High Tales of The Week

‘We’re shopping for’: Michael Saylor denies studies of Technique dumping BTC

Michael Saylor, govt chair of Technique, denied studies that the corporate was offloading a few of its Bitcoin amid a flash crash within the cryptocurrency’s value.

In a Friday X submit, Saylor mentioned that there was “no fact” to a report claiming that Technique lowered its total Bitcoin holdings by about 47,000 BTC, or $4.6 billion on the time of publication. Saylor mentioned the corporate was persevering with to purchase Bitcoin as the worth dropped by greater than 4% in lower than 24 hours, from greater than $100,000 to lower than $95,000.

“I feel the volatility comes with the territory,” mentioned Saylor in a Friday CNBC interview. “In case you’re going to be a Bitcoin investor, you want a four-year time horizon and you should be ready to deal with the volatility on this market.”

Uniswap revives ICO-style token launches with new onchain public sale system

Decentralized finance heavyweight Uniswap launched Steady Clearing Auctions (CCA), a brand new protocol aiming to facilitate token choices by way of its infrastructure.

In accordance with a Thursday announcement, Uniswap’s CCA “helps groups bootstrap liquidity on Uniswap v4 and discover the market value for brand new and low-liquidity tokens.” The corporate mentioned this was simply “the primary of a number of instruments” it’s constructing to assist initiatives launch and deepen token liquidity on the platform.

The announcement coincided with preparations for the primary CCA-enabled sale. Privateness-focused Aztec Community opened its community-only AZTEC token sale on Thursday, with a public section scheduled for Dec. 2.

The Aztec group claimed that it has “taken the neighborhood entry that made the 2017 ICO period nice and made it even higher.” The group reportedly labored alongside Uniswap to develop the brand new protocol and “prioritize honest entry, permissionless, on-chain entry to neighborhood members and most of the people pre-launch.” The group mentioned the AZTEC token can be 100% community-owned as soon as tokens unlock.

Cathie Wooden’s ARK luggage $46M of Circle inventory as value dips under $90

Cathie Wooden’s funding firm ARK Make investments is again to purchasing shares of USDC issuer Circle because the inventory sinks under $90.

ARK purchased a complete of 542,269 Circle (CRCL) shares over the previous two buying and selling days, investing round $46 million, in response to the agency’s every day buying and selling disclosures seen by Cointelegraph.

The 2 acquisitions — a $30.4 million buy on Wednesday and a $15.5 million purchase on Thursday — got here amid a decline in CRCL shares, which closed at $86 and $82.30, respectively.

The contemporary purchases mark ARK’s first CRCL transactions because the agency offloaded about 1.7 million Circle shares throughout 4 gross sales in June at a median closing value of $200, producing $352 million.

XRP ETF debut outshines all 2025 launches with $250M inflows, document quantity

The debut of the Canary Capital XRP exchange-traded fund (ETF) is signaling renewed demand for altcoins, after the fund posted the strongest first-day efficiency of the greater than 900 ETFs launched in 2025.

Canary Capital’s XRP ETF closed its first day with $58 million in buying and selling quantity, marking probably the most profitable ETF debut of 2025 amongst each crypto and conventional ETFs, mentioned Bloomberg ETF analyst Eric Balchunas in a Thursday X submit.

The brand new fund garnered over $250 million in inflows throughout its first buying and selling day, surpassing the latest inflows of all different crypto ETFs.

A part of the explanation behind the profitable launch was the ETF’s in-kind creation mannequin, in response to ETF analyst and president of NovaDius Wealth Administration Nate Geraci.

Bitcoin ETFs bleed $866M in second-worst day on document, however some analysts nonetheless bullish

Demand for Bitcoin and crypto-linked funding funds continued to say no Thursday, regardless of the long-awaited finish of the 43-day US authorities shutdown.

US spot Bitcoin exchange-traded funds (ETFs) noticed $866 million in internet outflows on Thursday, marking their second-worst day on document after the $1.14 billion every day outflows on Feb. 25, 2025, in response to Farside Traders.

This marked the second consecutive day of outflows for the Bitcoin ETFs, as the tip of the 43-day US authorities shutdown did not reignite investor urge for food.

