Be part of Our Telegram channel to remain updated on breaking information protection

After a bruising week for crypto, Bitwise says promoting stress is easing, providing buyers a glimmer of hope whilst market sentiment hit its lowest stage since February.

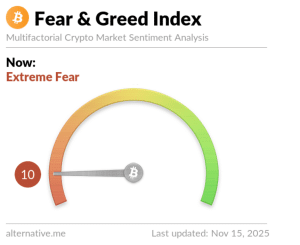

Bitcoin fell beneath $96k and Ethereum, XRP and Solana tumbled because the Crypto Concern & Greed Index, a instrument used to gauge market sentiment, plunged 6 factors within the final 24 hours to 10, signaling “excessive worry” amongst crypto buyers.

Crypto Concern & Greed Index (Supply: Different.me)

However Bitwise’s European head of analysis Andre Dragosh mentioned that “sellers are exhausted and it reveals,” suggesting the market could also be stabilizing after a string of declines.

Whereas the agency’s sentiment index stays bearish, it’s “much less so than earlier corrections regardless of decrease costs,” he mentioned.

🔴UPDATE: Our Cryptoasset Sentiment Index additionally continues to point out a constructive divergence.

Learn: Sentiment index is bearish however much less so than throughout earlier corrections regardless of decrease costs.

Sellers are exhausted and it reveals. https://t.co/GYl5Ytc5zR pic.twitter.com/XxSeuo5Ewb

— André Dragosch, PhD⚡ (@Andre_Dragosch) November 14, 2025

Santiment Says Over-Leveraged Longs Are Largely Cleared

On-chain analytics agency Santiment echoed the identical view, noting liquidations have been far smaller than throughout previous selloffs and that over-leveraged lengthy positions have largely been cleared out. Retail wallets, in the meantime, have continued to build up whilst bigger holders lowered publicity.

“The market could have exhausted the provision of over-leveraged lengthy positions to liquidate,” Santiment mentioned, including {that a} shift in pockets habits may mark a “true backside sign” for Bitcoin and broader crypto costs

Liquidations previously 24 hours surpassed $763 million, in accordance to Coinglass. Most of those liquidations ($580.39 million) have been for lengthy trades, that are bets that costs would rise.

That is far decrease than the document $19 billion that was liquidated on Oct. 10, and tright here appears to have been a shift in current hours, with the market seeing considerably extra brief liquidations than lengthy liquidations throughout this era. For example, $1.38 million was worn out from brief positions within the final hour, whereas solely $696.90K was liquidated from longs.

Santiment additionally identified that open curiosity for perpetual contracts is now a fraction of what it was a month in the past, suggesting this might ”change the market’s inside dynamics.”

It added that whereas bigger Bitcoin holders, particularly addresses holding between 10 and 10,000 BTC, have been steadily promoting off their holdings since BTC reached its all-time excessive in October, smaller retail wallets “have continued to build up throughout the drop.”

A “true backside sign” for the market will possible be if that dynamic between giant addresses and smaller wallets shifts, it mentioned.

Associated Articles:

Greatest Pockets – Diversify Your Crypto Portfolio

- Straightforward to Use, Characteristic-Pushed Crypto Pockets

- Get Early Entry to Upcoming Token ICOs

- Multi-Chain, Multi-Pockets, Non-Custodial

- Now On App Retailer, Google Play

- Stake To Earn Native Token $BEST

- 250,000+ Month-to-month Lively Customers

Be part of Our Telegram channel to remain updated on breaking information protection