, signaling sturdy long-term confidence in Ethereum’s fundamentals and restoration potential.

This divergence between short-term worry and long-term accumulation paints a fancy image for Ethereum. Whereas short-term volatility stays a priority, giant holders’ continued shopping for could also be setting the inspiration for a extra sustained rebound as soon as market situations stabilize and sentiment improves.

Ethereum Whale Retains Shopping for Regardless of Market Turbulence

In response to information from Lookonchain, the distinguished Ethereum investor often called Whale ’66kETHBorrow’ has continued his large-scale accumulation regardless of the continued market downturn. Earlier as we speak, the whale bought 19,508 ETH price roughly $61 million, increasing his already huge place constructed over the previous week.

Shortly after, an replace revealed yet one more buy — 16,937 ETH valued at $53.91 million — bringing his complete accumulation since November 4 to 422,175 ETH, price roughly $1.34 billion at a mean worth close to $3,489. Regardless of the latest worth drop, the whale is at the moment sitting on greater than $120 million in unrealized losses, however continues to double down on Ethereum publicity.

This aggressive technique signifies sturdy long-term confidence, because the investor seems unfazed by short-term volatility. Market observers counsel this accumulation sample might sign institutional-level conviction that Ethereum’s present costs characterize a strategic shopping for zone.

Whereas retail sentiment stays cautious amid heightened uncertainty, the whale’s constant exercise underscores a broader development: giant gamers are quietly accumulating, positioning themselves forward of a possible restoration as soon as macro situations stabilize and danger urge for food returns to the crypto market.

Associated Studying

ETH Struggles Under $3,300 as Promoting Stress Intensifies

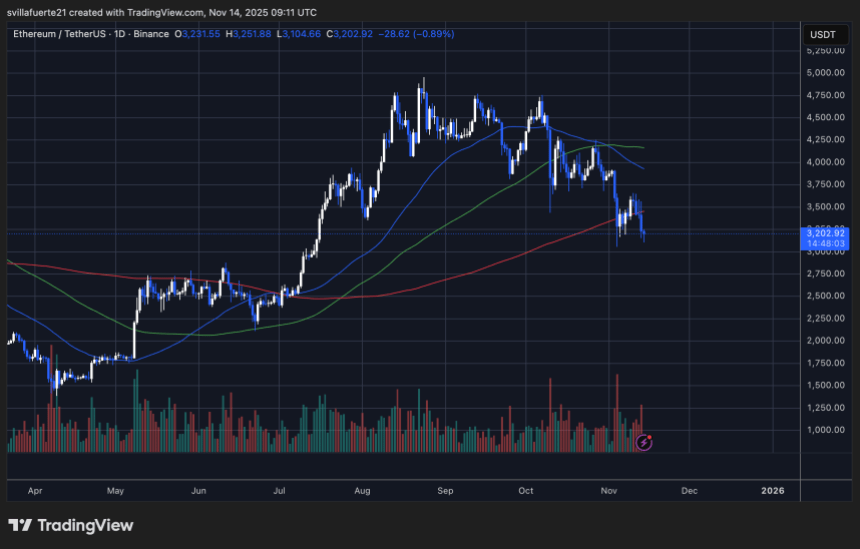

Ethereum is at the moment buying and selling round $3,200, dealing with renewed promoting stress after briefly reclaiming the $3,400 zone earlier this week. The each day chart exhibits ETH struggling to carry above its 200-day transferring common (crimson line) — a key assist degree that always defines long-term market construction. A decisive shut under this line might verify a deeper correction section.

The 50-day and 100-day transferring averages proceed to development downward, reinforcing the short-term bearish outlook. If Ethereum fails to recuperate momentum, the following main assist sits close to $3,000, adopted by $2,850, the place patrons beforehand stepped in throughout the summer season consolidation. Conversely, a restoration above $3,400–$3,500 can be the primary sign that bullish momentum is returning.

Associated Studying

Regardless of the pullback, analysts emphasize that enormous holders — together with the #66kETHBorrow whale — proceed to build up ETH, signaling sturdy conviction within the asset’s long-term potential. For now, Ethereum’s development stays fragile, and bulls should defend the $3,000 area to stop additional draw back momentum.

Featured picture from ChatGPT, chart from TradingView.com