The $866 million outflows occurred a day after President Donald Trump signed a authorities funding invoice on Wednesday. The invoice gives funding till Jan. 30, 2026.

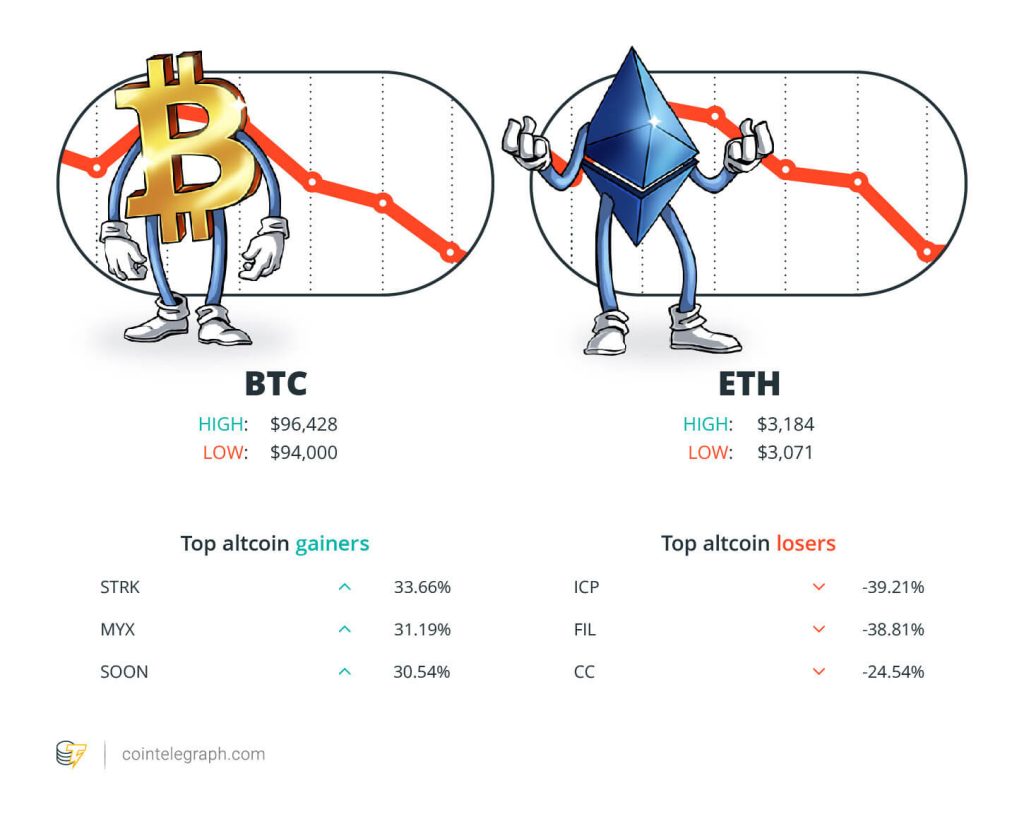

Winners and Losers

On the finish of the week, Bitcoin (BTC) is at $96,428, Ether (ETH) at $3,184 and XRP at $2.29. The overall market cap is at $3.27 trillion, in response to CoinMarketCap.

Among the many greatest 100 cryptocurrencies, the highest three altcoin gainers of the week are Starknet (STRK) at 33.66%, MYX Finance (MYX) at 31.19% and SOON (SOON) at 30.54%.

The highest three altcoin losers of the week are Web Pc (ICP) at 39.21%, Filecoin (FIL) at 38.81% and Canton (CC) at 24.54%. For more information on crypto costs, make certain to learn Cointelegraph’s market evaluation.

High Prediction of The Week

Likelihood of December rate of interest lower falls under 50%

Solely 45.9% of traders anticipate an rate of interest lower on the subsequent US Federal Open Market Committee assembly in December, amid declining market sentiment and a downturn within the cryptocurrency market.

The percentages of a 25 foundation level (BPS) rate of interest lower in December have been almost 67% on Nov. 7, in response to information from the Chicago Mercantile Trade Group.

