- XRP ETFs give conventional buyers a simple, regulated path into XRP publicity, creating recent demand that doesn’t depend on crypto-native customers.

- XRP value didn’t spike at launch as a result of ETF inflows settle slowly — actual XRP purchases seem solely after share creation cycles kick in.

- Lengthy-term, institutional entry via ETFs may help regular accumulation, giving XRP a brand new basis for future value progress.

For years, the entire thought of an XRP ETF felt sort of distant, virtually like a kind of issues folks talked about however didn’t count on to really occur anytime quickly. And but right here we’re — the primary wave of XRP ETF merchandise has lastly launched, and the response was loud sufficient to get everybody asking the identical query on repeat: Alright, so what does this truly imply for XRP’s value?

Even analysts on the Working Cash Channel jumped proper into the numbers, breaking down how these ETFs perform and what sort of strain (or lack of it) they could placed on XRP within the early days.

XRP ETF Opens the Door for a Model New Crowd

One of many largest factors the analyst made is straightforward however essential: ETFs usher in individuals who by no means wished to mess with wallets, exchanges, or crypto storage complications. Out of the blue, conventional buyers can get XRP publicity the identical manner they purchase shares or gold ETFs.

And the early numbers? Fairly stunning.

Within the first hours, XRP ETF buying and selling quantity was sturdy sufficient to beat out a number of well-known crypto ETFs. That doesn’t normally occur except there’s actual curiosity past the common crypto crowd.

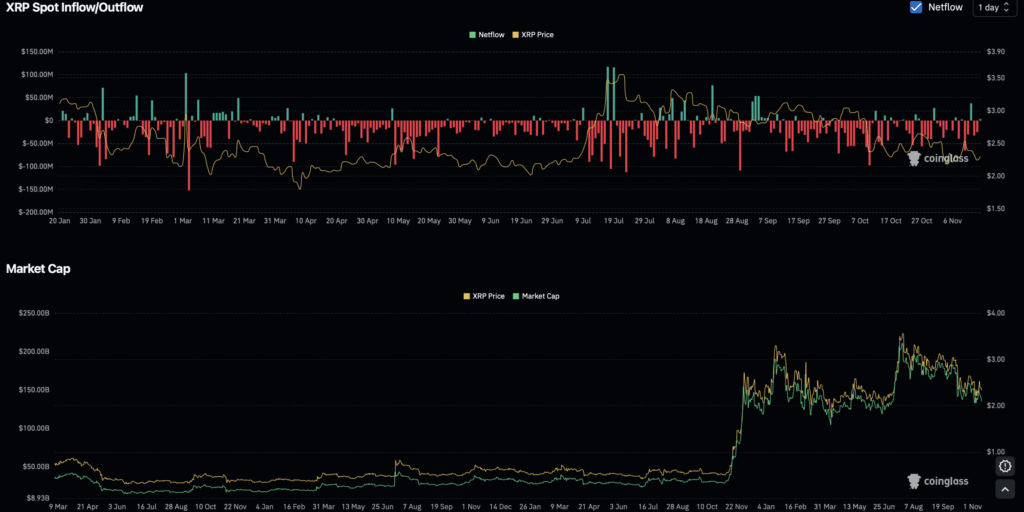

It feels a bit just like the early Bitcoin ETF second — the worth didn’t explode immediately, however the tone of the dialog modified virtually in a single day. And since XRP ETFs require issuers to truly maintain bodily XRP, this creates regular demand over time as an alternative of 1 large spike that fades away.

That’s why the analyst believes the actual influence on XRP value received’t present up instantly, even when the joy did.

Why XRP Didn’t Pump Proper After ETF Launch

Lots of people anticipated XRP to moon the minute the ETF went dwell… after which felt confused when nothing occurred. The analyst breaks this down fairly clearly:

ETF inflows don’t immediately convert into XRP buys.

Funds want time to settle. Licensed contributors create new ETF shares. These shares then want actual XRP backing — however that half typically occurs the subsequent enterprise day, not the identical minute the ETF begins buying and selling.

So what you see in early hours is generally ETF shares shifting round, not precise XRP being purchased on the open market. That’s why XRP can look so calm whereas ETF quantity is “wow-level.”

Bitcoin did the identical factor again when its ETFs launched. Worth dipped at first, then step by step lifted as actual inflows lastly kicked in. XRP appears to be following that very same slow-burn sample.

Institutional Cash Strikes Sluggish — However It Strikes Massive

One thing else the analyst identified is the “second wave impact.” Early ETF quantity normally comes from retail merchants, however large establishments take longer.

Funds and company buyers want:

- compliance checks

- inner approvals

- danger opinions

- allocation conferences

That may take weeks. Generally months.

Which implies actual institutional inflows would possibly begin after the noise dies down — not earlier than.

And for large cash gamers, ETFs are an ideal answer as a result of they keep away from the messy stuff like:

- storing XRP

- managing non-public keys

- navigating trade dangers

- coping with inner crypto insurance policies

A regulated ETF is clear and straightforward. That comfort alone may help a sluggish however regular upward strain on XRP over time.

What an XRP ETF Means Going Ahead

The analyst’s ultimate takeaway was fairly balanced: don’t count on fireworks within the first hour. XRP’s response will most likely are available in waves — settlement cycles, inflows, share creation, after which possibly a shift in value as soon as the construction stabilizes.

This mirrors how Bitcoin ETFs behaved. Early dip… then a gradual climb as soon as capital truly began flowing into the underlying asset.

And whereas XRP typically strikes in Bitcoin’s orbit throughout speculative intervals, the ETF may introduce a distinctive catalystthat XRP hasn’t had earlier than:

a brand-new stream of institutional cash getting into the asset via regulated channels.

Does it assure new highs? No.

Does it create a robust new pathway for adoption? Completely.

For buyers who by no means purchased crypto earlier than — and by no means deliberate to — the XRP ETF is their first actual doorway into the XRP ecosystem.

Disclaimer: BlockNews gives impartial reporting on crypto, blockchain, and digital finance. All content material is for informational functions solely and doesn’t represent monetary recommendation. Readers ought to do their very own analysis earlier than making funding choices. Some articles could use AI instruments to help in drafting, however each piece is reviewed and edited by our editorial crew of skilled crypto writers and analysts earlier than publication.