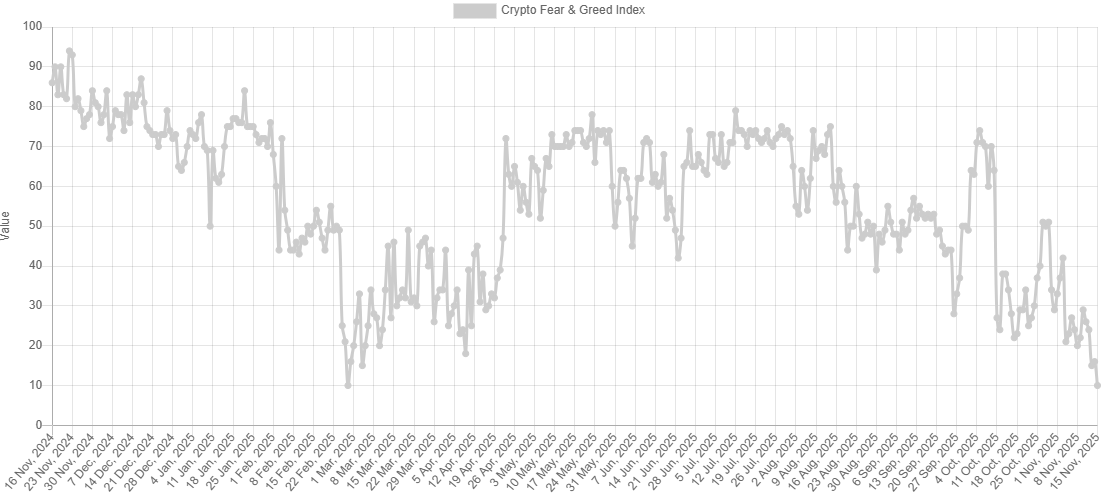

It’s protected to say that the general narrative within the cryptocurrency markets has modified considerably in simply over a month, and that is evident from the favored Concern and Greed Index.

The query now requested by a number of analysts is whether or not that is the second the place individuals can construct generational wealth in the event that they act correctly.

Deep in Concern Territory

It was simply over a month in the past. The so-called ‘Uptober’ had simply began, and bitcoin’s worth was on the rise because it tapped a recent all-time excessive of over $126,000. All the pieces gave the impression to be going nicely in BTC land.

Nonetheless, this rally was short-lived, and the cryptocurrency began a protracted correction that culminated in early November with the primary dip under $100,000 since July. The panorama worsened on November 14 when the asset plunged under that stage once more, and all the way in which right down to $94,000. This turned its lowest price ticket in six months.

Looking back, the Concern and Greed Index exhibits an attention-grabbing story. It jumped to ‘excessive greed’ territory in early October, which is usually adopted by a correction. In any case, bear in mind the immortal phrases of Warren Buffett – be fearful when others are grasping (and vice versa).

The following leg down modified the market sentiment, and the Index has plunged to 10 – the bottom stage (that means the deepest ‘excessive concern’ state) since late February. So, will there be a rebound if historical past is any indication?

Generational Wealth within the Making?

Given BTC’s efficiency following a pointy change within the Index, many now speculate whether or not this large decline from 50 to 10 within the span of only a few weeks will present a correct shopping for alternative.

For instance, BTC dropped under $80,000 in late February/early March when the metric reached related ranges. In a number of weeks, it rebounded briefly to $88,000, and in a few months, bitcoin was again inside a six-digit worth territory.

Satoshi Flipper weighed in on the matter, predicting that traders can construct “generational wealth” in the event that they go away feelings on the door and capitalize on this momentum.

You probably have capital remaining, longing the F out of $BTC & crypto after a 26-30% $BTC correction and a F/G index of 10 is the place you make generational wealth

— Satoshi Flipper (@SatoshiFlipper) November 15, 2025

The put up Bitcoin Concern and Greed Index Plunges to 9-Month Low: Final Purchase The Dip Sign? appeared first on CryptoPotato.