Learn additionally

Options

4 out of 10 NFT gross sales are faux: Be taught to identify the indicators of wash buying and selling

Options

Powers On… Why aren’t extra regulation faculties instructing blockchain, DeFi and NFTs?

In September, a number of banking establishments forecast at the very least two rate of interest cuts in 2025, with market analysts at funding banking firm Goldman Sachs and banking big Citigroup every projecting three 25 BPS cuts in 2025.

High FUD of The Week

Bitfarms plunges 18% after plan to wind down Bitcoin mining ops

Bitfarms’ inventory has plunged after the corporate introduced it might be shuttering its Bitcoin mining operations over the following two years and changing them to synthetic intelligence and high-compute information facilities.

The corporate mentioned on Thursday that its 18-megawatt Bitcoin mining web site within the US state of Washington would be the first to be totally transformed to help AI and high-performance computing, with completion anticipated in December 2026.

“Regardless of being lower than 1% of our complete developable portfolio, we consider that the conversion of simply our Washington web site to GPU-as-a-Service may doubtlessly produce extra internet working earnings than we have now ever generated with Bitcoin mining,” mentioned Bitfarms CEO Ben Gagnon.

He added the conversion would assist the corporate because it winds down its Bitcoin mining enterprise in 2026 and 2027.

Skittish threat managers may flip Bitcoin’s institutional increase into bust, CEO warns

The highly effective wave of institutional shopping for that helped propel Bitcoin increased since early 2024 may additionally amplify a correction if market fatigue persists, in response to Markus Thielen, CEO of 10x Analysis and a former portfolio supervisor.

In an interview with Bloomberg, Thielen mentioned the crypto market, and Bitcoin particularly, is exhibiting all of the tell-tale indicators of fatigue following a tough October marked by the biggest liquidation occasion within the business’s historical past. These losses, he famous, have compounded underlying macroeconomic dangers that Bitcoin has more and more mirrored.

As a result of institutional inflows, particularly from spot Bitcoin exchange-traded funds, have been a key driver of the 2024 rally, Thielen warned that the identical investor base may speed up draw back stress if exercise continues to sluggish.

Kraken co-CEO warns UK guidelines meant to guard customers punish them: FT

Arjun Sethi, the co-CEO of main crypto trade Kraken, criticized the UK’s crypto rules, which he mentioned hinder providers for his or her prospects.

In an interview with the Monetary Instances, Sethi mentioned that “within the UK in the present day, if you happen to go to any crypto web site, together with Kraken’s, you see the equal to a cigarette field.” He instructed that the disclaimers have a major influence on buyer expertise.

Learn additionally

Options

Memecoin degeneracy is funding groundbreaking anti-aging analysis

Options

Championing Blockchain Training in Africa: Ladies Main the Bitcoin Trigger

Sethi instructed that disclosures sluggish customers down and that, due to the significance of velocity in crypto buying and selling, “it’s worse for patrons.” He concluded that “disclosures are essential […] but when there are 14 steps, it’s worse.”

The UK Monetary Conduct Authority’s up to date monetary promotion regime got here into power in October 2023. It launched a “cooling-off” interval for first-time crypto traders and required corporations to evaluate whether or not customers had ample information and expertise earlier than permitting them to commerce.

High Journal Tales of The Week

2026 is the yr of pragmatic privateness in crypto: Canton, Zcash and extra

After years speaking up transparency, 2026 is the yr privateness takes off in crypto because of Canton, Zcash, the Ethereum Basis and others.

Taiwan considers Bitcoin reserve, Sony’s Ethereum L2 tremendous app: Asia Specific

Taiwan will formally assess holding Bitcoin in its reserves. Sony’s Ethereum L2 Soneium launches a DeFi tremendous app, and extra.

Massive Questions: Did a time-traveling AI invent Bitcoin?

Did an AI journey to the previous to create Bitcoin as the proper decentralized community so people may by no means swap the AI off? Some suppose so.

Subscribe

Probably the most partaking reads in blockchain. Delivered as soon as a

week.

Editorial Workers

Cointelegraph Journal writers and reporters contributed to this text.