A senior VanEck govt has reignited a long-running debate over XRP’s real-world utility, questioning each the relevance of the XRP Ledger and the financial case for holding the token—simply as a brand new spot ETF has posted the strongest launch numbers of any fund this yr.

Matthew Sigel, head of digital belongings analysis at VanEck, took direct intention at supporters on X, opening with a publish that mixed sarcasm and skepticism. “Expensive XRP maxis,” he wrote, “I could by no means perceive what your ‘blockchain’ really does, however I’ll at all times respect the eagerness required to faux it does one thing. So hold hustling!”

XRP Utility Debate Reignites

The tone set the stage for a thread that pushed past memes into pointed questions on developer exercise and worth accrual. In a follow-up publish, Sigel requested: “Real query: has any developer ever woken up and mentioned, ‘Time to construct… on XRP’? Would love citations.”

Hours later, he underscored the shortage of detailed responses from the neighborhood with a terse replace: “Zero replies up to now”. The problem is evident. In a market the place developer traction and on-chain exercise are sometimes handled as proxies for community worth, Sigel is not only criticizing the narrative, however demanding proof that ledger is definitely a goal platform for builders.

When an supporter pointed to Ondo Finance launching its OUSG tokenized Treasury fund on the XRP Ledger as proof the ecosystem is lively, Sigel shifted the dialogue to token economics.

“Cool initiative, however does any of this really accrue worth to XRP token holders? I’m not conscious of any price seize, income share, burn, or financial linkage. I feel possibly I’m not good sufficient to know however I’ll hold making an attempt to be taught and replace my views!”

The trade additionally touched on the fortunes created across the token and the controversies connected to them. After one consumer sarcastically wrote that XRP had “funded a complete firm [Ripple] on nothing and obtained a number of billionaires out of it,” Sigel replied: “Just like the one who funded Greenpeace’s ‘Change the Code’ marketing campaign to strain Bitcoin into abandoning PoW? Fairly a legacy.”

The comment alludes to the well-known funding of Greenpeace’s anti–proof-of-work marketing campaign by a Ripple co-founder, a transfer that has lengthy polarized Bitcoin and XRP communities.

When one other commenter accused him of making an attempt to “maintain ppl again” from investing within the token and dismissed Bitcoin as “utterly speculative,” Sigel contrasted the 2 belongings when it comes to institutional adoption and state-level engagement.

He argued that “retail buyers like College Endowments, Sovereign Wealth Funds, and at the moment a Central Financial institution” are actually in bitcoin, and claimed that “12 international locations are actually mining Bitcoin with direct authorities assist, due to its synergies with {the electrical} grid,” earlier than including, “Anyway by all means, make investments away in XRP. I’m not stopping you.”

The thread drew in Solana Basis’s Vibhu Norby, who has beforehand clashed with the XRP neighborhood however right here provided a extra reconciliatory, if nonetheless important, framing.

“XRP is a SoV coin much like Bitcoin with cheaper charges wrapped in 13 years of funds mythology. As an alternative of Satoshi, the collective unconscious of the XRP Military facilities round an organization (which btw occurs to be very properly run). The XRPL has minimal utilization for transactions in comparison with good contract blockchains, however it isn’t vital to its worth identical to Bitcoin has minimal transactions in comparison with good contract blockchains however it isn’t vital to its worth,” Norby commented.

All of this unfolded in opposition to a putting market backdrop. Canary Capital’s spot ETF XRPC, started buying and selling on November 13 and generated round $58 million in first-day quantity, together with $26 million in its first hour—sufficient to make it the largest ETF debut of 2025 up to now and narrowly surpass the launch-day quantity of Bitwise’s Solana ETF, BSOL. The 2 funds now outline the higher tier of single-asset ETF launches this yr, with the next-best newcomer greater than $20 million behind in day-one buying and selling.

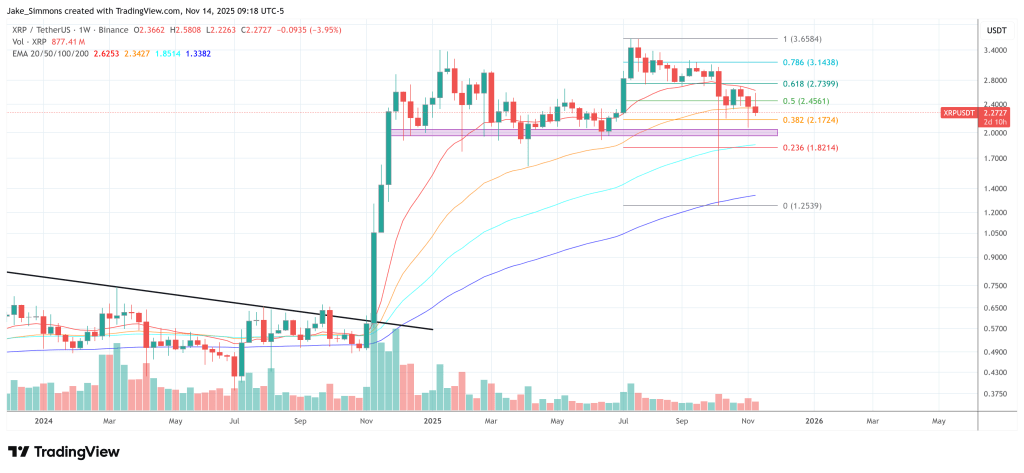

At press time, XRP traded at $2.27.

Featured picture created with DALL.E, chart from TradingView.com

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent overview by our staff of prime know-how specialists and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.